Question: based on these giving ratios, write a short comparison analysis between company A and company B Beta 2015 Company Name 2014 Ave, Beta COMPANY A

based on these giving ratios, write a short comparison analysis between company A and company B

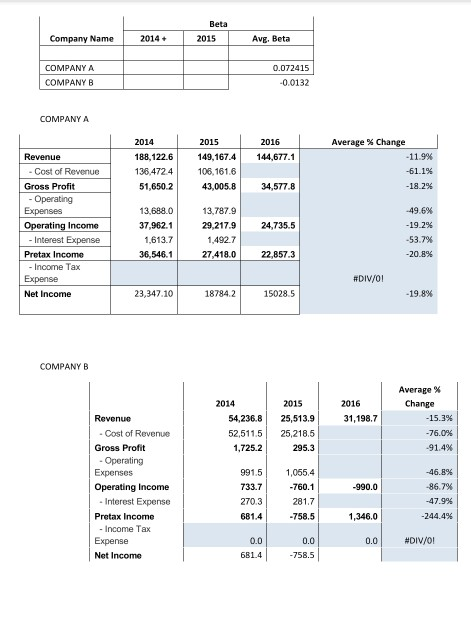

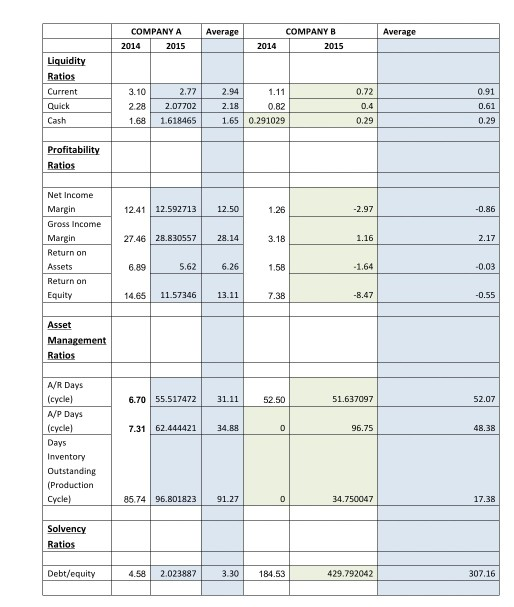

Beta 2015 Company Name 2014 Ave, Beta COMPANY A COMPANY B 0.072415 -0.0132 COMPANY A 2016 144,677.1 2014 188,122.6 136,4724 51,650.2 2015 149,167.4 106, 161.6 43,005.8 Average % Change -11.9% -61.1% -18.2% 34,577.8 Revenue - Cost of Revenue Gross Profit - Operating Expenses Operating Income - Interest Expense Pretax Income - Income Tax Expense Net Income 24,735.5 13.688.0 37.962.1 1,613.7 36,546.1 13,787.9 29.217.9 1.492.7 27.418.0 -49.6% -19.2% -53.7% -20.8% 22.8573 #DIV/01 23,347.10 187842 15028.5 -19.8% COMPANY B 2016 31,198.7 2014 54,236.8 52,511.5 1.725.2 2015 25,513.9 25,218.5 295.3 Average % Change -15.3% -76.0% -91.4% Revenue Cost of Revenue Gross Profit - Operating Expenses Operating Income Interest Expense Pretax Income - Income Tax Expense Net Income 991.5 733.7 -990.0 1,055.4 -760.1 281.7 -758.5 -46.8% 86.7% -47.9% -244.4% 270.3 681.4 1,346.0 #DIV/0! 0.0 681.4 0.0 -758.5 Average A verage COMPANY A 2014 2015 COMPANY B 2015 2014 Liquidity Ratios Current Quick 3.10 228 1.68 2.77 2.07702 1.618465 2.94 2.18 1.65 1.11 0.82 0.291029 0.72 0.4 0.29 Cash 0.29 Profitability Ratios 12.41 12.592713 12.50 -2.97 Net Income Margin Gross Income Margin 27.46 28.830557 28.14 1.16 Return on Assets 6.89 5.62 6.26 -1.64 Return on Equity 14.65 11.57346 13.11 7.38 -8.47 -0.55 Asset Management Ratios 6.70 55.517472 31.11 52.50 51.637097 7.31 62.444421 34.88 96.75 AVR Days (cycle) A/P Days (cycle) Days Inventory Outstanding (Production Cycle) 85.74 96.801823 91.27 0 34.750047 Solvency Ratios Debt/equity 4.58 2.023887 3.30 184.53 429.792042 307.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts