Question: Based on this approach and using the Fama-French 3-factor asset pricing model, what is the companys cost of equity (i.e., investors expected/required rate of return

Based on this approach and using the Fama-French 3-factor asset pricing model, what is the companys cost of equity (i.e., investors expected/required rate of return on firms equity) at the target 0.40 debt-to-value ratio?

NOTE: the risk free rate is 3.10%

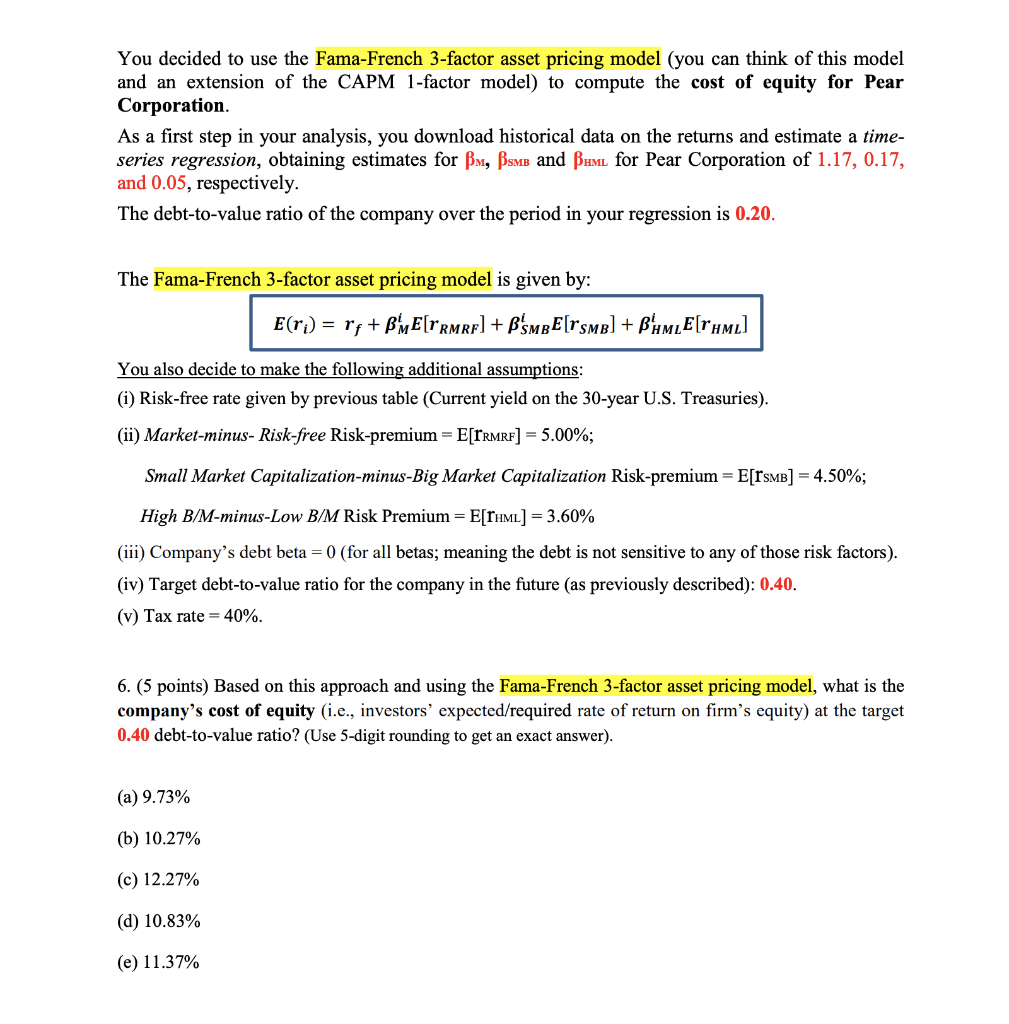

You decided to use the Fama-French 3-factor asset pricing model (you can think of this model and an extension of the CAPM 1-factor model) to compute the cost of equity for Pear Corporation. As a first step in your analysis, you download historical data on the returns and estimate a time- series regression, obtaining estimates for BM, Bsm and BuML for Pear Corporation of 1.17, 0.17, and 0.05, respectively. The debt-to-value ratio of the company over the period in your regression is 0.20. The Fama-French 3-factor asset pricing model is given by: E(r;) = rs + BME[TrMRE] + BMBE[rsme] + B'AMLE[rum] You also decide to make the following additional assumptions: (i) Risk-free rate given by previous table (Current yield on the 30-year U.S. Treasuries). (ii) Market-minus- Risk-free Risk-premium = E[TRMRF] = 5.00%; Small Market Capitalization-minus-Big Market Capitalization Risk-premium=E[ISMB] = 4.50%; High B/M-minus-Low B/M Risk Premium = E[THML] = 3.60% (iii) Company's debt beta = 0 (for all betas; meaning the debt is not sensitive to any of those risk factors). (iv) Target debt-to-value ratio for the company in the future (as previously described): 0.40. (v) Tax rate = 40%. 6. (5 points) Based on this approach and using the Fama-French 3-factor asset pricing model, what is the company's cost of equity (i.e., investors' expected/required rate of return on firm's equity) at the target 0.40 debt-to-value ratio? (Use 5-digit rounding to get an exact answer). (a) 9.73% (b) 10.27% (C) 12.27% (d) 10.83% (e) 11.37%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts