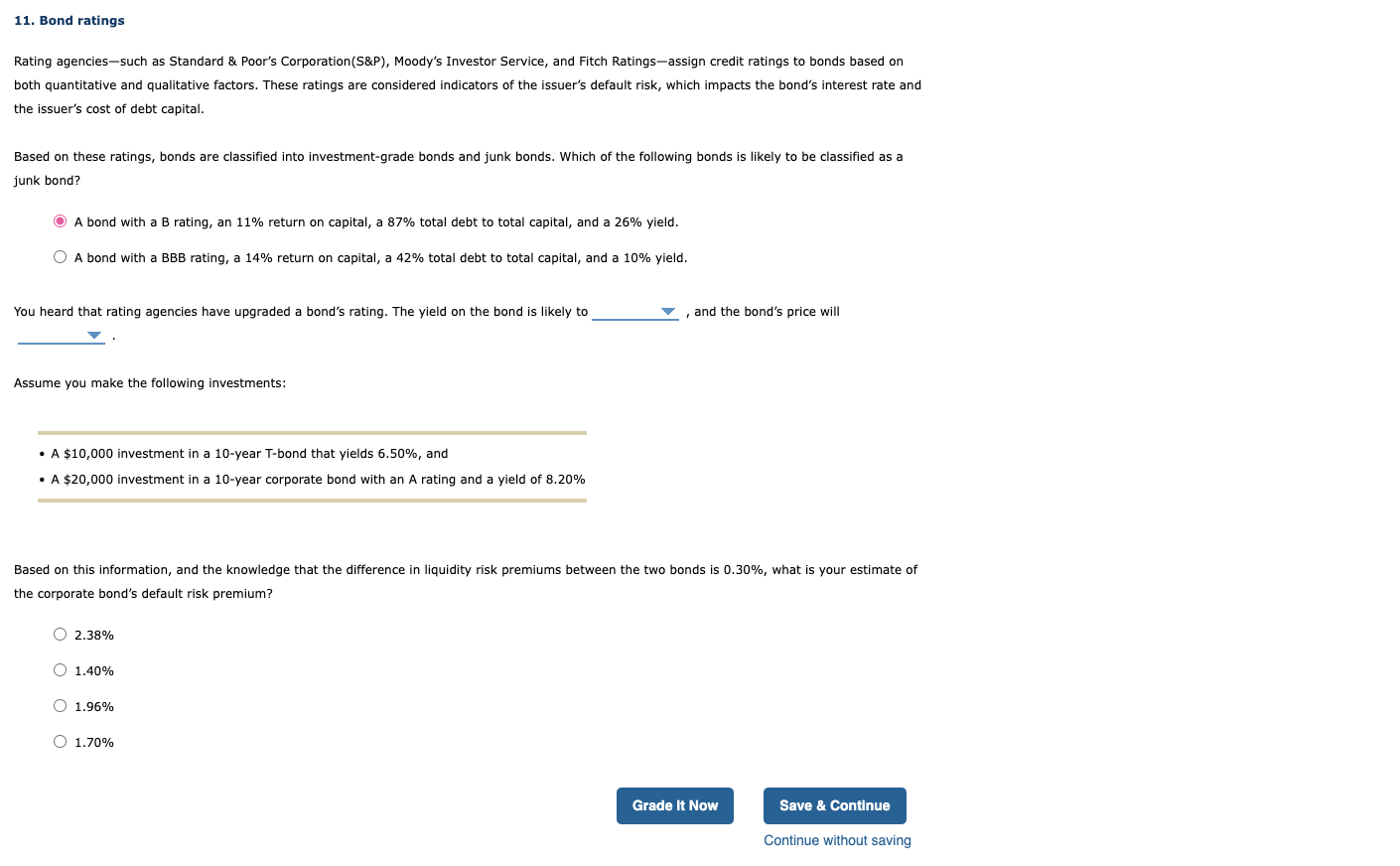

Question: Based on this information, and the knowledge that the difference in liquidity risk premiums between the two bonds is 0.30%, what is your estimate of

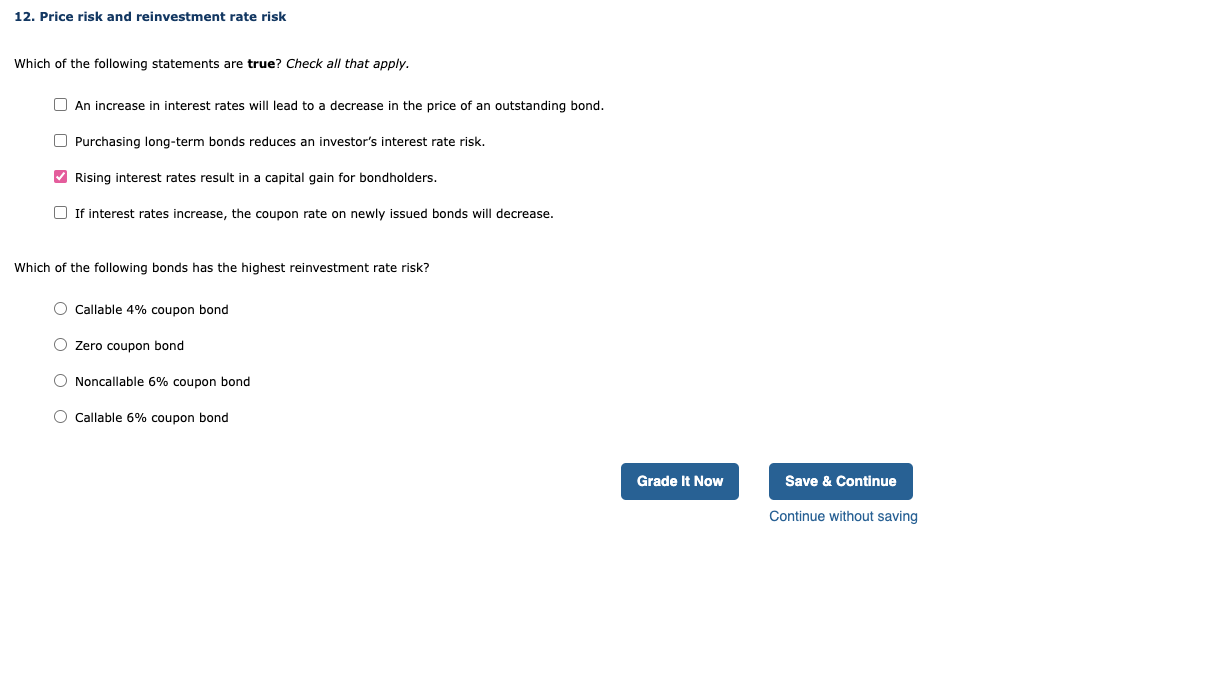

Based on this information, and the knowledge that the difference in liquidity risk premiums between the two bonds is 0.30%, what is your estimate of the corporate bond's default risk premium? 2.38% 1.40% 1.96% 1.70% 12. Price risk and reinvestment rate risk Which of the following statements are true? Check all that apply. An increase in interest rates will lead to a decrease in the price of an outstanding bond. Purchasing long-term bonds reduces an investor's interest rate risk. Rising interest rates result in a capital gain for bondholders. If interest rates increase, the coupon rate on newly issued bonds will decrease. Which of the following bonds has the highest reinvestment rate risk? Callable 4% coupon bond Zero coupon bond Noncallable 6% coupon bond Callable 6% coupon bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts