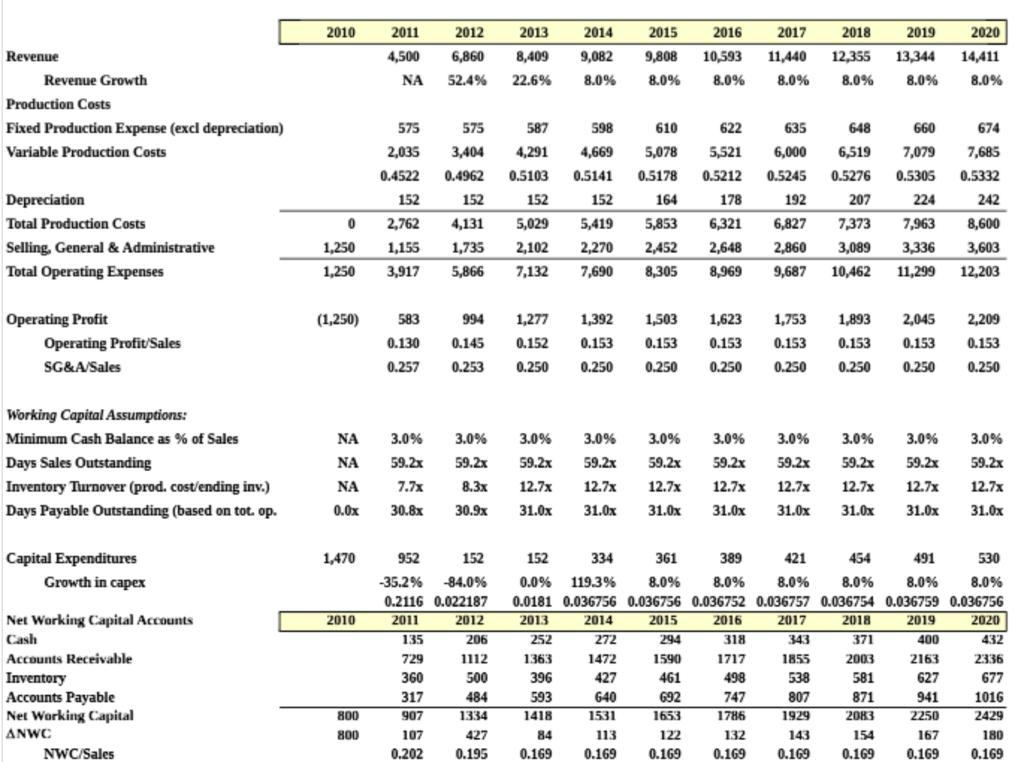

Question: Based on this information, how were the accounts payable values found? I keep getting different answers. Please show work. 2016 2020 4,500 6,860 8,409 9,082

Based on this information, how were the accounts payable values found? I keep getting different answers. Please show work.

2016 2020 4,500 6,860 8,409 9,082 9,808 10,593 11,440 12,355 13,344 14,411 NA 52.4% 22.6% 8.0% 8.0% 8.0% 8.0% 8.0% 8.0% 8.0% 2010 2011 2012 2013 2014 2015 2017 2018 2019 Revenue Growth Production Costs Fixed Production Expense (excl depreciation) Variable Production Costs 674 2,035 3,404 4,291 4,669 5,78 5,521 6,000 6,519 7,079 7,685 0.4522 0.4962 0.5103 0.5141 0.5178 0.5212 0.5245 0.5276 0.5305 0.5332 598 635 152 Total Production Costs Selling, General & Administrative Total Operating Expenses 0 2,762 4,131 5,029 5,419 5,853 6,32 6,8277373 7,963 8,600 1,250 1,155 1,735 2,102 2,270 2,452 2,648 2,860 3,089 3,336 3,603 1,250 3,917 5,866 7,132 7,690 8,305 8,969 9,687 10,462 11,299 12,203 1,250) 583 9941,277 1,392 1,503 1,623 1,753 1,893 2,045 2,209 0.130 0.145 0.152 0.153 0.1530.153 0.153 0.153 0.153 0.153 0.2570.253 0.250 0.250 0.250 0.250 0.250 0.250 0.250 0.250 Operating Profit Operating Profit/Sales SG&ASales Working Capital Assumptions: Minimum Cash Balance as % of Sales Days Sales Outstanding Inventory Turnover (prod. cost/ending inv.) Days Payable Outstanding (based on tot. op. NA 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% NA 59.2x59.2x 59.2x 59.2x59.2x 59.2x 59.2x 59.2x59.2x 59.2x NA 0.0x 30.8x 30.9x31.0x 31.0x31.0x 31.0x 31.0x 31.0x31.0x 31.0x 7.7x 8.3x 12.7x 12.7x12.7x 12.7x12.7x12.7x 12.7x 12.7x 1,470 152 152 361 421 530 -35.2% -84.0% 0.0% 119.3% 8.0% 8.096 8.0% 8.0% 8.0% 8.0% 0.2116 0.022187 0.0181 0.036756 0.036756 0.036752 0.036757 0.036754 0.036759 0.036756 2020 432 2336 677 941 1016 Capital Expenditures 491 Growth in capex Net Working Capital Accounts 2015 2017 343 1855 538 2010 2012 206 1112 500 2013 2014 2016 2018 2019 135 272 1472 252 1590 461 Accounts Receivable 363 2003 2163 360 317 Accounts Payable Net Working Capital 747 1786 334 427 800 1531 1653 1929 2083 ANWC 180 0.202 0.195 0.169 0.1690.169 0.169 0.169 0.169 0.169 0.169 800 107 167 NWC/Sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts