Question: Based on Walmart's cash flow statement, a). deciding which statements below is useful doing pro forma financial analysis? b). How to create a Pro Forma

Based on Walmart's cash flow statement, a). deciding which statements below is useful doing pro forma financial analysis? b). How to create a Pro Forma financial analysis on Cash Flow Statements required to have three sets of financial projections(base or most likely case, worst case, best case)? 3). and Valuation using price multiples (comparable companies); Provide reasons why you select certain ratios.

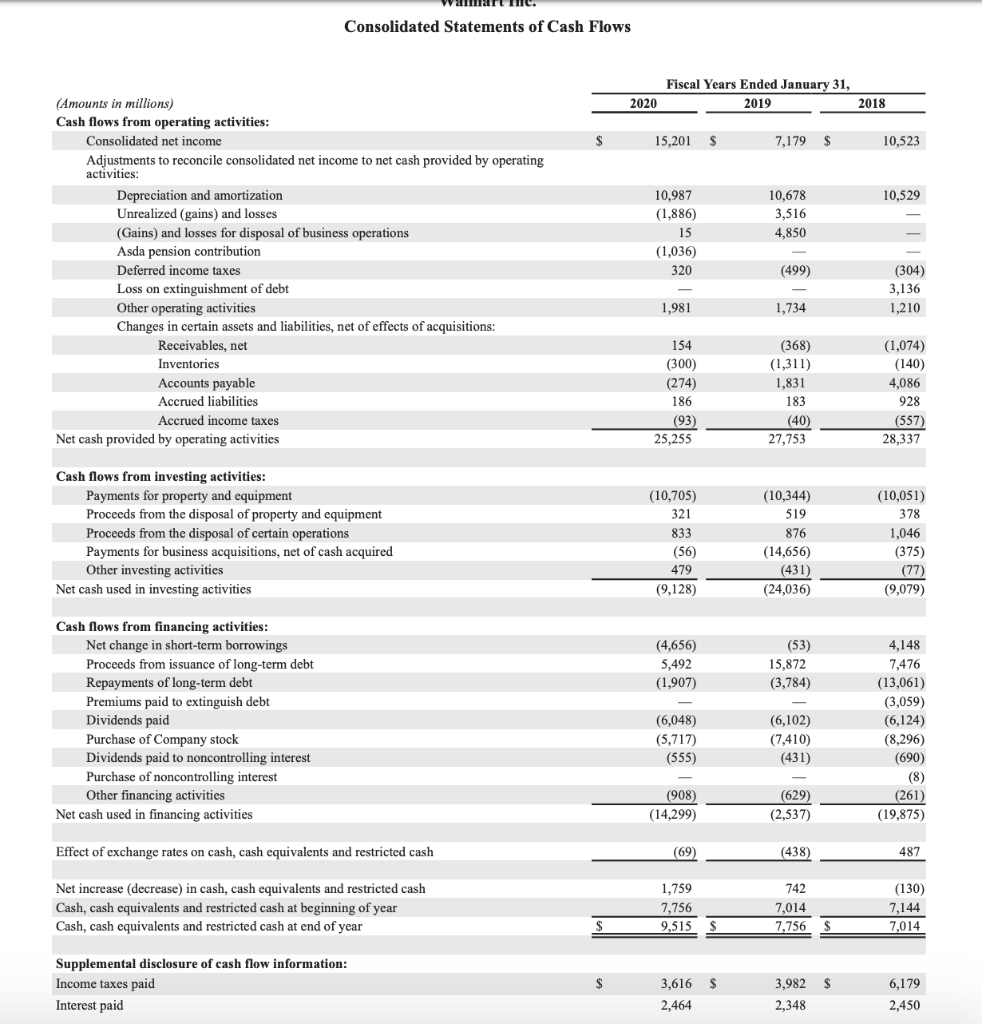

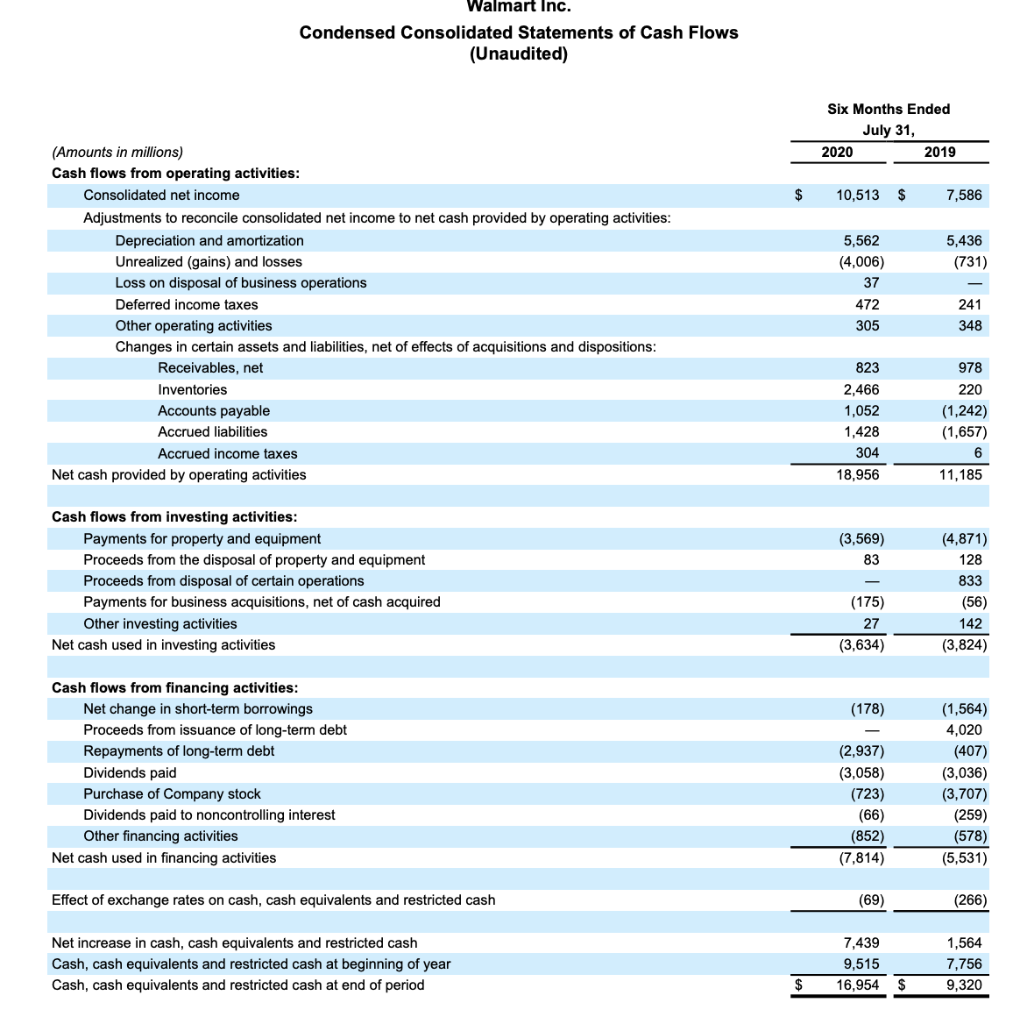

Consolidated Statements of Cash Flows Fiscal Years Ended January 31, 2019 2020 2018 S 15.201 S 7,179 $ 10.523 10,529 (Amounts in millions) Cash flows from operating activities: Consolidated net income Adjustments to reconcile consolidated net income to net cash provided by operating activities: Depreciation and amortization Unrealized (gains) and losses (Gains) and losses for disposal of business operations Asda pension contribution Deferred income taxes Loss on extinguishment of debt Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions: Receivables, net Inventories Accounts payable Accrued liabilities Accrued income taxes Net cash provided by operating activities 10,987 (1,886) 15 (1,036) 320 10,678 3,516 4,850 (499) (304) 3,136 1,210 1,981 1,734 154 (300) (274) 186 (93) 25,255 (368) (1,311) 1,831 183 (40 27,753 (1,074) (140) 4,086 928 (557) 28,337 Cash flows from investing activities: Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities (10,705) 321 833 (56) 479 (9,128) (10,344) 519 876 (14,656) (431) (10,051) 378 1,046 (375) (77) (9,079) (24,036) (4,656) 5,492 (1,907) (53) 15,872 (3,784) Cash flows from financing activities: Net change in short-term borrowings Proceeds from issuance of long-term debt Repayments of long-term debt Premiums paid to extinguish debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities (6,048) (5,717) (555) (6,102) (7,410) (431) 4,148 7,476 (13,061) (3,059) (6,124) (8,296) (690) (8) (261) (19,875) (908) (629) (2,537) (14.299) Effect of exchange rates on cash, cash equivalents and restricted cash (69) (438) 487 Net increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of year 1,759 7,756 9,515 742 7,014 7,756 (130) 7,144 7,014 Supplemental disclosure of cash flow information: Income taxes paid Interest paid $ $ $ 3,616 2,464 3,982 2,348 6,179 2,450 Walmart Inc. Condensed Consolidated Statements of Cash Flows (Unaudited) Six Months Ended July 31, 2020 2019 $ 10,513 $ 7,586 5,436 (731) (Amounts in millions) Cash flows from operating activities: Consolidated net income Adjustments to reconcile consolidated net income to net cash provided by operating activities: Depreciation and amortization Unrealized (gains) and losses Loss on disposal of business operations Deferred income taxes Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions and dispositions: Receivables, net Inventories Accounts payable Accrued liabilities Accrued income taxes Net cash provided by operating activities 5,562 (4,006) 37 472 305 241 348 823 2,466 1,052 1,428 304 978 220 (1,242) (1,657) 6 11,185 18,956 (3,569) 83 Cash flows from investing activities: Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from disposal of certain operations Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities (4,871) 128 833 (56) 142 (3,824) (175) 27 (3,634) (178) Cash flows from financing activities: Net change in short-term borrowings Proceeds from issuance of long-term debt Repayments of long-term debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Other financing activities Net cash used in financing activities (2,937) (3,058) (723) (66) (852) (7,814) (1,564) 4,020 (407) (3,036) (3,707) (259) (578) (5,531) Effect of exchange rates on cash, cash equivalents and restricted cash (69) (266) Net increase in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of period 7,439 9,515 16,954 $ 1,564 7,756 9,320

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts