Question: Based on your above ratio analysis, please comment on the reason for changes in ROE, other profitability and Felu Corporations ability to fulfill its short-term

Based on your above ratio analysis, please comment on the reason for changes in ROE, other profitability and Felu Corporations ability to fulfill its short-term and long-term debt obligations

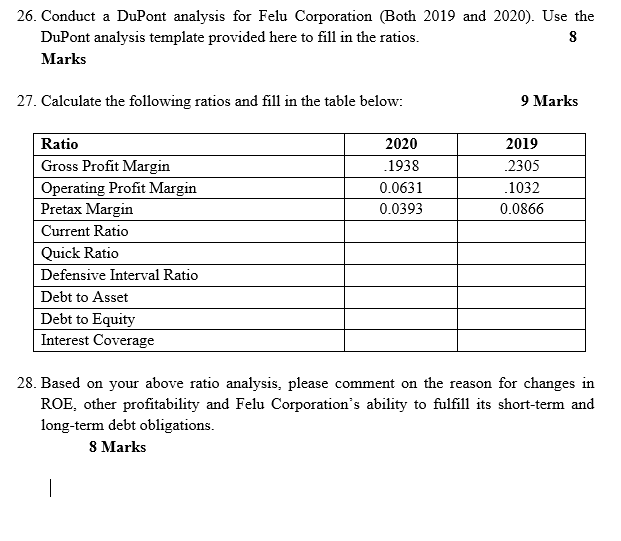

26. Conduct a DuPont analysis for Felu Corporation (Both 2019 and 2020). Use the DuPont analysis template provided here to fill in the ratios. 8 Marks 27. Calculate the following ratios and fill in the table below: 9 Marks 2020 .1938 0.0631 0.0393 2019 .2305 .1032 0.0866 Ratio Gross Profit Margin Operating Profit Margin Pretax Margin Current Ratio Quick Ratio Defensive Interval Ratio Debt to Asset Debt to Equity Interest Coverage 28. Based on your above ratio analysis, please comment on the reason for changes in ROE, other profitability and Felu Corporation's ability to fulfill its short-term and long-term debt obligations. 8 Marks 26. Conduct a DuPont analysis for Felu Corporation (Both 2019 and 2020). Use the DuPont analysis template provided here to fill in the ratios. 8 Marks 27. Calculate the following ratios and fill in the table below: 9 Marks 2020 .1938 0.0631 0.0393 2019 .2305 .1032 0.0866 Ratio Gross Profit Margin Operating Profit Margin Pretax Margin Current Ratio Quick Ratio Defensive Interval Ratio Debt to Asset Debt to Equity Interest Coverage 28. Based on your above ratio analysis, please comment on the reason for changes in ROE, other profitability and Felu Corporation's ability to fulfill its short-term and long-term debt obligations. 8 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts