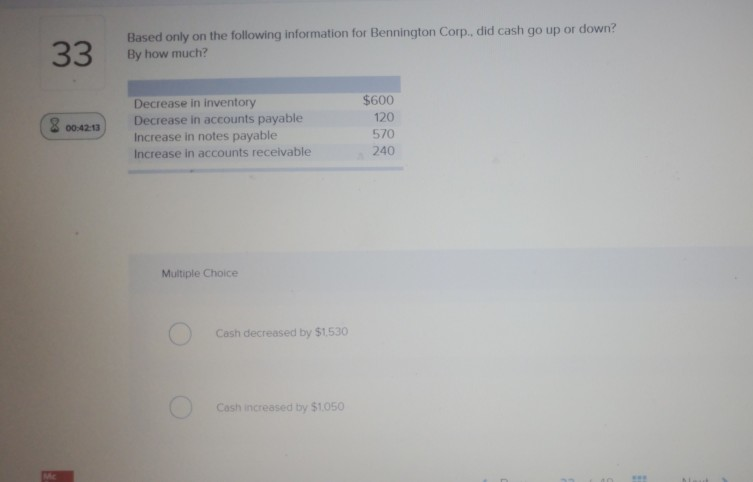

Question: Based only on the following information for Bennington Corp. did cash go up or down? By how much? Decrease in inventory Decrease in accounts payable

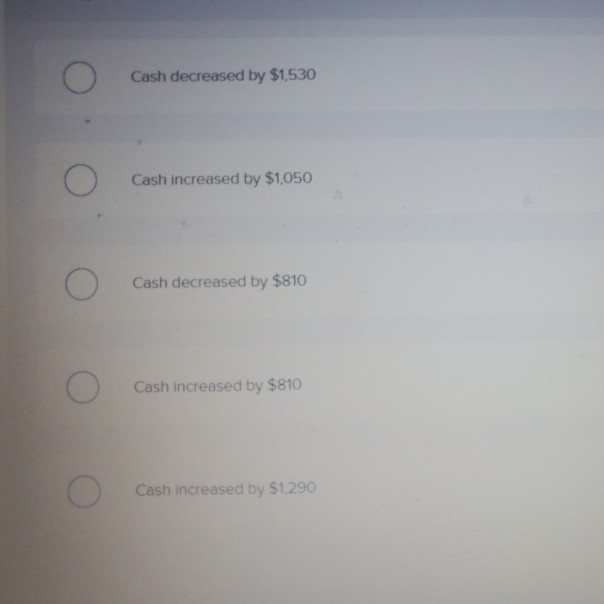

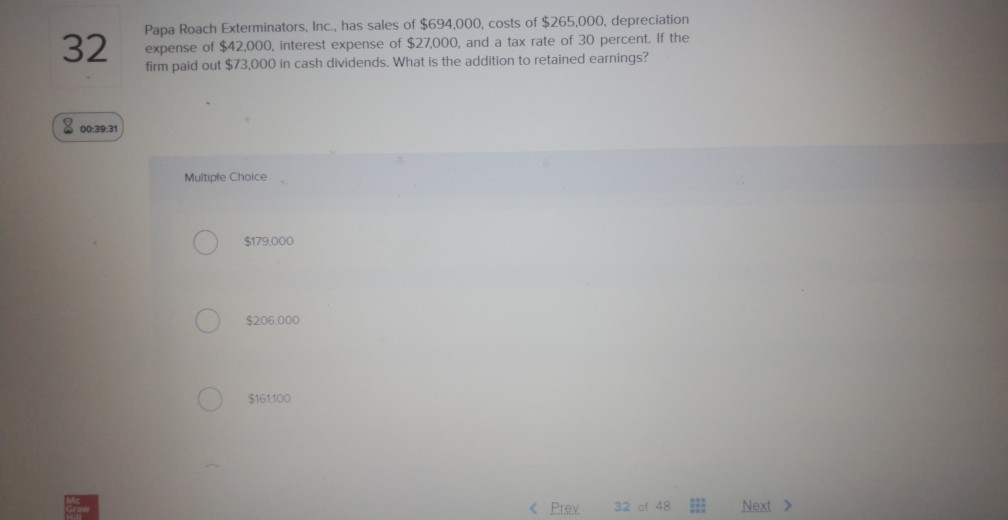

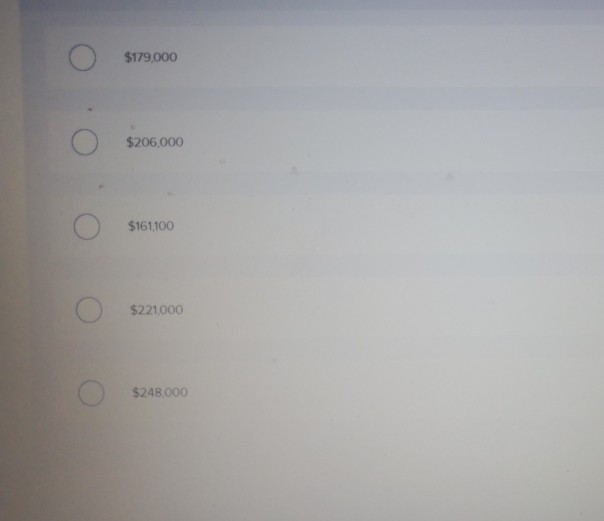

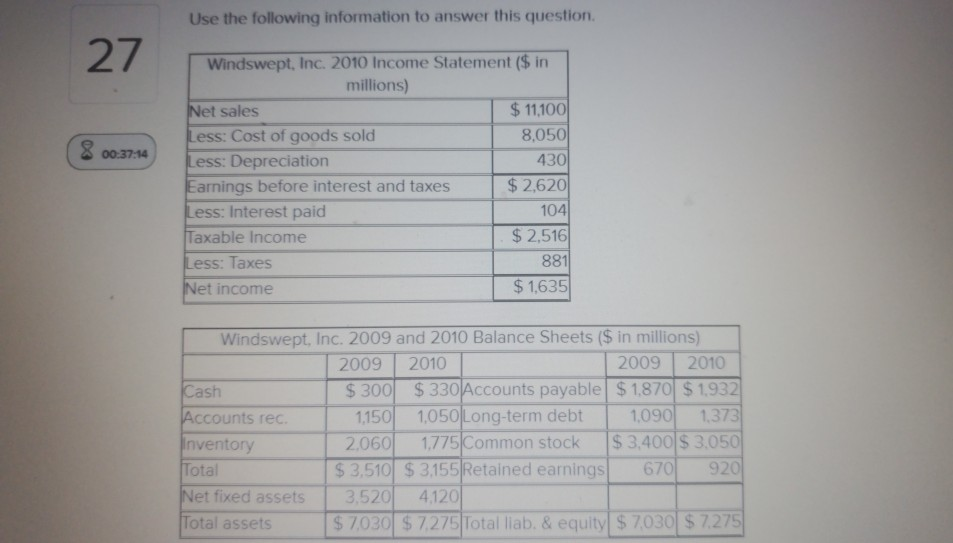

Based only on the following information for Bennington Corp. did cash go up or down? By how much? Decrease in inventory Decrease in accounts payable Increase in notes payable Increase in accounts receivable $600 120 570 240 Multiple Choice Cash decreased by $1.530 Cash increased by $1.050 Cash decreased by $1,530 Cash increased by $1,050 Cash decreased by $810 Cash increased by $810 Cash increased by $1.290 32. Papa Roach Exterminators, Inc., has sales of $694,000, costs of $265.000, depreciation expense of $42,000, interest expense of $27.000, and a tax rate of 30 percent. If the firm paid out $73,000 in cash dividends. What is the addition to retained earnings? 8 00:30-31 Multiple Choice $179,000 $206.000 $161100 . $179.000 . $206,000 $161100 5221000 S248.000 Use the following information to answer this question. 8 00:37:14 Windswept, Inc. 2010 Income Statement ($ in millions) Net sales $ 11,100 Less: Cost of goods sold 8,050 Less: Depreciation 430 Earnings before interest and taxes $ 2,620 Less: Interest paid 104 Taxable income $ 2,516 Less: Taxes Net income $ 1,635 881 Windswept. Inc. 2009 and 2010 Balance Sheets ($ in millions) 2009 2010 2009 2010 Cash $ 300 $ 330 Accounts payable $ 1,870 $ 1.932 Accounts rec 1,150 1,050 Long-term debt 1.090 1373 Inventory 2,060 1,775 Common stock $ 3.400 $ 3.050 Total $ 3,510 $ 3,155 Retained earnings 670 920 Net fixed assets 3,520 4120 Total assets $ 7030 $ 7.275 Total liab. & equity $ 7,030 $ 7.275 Multiple Choice 280 183 239 3.64 1.35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts