Question: Basic 1. FV = PV(1 + r) 2. PV - FV + (1 + r) 3. r=(FV + PV) - 1 4. n-In (FV +

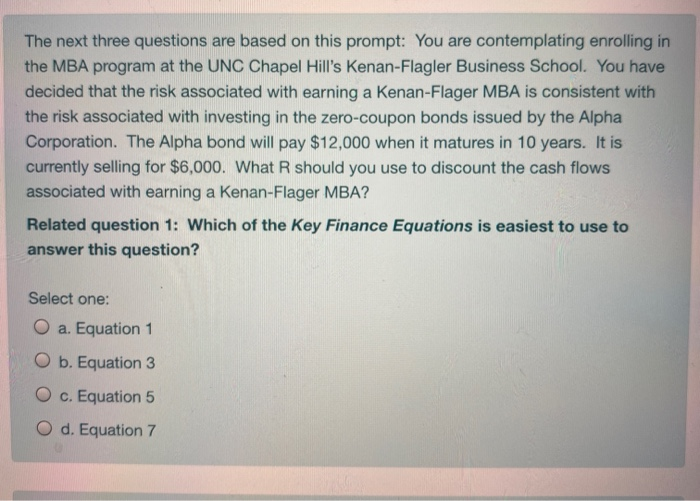

Basic 1. FV = PV(1 + r) 2. PV - FV + (1 + r)" 3. r=(FV + PV) - 1 4. n-In (FV + PV) + In (1 + r) Multiple Cash Flow 5. PV. =(FVA +r)(1-(1 + (1 + r)")) 6. PV, =(FV, +r) 7. Only ifr>g: PVcor - FVcor+ (r - g) 8. Ift-1: FV. - TPVx+(1- (1 + (1 + r)")) 9. Ift>1; p=r+t: FV-PPV +(1- (1 + (1 + p) "")) 10. EAR=(1+p)-1 Solving for r [R] 11. Zero-coupon bond: use basic equation 3. 12. Coupon bond: Use an online bond yield calculator or a financial calculator. 13. Preferred stock: Solve equation 6 for r, yielding r= - FV + PV =D, P, 14. Constant growth stock: Solve equation 7 for r, yielding r = (FV, + PV)+g=(D,+P) +g Bonus Equations: 15. E(R)=R+B. [E(R) - RJ 16. Degree of leverage = value of the asset + amount of equity 17. WACC = (CSW, R.) + (CSW, *R, [1 - tax rate]) The next three questions are based on this prompt: You are contemplating enrolling in the MBA program at the UNC Chapel Hill's Kenan-Flagler Business School. You have decided that the risk associated with earning a Kenan-Flager MBA is consistent with the risk associated with investing in the zero-coupon bonds issued by the Alpha Corporation. The Alpha bond will pay $12,000 when it matures in 10 years. It is currently selling for $6,000. What R should you use to discount the cash flows associated with earning a Kenan-Flager MBA? Related question 1: Which of the Key Finance Equations is easiest to use to answer this question? Select one: O a. Equation 1 O b. Equation 3 O c. Equation 5 O d. Equation 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts