Question: Basic Analysis: 1)For each firm, compute and interpret the interest coverage ratio (as defined in class) and cash flow adequacy ratio for the most recent

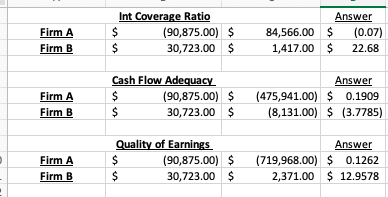

Basic Analysis: 1)For each firm, compute and interpret the interest coverage ratio (as defined in class) and cash flow adequacy ratio for the most recent year. (Interest Expense for Firm A is $84,566 and for Firm B is $1,417.) Explain what ratio says.

2)For each firm, compute and interpret the quality of earnings ratio for the most recent year. Discuss any weaknesses of the ratio as a measure of the actual quality of earnings.  PLEASE ANSWER BOLD SECTION

PLEASE ANSWER BOLD SECTION

Int Coverage Ratio $ (90,875.00) $ $ 30,723.00 $ Firm A Firm B Answer 84,566.00 $ 1,417.00 $ 22.68 (0.07) Firm A Firm B Cash Flow Adequacy. $ (90,875.00) $ $ 30,723.00 $ Answer (475,941.00) $ 0.1909 (8,131.00) $ (3.7785) Firm A Firm B Quality of Earnings $ (90,875.00) $ $ 30,723.00 $ Answer (719,968.00) $ 0.1262 2,371.00 $ 12.9578

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts