Question: Basic Eps = $7.40 and Diluted EPS = $6.83. Please show work. Punch Manufacturing Corporation owns 80 percent of the common shares of Short Retail

Basic Eps = $7.40 and Diluted EPS = $6.83. Please show work.

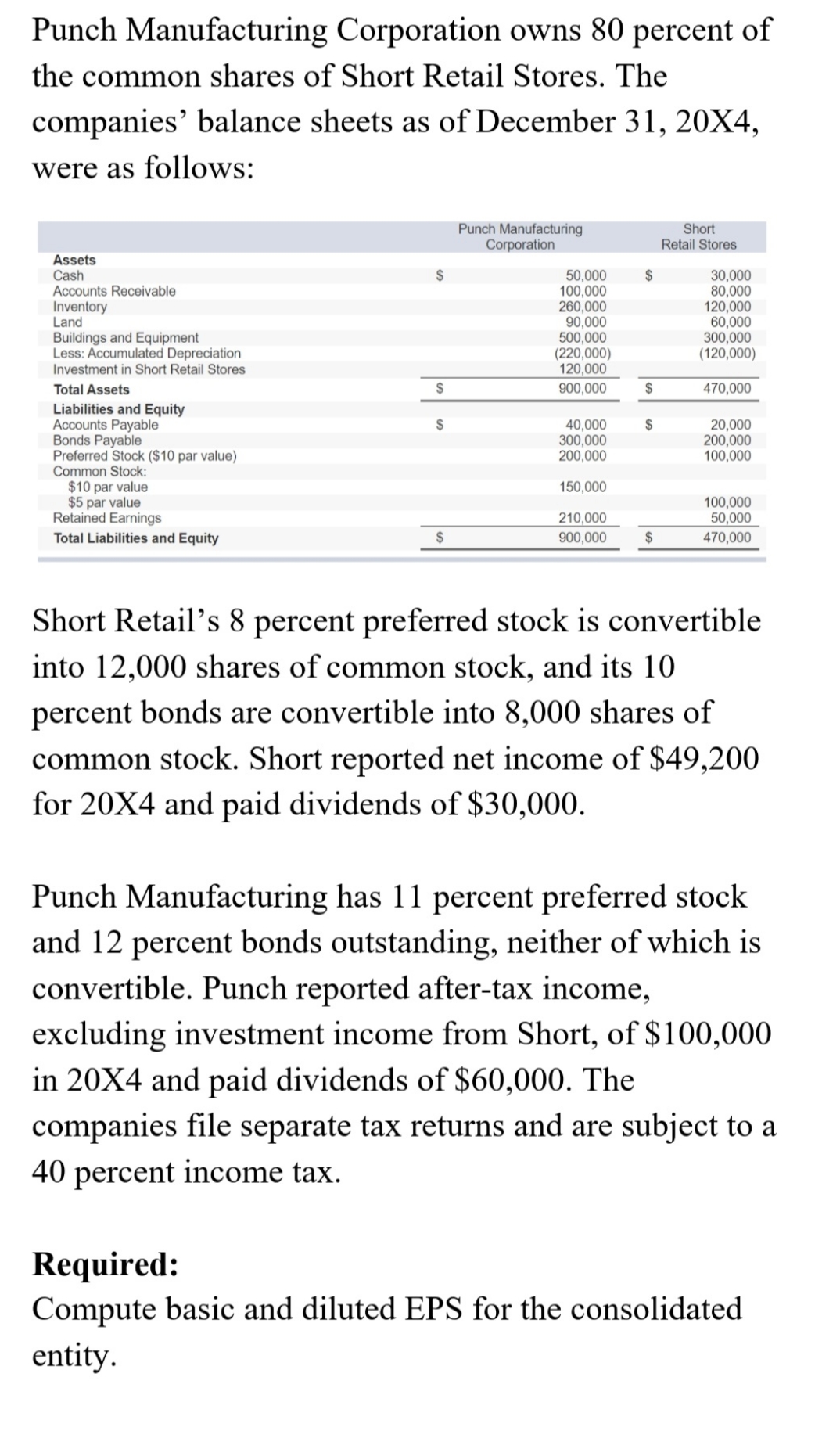

Punch Manufacturing Corporation owns 80 percent of the common shares of Short Retail Stores. The companies' balance sheets as of December 31, 20X4, were as follows: Punch Manufacturing Short Corporation Retail Stores Assets Cash 50,000 $ 30,000 Accounts Receivable 100,000 80,000 Inventory 260,000 120,000 Land 90,000 60,000 Buildings and Equipment 500,000 300,000 Less: Accumulated Depreciation (220,000) (120,000) Investment in Short Retail Stores 120,000 Total Assets $ 900,000 470,000 Liabilities and Equity Accounts Payable 40,000 20,000 Bonds Payable 300,000 200,000 Preferred Stock ($10 par value) 200,000 100,000 Common Stock: $10 par value 150,000 $5 par value 100,000 Retained Earnings 210,000 50,000 Total Liabilities and Equity $ 900,000 $ 470,000 Short Retail's 8 percent preferred stock is convertible into 12,000 shares of common stock, and its 10 percent bonds are convertible into 8,000 shares of common stock. Short reported net income of $49,200 for 20X4 and paid dividends of $30,000. Punch Manufacturing has 11 percent preferred stock and 12 percent bonds outstanding, neither of which is convertible. Punch reported after-tax income, excluding investment income from Short, of $100,000 in 20X4 and paid dividends of $60,000. The companies file separate tax returns and are subject to a 40 percent income tax. Required: Compute basic and diluted EPS for the consolidated entity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts