Question: BASIC FACT PATTERN. CR Electrical Contractors, Inc. CREC) is an lowa corporation with its principal place of business in Cedar Rapids, Iowa. It is owned

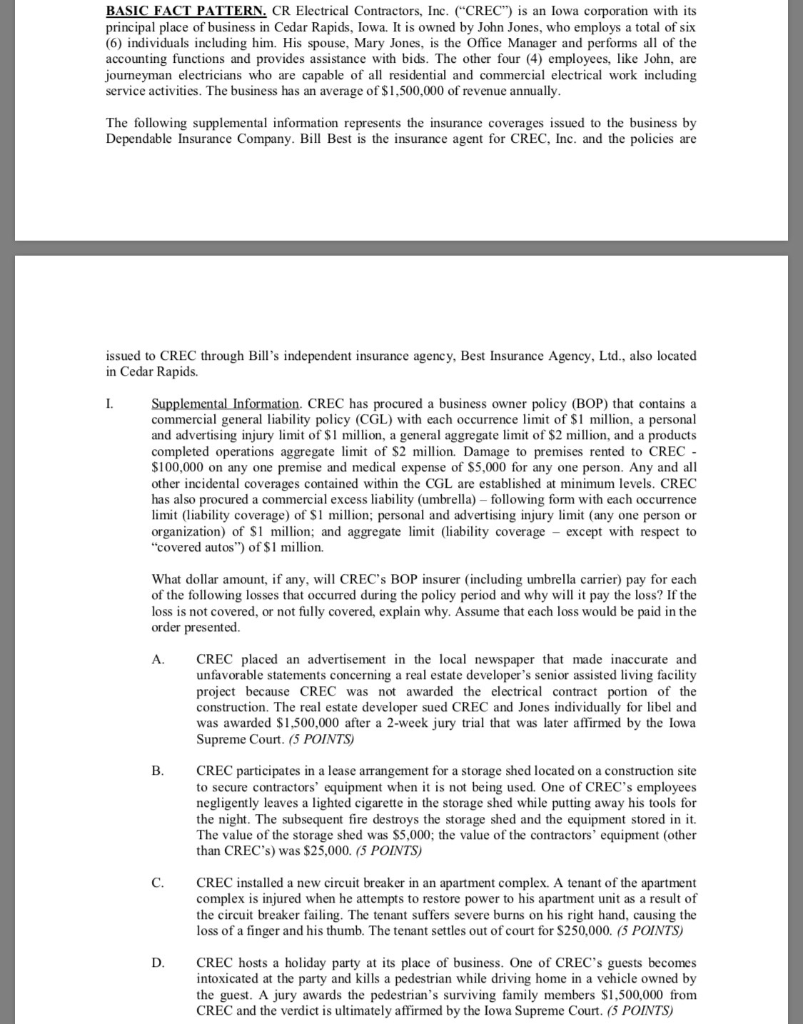

BASIC FACT PATTERN. CR Electrical Contractors, Inc. CREC) is an lowa corporation with its principal place of business in Cedar Rapids, Iowa. It is owned by John Jones, who employs a total of six (6) individuals including him. His spouse, Mary Jones, is the Office Manager and performs all of the accounting functions and provides assistance with bids. The other four (4) employees, like John, are journeyman electricians who are capable of all residential and commercial electrical work including service activities. The business has an average of $1,500,000 of revenue annually The followin supplemental information represents the insurance coverages issued to the business by Dependable Insurance Company. Bill Best is the insurance agent for CREC, Inc. and the policies are issued to CREC through Bill's independent insurance agency, Best Insurance Agency, in Cedar Rapids. Ltd., also located I. Supplemental Information. CREC has procured a business owner policy (BOP) that contains a commercial general liability policy (CGL) with each occurrence limit of $ mil, a personal and advertising injury limit of S1 millon, a general aggregate limit of $2 million, and a products completed operations aggregate limit of S2 million. Damage to premises rented to CREC 100,000 on any one premise and medical expense of $5,000 for any one person. Any and all other incidental coverages contained within the CGL are established at minimum levels. CREC has also procured a commercial excess liability (umbrella) following form with each occurrence limit (liability coverage) of S1 million; personal and advertising injury limit (any one person or organization) of S1 million; and aggregate limit (liability coverage except with respect to "covered autos" of S1 million. What dollar amount, if any, will CREC's BOP insurer (including umbrella carrier) pay for each of the following losses that occurred during th loss is not covered, or not fully covered, explain why. Assume that each loss would be paid in the order presented. he policy per iod and why will it pay the loss? If the A. CREC placed an advertisement in the local newspaper that unfavorable statements concerning a real estate developer's senior assisted living facility project because CREC was not awarded the electrical contract portion of the construction. The real estate developer sued CREC and Jones individually for libel and was awarded $1,500,000 after a 2-week jury trial that was later affirmed by the lowa Supreme Court. (5 POINTS made inaccurate and B. CREC participates in a lease arrangement for a storage shed located on a construction site to secure contractors' equipment when it is not being used. One of CREC's employees negligently leaves a lighted cigarette in the storage shed while putting away his tools for the night. The subsequent fire destroys the storage shed and the equipment stored in it. The value of the storage shed was S5,000; the value of the contractors' equipment (other than CREC's) was $25,000. (5 POINTS C. CREC installed a new circuit breaker in an apartment complex. A tenant of the apartment complex is injured when he attempts to restore power to his apartment unit as a result of the circuit breaker failing. The tenant suffers severe burns on his right hand, causing the loss of a finger and his thumb. The tenant settles out of court for S250,000. (5 POINTS) D. CREC hosts a holiday party at its place of business. One of CREC's guests becomes intoxicated at the party and kills a pedestrian while driving home in a vehicle owned by the guest. A jury awards the pedestrian's surviving family members $1,500,000 from CREC and the verdict is ultimately affirmed by the lowa Supreme Court. (5 POINTS) BASIC FACT PATTERN. CR Electrical Contractors, Inc. CREC) is an lowa corporation with its principal place of business in Cedar Rapids, Iowa. It is owned by John Jones, who employs a total of six (6) individuals including him. His spouse, Mary Jones, is the Office Manager and performs all of the accounting functions and provides assistance with bids. The other four (4) employees, like John, are journeyman electricians who are capable of all residential and commercial electrical work including service activities. The business has an average of $1,500,000 of revenue annually The followin supplemental information represents the insurance coverages issued to the business by Dependable Insurance Company. Bill Best is the insurance agent for CREC, Inc. and the policies are issued to CREC through Bill's independent insurance agency, Best Insurance Agency, in Cedar Rapids. Ltd., also located I. Supplemental Information. CREC has procured a business owner policy (BOP) that contains a commercial general liability policy (CGL) with each occurrence limit of $ mil, a personal and advertising injury limit of S1 millon, a general aggregate limit of $2 million, and a products completed operations aggregate limit of S2 million. Damage to premises rented to CREC 100,000 on any one premise and medical expense of $5,000 for any one person. Any and all other incidental coverages contained within the CGL are established at minimum levels. CREC has also procured a commercial excess liability (umbrella) following form with each occurrence limit (liability coverage) of S1 million; personal and advertising injury limit (any one person or organization) of S1 million; and aggregate limit (liability coverage except with respect to "covered autos" of S1 million. What dollar amount, if any, will CREC's BOP insurer (including umbrella carrier) pay for each of the following losses that occurred during th loss is not covered, or not fully covered, explain why. Assume that each loss would be paid in the order presented. he policy per iod and why will it pay the loss? If the A. CREC placed an advertisement in the local newspaper that unfavorable statements concerning a real estate developer's senior assisted living facility project because CREC was not awarded the electrical contract portion of the construction. The real estate developer sued CREC and Jones individually for libel and was awarded $1,500,000 after a 2-week jury trial that was later affirmed by the lowa Supreme Court. (5 POINTS made inaccurate and B. CREC participates in a lease arrangement for a storage shed located on a construction site to secure contractors' equipment when it is not being used. One of CREC's employees negligently leaves a lighted cigarette in the storage shed while putting away his tools for the night. The subsequent fire destroys the storage shed and the equipment stored in it. The value of the storage shed was S5,000; the value of the contractors' equipment (other than CREC's) was $25,000. (5 POINTS C. CREC installed a new circuit breaker in an apartment complex. A tenant of the apartment complex is injured when he attempts to restore power to his apartment unit as a result of the circuit breaker failing. The tenant suffers severe burns on his right hand, causing the loss of a finger and his thumb. The tenant settles out of court for S250,000. (5 POINTS) D. CREC hosts a holiday party at its place of business. One of CREC's guests becomes intoxicated at the party and kills a pedestrian while driving home in a vehicle owned by the guest. A jury awards the pedestrian's surviving family members $1,500,000 from CREC and the verdict is ultimately affirmed by the lowa Supreme Court. (5 POINTS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts