Question: Basic IRR Analysis Friedman Company is considering installing a new IT system. The cost of the new system is estimated to be $2,250,000, but it

Basic IRR Analysis

Friedman Company is considering installing a new IT system. The cost of the new system is estimated to be $2,250,000, but it would produce after-tax savings of $450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving $450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent.

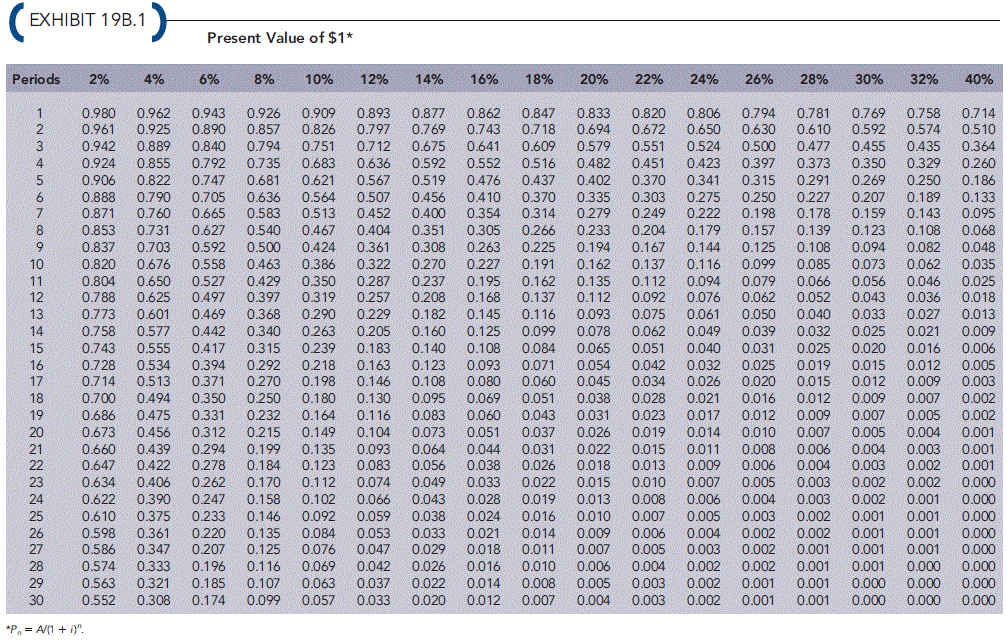

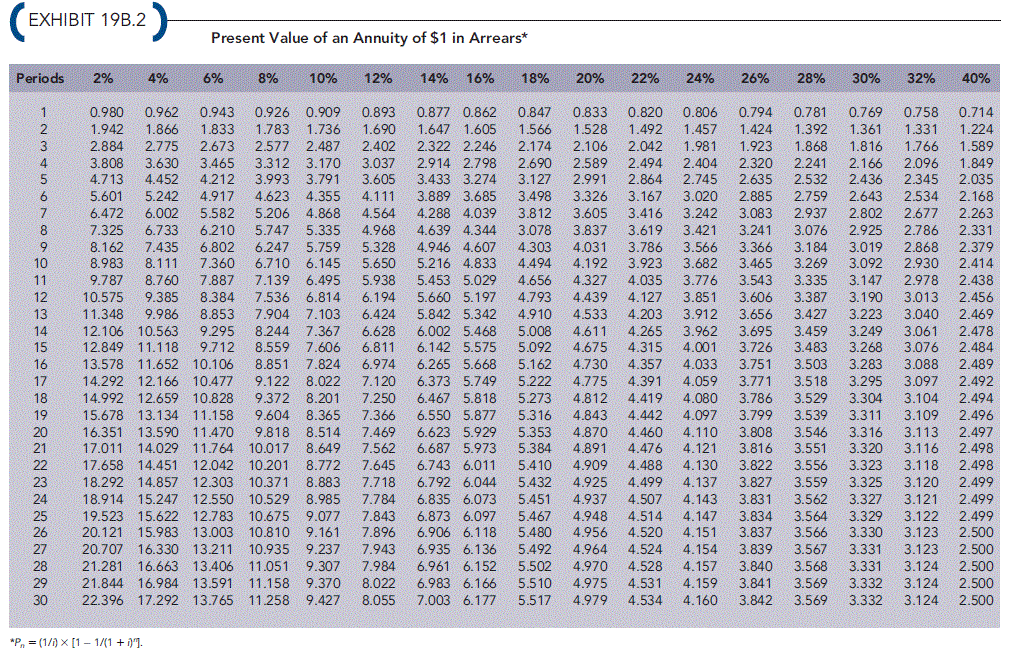

The present value tables provided in Exhibit 19B.1 and 19B.2 must be used to solve the following problems.

Required:

1. Calculate the projects internal rate of return. Enter your answers as whole percentage values (for example, 10% should be entered as "10" in the answer box).

Between % and %

Should the company acquire the new IT system? Yes

2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Round your answer to the nearest dollar. $

What is the amount of the safety margin (rounded to the nearest dollar)? $

3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Enter your percentage answers as whole percentage values (for example, 10% should be entered as "10" in the answer box). Round the cash flow amount to the nearest dollar.

| IRR | Between | % | and | % | |

| Minimum cash flow | $ |

EXHIBIT 19B.1 Present Value of $1* Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% 40% 0.980 0.962 0.9430.926 0.909 0.893 0.877 0.862 0.847 0.833 0.820 0.806 0.794 0.781 0.769 0.758 0.714 0.961 0.9250.890 0.8570.826 0.797 0.769 0.743 0.718 0.694 0.672 0.650 0.630 0.610 0.592 0.574 0.510 0.942 0.8890.8400.794 0.751 0.712 0.675 0.641 0.609 0.579 0.551 0.524 0.500 0.477 0.455 0435 0.364 0.924 0.8550.792 0.7350.683 0.636 0.592 0.552 0.516 0.482 0.451 0.423 0.397 0.373 0.350 0.3290.260 5 0.906 0.822 0.747 0.681 0.621 0.567 0.519 0.476 0.437 0.402 0.370 0.341 0.315 0.291 0.269 0.250 0.186 0888 0.790 0.705 0.636 0.564 0.507 0.456 0.410 0.370 0.335 0.303 0.275 0.250 0.227 0.207 0.189 0.133 0.871 0.760 0.665 0.583 0.513 0.452 0.400 0.354 0.314 0.279 0.249 0.222 0.198 0.178 0.159 0.1430.095 8 0.853 0.731 0.627 0.540 0.467 0.404 0.351 0.305 0.266 0.233 0.204 0.179 0.157 0.139 0.1230.108 0.068 9 0.837 0.703 0.592 0.500 0.424 0.361 0.308 0.263 0.225 0.194 0.167 0.144 0.125 0.108 0.094 0.082 0.048 0.820 0.676 0.558 0.463 0.386 0.322 0.270 0.2270.191 0.162 0.137 0.116 0.099 0.085 0.073 0.062 0.035 0.804 0.650 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.135 0.112 0.094 0.079 0.066 0.056 0.046 0.025 0.788 0.6250.497 0.3970.319 0.257 0.208 0.168 0.137 0.112 0.092 0.076 0.062 0.052 0.043 0.0360.018 3 10 12 13 0.773 0.601 0.469 0.368 0290 0229 0.182 0.145 OLI 16 0093 0075 0091 0050 0040 0083 D027 14 0.758 0.577 0.442 0.340 0.263 0.205 0.160 0.125 0.099 0.078 0.062 0.049 0.039 0.032 0.025 0.021 0.009 15 0.743 0.555 0.417 0.315 0.239 0.183 0.140 0.108 0.084 0.0650.0510.040 0.031 0.025 0.020 0.016 0.006 0.728 0.534 0.3940.292 0.218 0.163 0.123 0.093 0.071 0.054 0.042 0.032 0.025 0.019 0.015 0.0120.005 17 0.714 0.513 0.371 0.270 0.198 0.146 0.108 0.080 0.060 0.045 0.034 0.026 0.020 0.015 0.012 0.009 0.003 0.700 0.494 0.350 0.250 0.180 0.130 0.095 0.069 0.051 0.038 0.028 0.021 0.016 0.012 0.009 0.0070.002 0.686 0.4750.3310.232 0.164 0.116 0.083 0.060 0.043 0.031 0.023 0.017 0.012 0.009 0.007 0.005 0.002 0.673 0.4560.312 0.2150.149 0.104 0.073 0.051 0.037 0.026 0.019 0.014 0.010 0.007 0.005 0.004 0.001 0.660 0.439 0.294 0.199 0.135 0.093 0.0640.044 0.0310.022 0.015 0.011 0.008 0.006 0.004 0.003 0.001 0.647 0.422 0.278 0.184 0.123 0.083 0.056 0.038 0.026 0.018 0.013 0.009 0.006 0.004 0.003 0.002 0.001 0.634 0.406 0.262 0.170 0.112 0.074 0.049 0.033 0.022 0.015 0.010 0.007 0.005 0.003 0.002 0.0020.000 24 0.622 0.390 0.247 0.158 0.102 0.066 0.043 0.028 0.019 0.013 0.008 0.006 0.004 0.003 0.002 0.001 0.000 0.610 0.375 0.233 0.146 0.092 0.059 0.038 0.024 0.016 0.010 0.007 0.005 0.003 0.002 0.001 0.0010.000 0.598 0.361 0.220 0.135 0.084 0.053 0.0330.021 0.014 0.009 0.006 0.004 0.002 0.002 0.001 0.001 0.000 0.586 0.3470.2070.1250.076 0.047 0.029 0.018 0.011 0.007 0.005 0.003 0.002 0.001 0.001 0.001 0.000 0.574 0.333 0.1960.116 0.069 0.042 0.026 0.016 0.010 0.006 0.004 0.002 0.002 0.001 0.001 0.000 0.000 0.563 0.3210.185 0.1070.063 0.037 0.022 0.014 0.008 0.005 0.003 0.002 0.001 0.001 0.000 0.0000.000 0.552 0.308 0.1740.0990.057 0.033 0.020 0.012 0.007 0.004 0.003 0.002 0.001 0.001 0.0000.0000.000 18 20 23 25 26 27 28 29 30 EXHIBIT 19B.2 Present Value of an Annuity of $1 in Arrears Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% 40% 0.980 0.962 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 0.820 0.806 0.794 0.781 0.769 0.758 0.714 1.942 1.866 1833 1.783 1.736 1.690 1.647 1.605 1.566 1.528 1.492 1.457 1.424 1.392 1.361 1331 1.224 2.884 2.7752.6732.577 2.487 2.402 2.322 2.246 2.174 2.106 2.042 1.981 1.923 1.868 1.816 1.766 1.589 3.808 3.630 3.465 3.312 3.170 3.037 2.914 2.798 2.690 2.589 2.494 2.404 2.320 2.241 2.166 2.096 1.849 4.713 4.452 4.212 3.9933.7913.605 3.433 3.274 3.127 2.991 2.864 2.745 2.635 2.532 2.436 2.345 2.035 5.601 5.24249174.623 4.355 4.111 3.889 3.685 3.498 3.326 3.167 3.020 2.885 2.759 2.643 2.534 2.168 6.472 6.002 5.582 5.206 4.868 4.564 4.288 4.039 3.812 3.605 3.416 3.242 3.083 2.937 2.802 2.677 2.263 7.325 6.733 6210 5.747 5.335 4968 4.639 4.344 3078 3.837 3.619 3.421 3.241 3.076 2.925 2.786 2.331 8.162 7.4356.8026.2475.759 5.328 4.946 4.607 4.303 4.031 3.786 3.566 3.366 3.184 3.019 2.868 2.379 8.983 8.111 7.360 6.710 6.145 5.650 5.216 4833 4.494 4.192 3.923 3.682 3.465 3.269 3.092 2.930 2.414 9.787 8.760 7.887 7.139 6.495 5.938 5.453 5.029 4.656 4.327 4.035 3.776 3.543 3.335 3.147 2.978 2.438 4.127 3.851 3.606 3.387 3.190 3.013 2.456 11.348 9.986 8.853 7.904 7.1036.424 5.842 5.342 4.910 4.5334.203 3.912 3.6563.427 3.223 3.0402.469 14 12.106 10.5639.295 8.244 7.367 6.628 6.002 5.468 5.008 4.611 4.265 3.962 3.695 3.459 3.249 3.061 2.478 15 12.849 11.1189.712 8.559 7.606 6.811 6.142 5.575 5.092 4.675 4.315 4.001 3.726 3.483 3.268 3.076 2.484 16 13.578 11.652 10.106 8.851 7.824 6.974 6.265 5.668 5.162 4.730 4.357 4.033 3.751 3.503 3.283 3.088 2.489 17 14.292 12.166 10.4779.122 8.022 7.120 6.373 5.749 5.222 4.775 4.391 4.059 3.771 3.518 3.295 3.097 2.492 18 14.992 12.659 10.8289.372 8.201 7.250 6.467 5.818 5.273 4.812 4.419 4.080 3.786 3.529 3.304 3.104 2.494 19 15.678 13.134 11.1589.604 8.365 7.366 6.550 5.877 5.316 4.843 4.442 4.097 3.799 3.539 3.311 3.109 2.496 20 16.351 13.590 11470 9.818 8.514 7.469 6.623 5.929 5.353 4.870 4.460 4.110 3.808 3.546 3.316 3.113 2.497 21 17.011 14.029 11.764 10.017 8.649 7.562 6.687 5.973 5.384 4.891 4.476 4.121 3.816 3.551 3.320 3.116 2.498 22 17.658 14.451 12.042 10.201 8.772 7.645 6.743 6.011 5.410 4.909 4.488 4.130 3.822 3.556 3.323 3.118 2.498 18.292 14.857 12.303 10.371 8.883 7.718 6.792 6.0445.432 4.925 4.499 4.137 3.827 3.559 3.325 3.120 2.499 24 18.914 15.247 12.550 10.529 8.985 7.784 6.835 6.07354514.937 4.507 4.143 3.831 3.562 3.327 3.121 2.499 19.523 15.622 12.783 10.675 9.077 7.843 6.873 6.097 5.467 4.948 4.514 4.147 3.834 3.564 3.329 3.122 2.499 26 20.121 15.983 13.003 10.810 9.161 7.896 6.906 6.118 5.480 4.956 4.520 4.151 3.837 3.566 3.330 3.123 2.500 27 20.707 16.330 13.211 10.935 9.237 7.943 6.935 6.136 5.492 4.964 4.524 4.154 3.839 3.567 3.331 3.123 2.500 28 21.281 16.663 13.406 11.051 9.307 7.984 6.961 6.152 5.502 4.970 4.528 4.157 3.840 3.568 3.331 3.124 2.500 29 21.844 16.98413.591 11.158 9.370 8.022 6.983 6.166 5.510 4.975 4.531 4.159 3.841 3.569 3.332 3.124 2.500 30 22.396 17.29213.765 11.258 9.427 8.055 7.003 6.177 5.517 4979 4.534 4.160 3.842 3.569 3.332 3.124 2.500 2 4 10 12 10.575 9.385 8.384 7.536 6.814 6.194 5.660 5.197 4.793 4439 23 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts