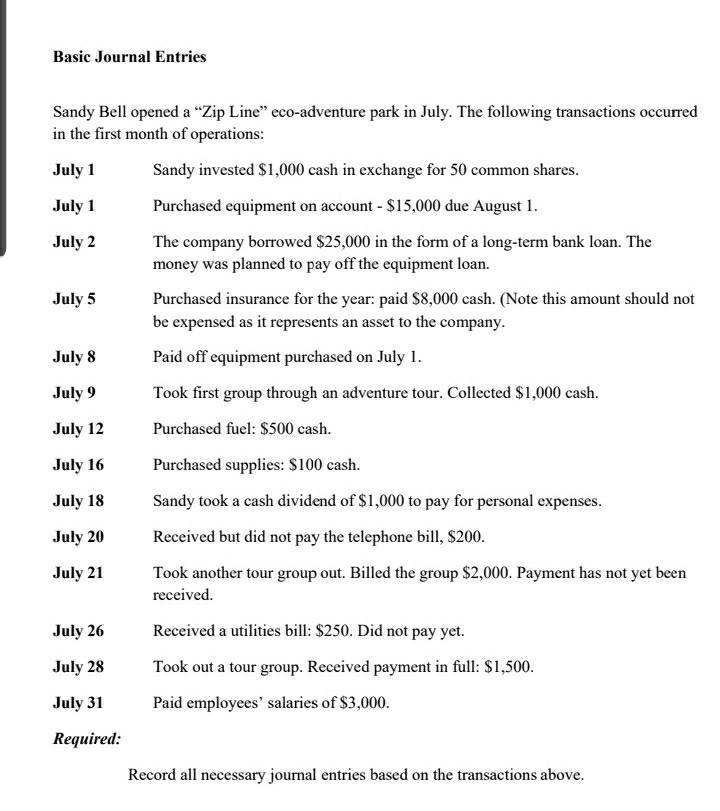

Question: Basic Journal Entries Sandy Bell opened a Zip Line eco-adventure park in July. The following transactions occurred in the first month of operations: July 1

Basic Journal Entries Sandy Bell opened a Zip Line eco-adventure park in July. The following transactions occurred in the first month of operations: July 1 Sandy invested $1,000 cash in exchange for 50 common shares. July 1 Purchased equipment on account - $15,000 due August 1. July 2 The company borrowed $25,000 in the form of a long-term bank loan. The money was planned to pay off the equipment loan. July 5 Purchased insurance for the year: paid $8,000 cash. (Note this amount should not be expensed as it represents an asset to the company. July 8 Paid off equipment purchased on July 1. July 9 Took first group through an adventure tour. Collected $1,000 cash. July 12 Purchased fuel: $500 cash. July 16 July 18 July 20 July 21 Purchased supplies: $100 cash. Sandy took a cash dividend of $1,000 to pay for personal expenses. Received but did not pay the telephone bill, $200. Took another tour group out. Billed the group $2,000. Payment has not yet been received Received a utilities bill: $250. Did not pay yet. Took out a tour group. Received payment in full: $1,500. Paid employees' salaries of $3,000. July 26 July 28 July 31 Required: Record all necessary journal entries based on the transactions above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock