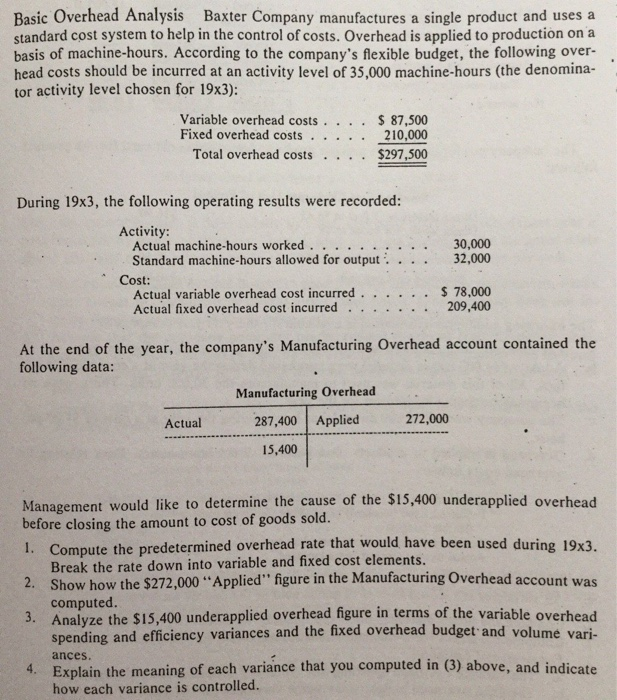

Question: . Basic Overhead Analysis Baxter Company manufactures a single product and uses a standard cost system to help in the control of costs. Overhead is

. Basic Overhead Analysis Baxter Company manufactures a single product and uses a standard cost system to help in the control of costs. Overhead is applied to production on a basis of machine-hours. According to the company's flexible budget, the following over- head costs should be incurred at an activity level of 35,000 machine-hours (the denomina- tor activity level chosen for 19x3): Variable overhead costs .... $ 87,500 Fixed overhead costs. 210,000 Total overhead costs $297,500 During 19x3, the following operating results were recorded: 30,000 32,000 Activity: Actual machine-hours worked . Standard machine-hours allowed for output Cost: Actual variable overhead cost incurred. Actual fixed overhead cost incurred . $ 78,000 209,400 At the end of the year, the company's Manufacturing Overhead account contained the following data: Manufacturing Overhead Actual 287,400 Applied 272,000 15,400 Management would like to determine the cause of the $15,400 underapplied overhead before closing the amount to cost of goods sold. 1. Compute the predetermined overhead rate that would have been used during 19x3. Break the rate down into variable and fixed cost elements. 2. Show how the $272,000 "Applied" figure in the Manufacturing Overhead account was computed. 3. Analyze the $15,400 underapplied overhead figure in terms of the variable overhead spending and efficiency variances and the fixed overhead budget and volume vari- 4. Explain the meaning of each variance that you computed in (3) above, and indicate how each variance is controlled. ances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts