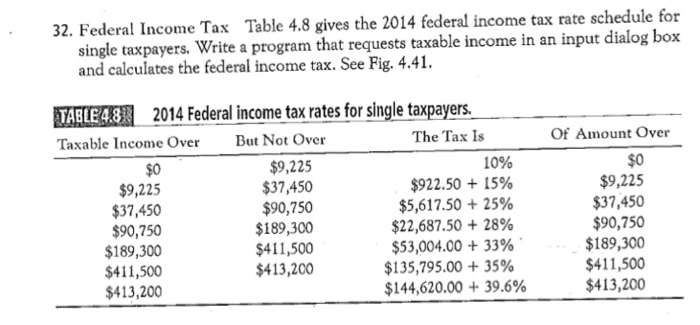

Question: Basic programming visual studios 32. Federal Income Tax Table 4.8 gives the 2014 federal income tax rate schedule for single taxpayers. Write a program that

Basic programming visual studios

Basic programming visual studios 32. Federal Income Tax Table 4.8 gives the 2014 federal income tax rate schedule for single taxpayers. Write a program that requests taxable income in an input dialog box and calculates the federal income tax. See Fig. 4.41. 2014 Federal income tax rates for single taxpayers. TABLE 48 Taxable Income OverBut Not Over The Tax Is Of Amount Over $0 $9,225 $37,450 $90,750 $189,300 411,500 $413,200 $9,225 $37,450 $90,750 $189,300 $411,500 $413,200 10% $922.50 + 15% $5,617.50 + 25% $22,687.50 + 28% $53,004.00 + 33% $135,795.00 + 35% $0 $9,225 $37,450 $90,750 $189,300 411,500 $413,200 $144,620.00 + 39.6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts