Question: Basic Reconciliation Statement reference: https://drive.google.com/file/d/11WkdBlbIdz3vHtTLK8tCbXJgk8jTuOOO/view?usp=sharing Activity 2 Identify whether the following independent transaction is a book or a bank reconciling. In addition, determine the amount

Basic Reconciliation Statement

reference: https://drive.google.com/file/d/11WkdBlbIdz3vHtTLK8tCbXJgk8jTuOOO/view?usp=sharing

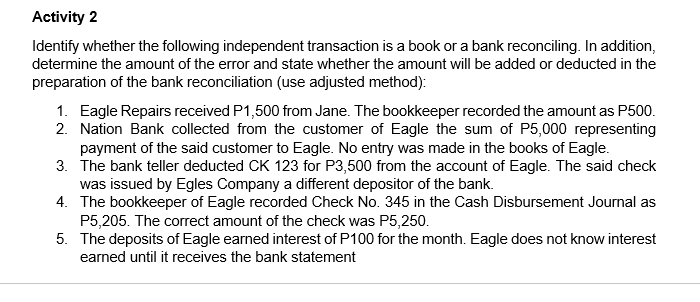

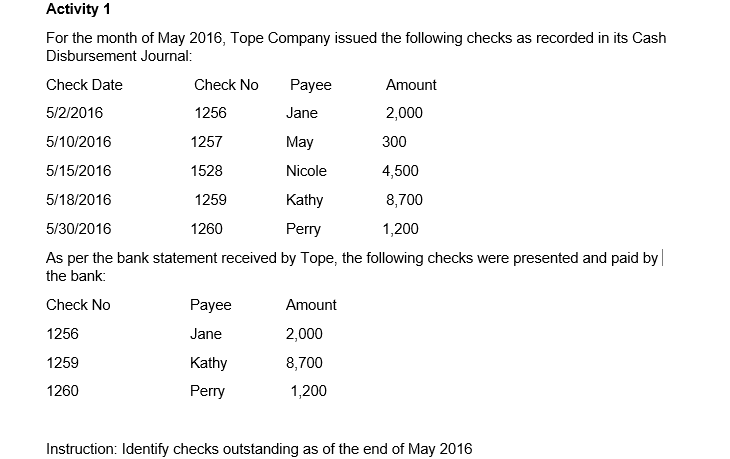

Activity 2 Identify whether the following independent transaction is a book or a bank reconciling. In addition, determine the amount of the error and state whether the amount will be added or deducted in the preparation of the bank reconciliation (use adjusted method): 1. Eagle Repairs received P1,500 from Jane. The bookkeeper recorded the amount as P500. 2. Nation Bank collected from the customer of Eagle the sum of P5,000 representing payment of the said customer to Eagle. No entry was made in the books of Eagle. 3. The bank teller deducted CK 123 for P3,500 from the account of Eagle. The said check was issued by Egles Company a different depositor of the bank. 4. The bookkeeper of Eagle recorded Check No. 345 in the Cash Disbursement Journal as P5,205. The correct amount of the check was P5,250. 5. The deposits of Eagle earned interest of P100 for the month. Eagle does not know interest earned until it receives the bank statementActivity 1 For the month of May 2016, Tope Company issued the following checks as recorded in its Cash Disbursement Journal: Check Date Check No Payee Amount 5/2/2016 1256 Jane 2,000 5/10/2016 1257 May 300 5/15/2016 1528 Nicole 4,500 5/18/2016 1259 Kathy 8,700 5/30/2016 1260 Perry 1,200 As per the bank statement received by Tope, the following checks were presented and paid by| the bank: Check No Payee Amount 1256 Jane 2,000 1259 Kathy 8,700 1260 Perry 1,200 Instruction: Identify checks outstanding as of the end of May 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts