Question: Basic Scenario 6: Bobbie Daniels Interview Notes Bobbie Daniels was separated from his spouse for 10 months in 2021. Bobbie and his spouse have decided

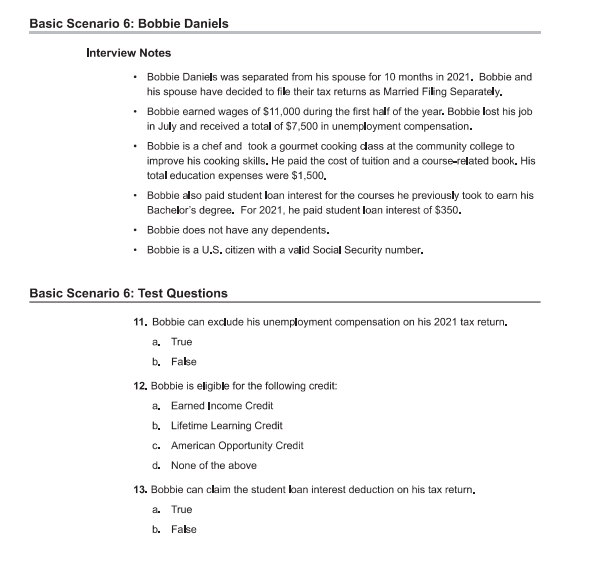

Basic Scenario 6: Bobbie Daniels Interview Notes Bobbie Daniels was separated from his spouse for 10 months in 2021. Bobbie and his spouse have decided to file their tax returns as Married Filing Separately. Bobbie earned wages of $11,000 during the first half of the year. Bobbie lost his job in July and received a total of $7,500 in unemployment compensation. . Bobbie is a chef and took a gourmet cooking dass at the community college to improve his cooking skills. He paid the cost of tuition and a course-related book. His total education expenses were $1,500. Bobble also paid student loan interest for the courses he previously took to eam his Bachelor's degree. For 2021, he paid student loan interest of $350. Bobbie does not have any dependents. Bobbie is a U.S. citizen with a valid Social Security number. . Basic Scenario 6: Test Questions 11. Bobbie can exclude his unemployment compensation on his 2021 tax return. a. True b. False 12. Bobbie is eligible for the following credit: a. Earned Income Credit b. Lifetime Learning Credit C. American Opportunity Credit d. None of the above 13. Bobbie can claim the student loan interest deduction on his tax return. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts