Question: Basic Social Security Retirement Decision Making and Financial Planning 1. Donna, a registered nurse, earns $48,000 annually. She is 30 years old (born on July

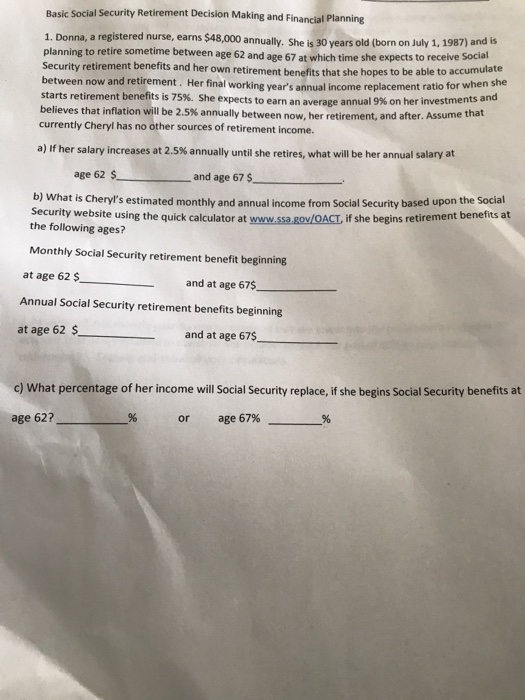

Basic Social Security Retirement Decision Making and Financial Planning 1. Donna, a registered nurse, earns $48,000 annually. She is 30 years old (born on July 1, 1987) and is planning to retire sometime between age 62 and age 67 at which time she expects to rece Security retirement benefits and her own retirement benefits that she hopes to be atl between now and retirement. Her final working year's annual income replacement ratio for when she starts retirement benefits is 75%. ve Social She expects to earn an average annual 9% on her investments and lieves that inflation will be 2.5% annually between now, her retirement, and after. Assume that currently Cheryl has no other sources of retirement income. a) if her salary increases at 2.5% annually until she retires, what will be her annual salary at age 62 $ and age 67 $ b) What is Cheryt's estimated monthly and annual income from Social Security based upon the Social security website using the quick calculator at www.ssa.gov/OACT,if she begins retirement benefits aft the following ages? Monthly Social Security retirement benefit beginning at age 62 $ Annual Social Security retirement benefits beginning at age 62 and at age 67$ and at age 67 c) What percentage of her income will Social Security replace, if she begins Social Security benefits at age 62? or age 67% %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts