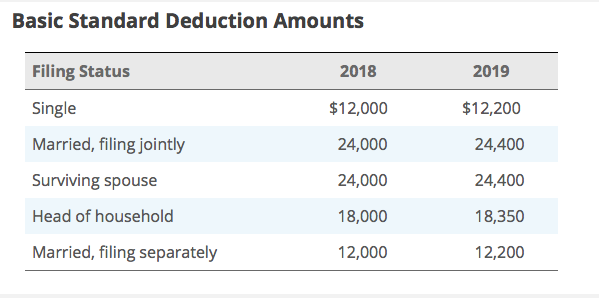

Question: Basic Standard Deduction Amounts Filing Status 2018 2019 Single $12,000 $12,200 Married, filing jointly 24,000 24,400 Surviving spouse 24,000 24,400 Head of household 18,000 18,350

Basic Standard Deduction Amounts Filing Status 2018 2019 Single $12,000 $12,200 Married, filing jointly 24,000 24,400 Surviving spouse 24,000 24,400 Head of household 18,000 18,350 Married, filing separately 12,000 12,200 Problem 3-25 (LO. 1, 8) The following information applies to Emily for 2019. Her filing status is single. Salary Interest income from bonds issued by Xerox Alimony payments received (divorce finalized in 2014) Contribution to traditional IRA $85,000 1,100 6,000 5,500 25,000 2,000 500 Gift from parents Capital gain from stock investment, held for 7 months Amount lost in football office betting pool (gambling loss) Age Emily has no gambling winnings this year. Emily's taxable income in 2019 is $ 85,000 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts