Question: Basically, I want the function to handle the negative equity values internally. Your function should internally call #3 to value the firm. Then, it will

Basically, I want the function to handle the negative equity values internally. Your function should internally call #3 to value the firm. Then, it will need to check to see if the equity value is negative and, if so, call the Black-Scholes function (#2) to return the proper equity value.

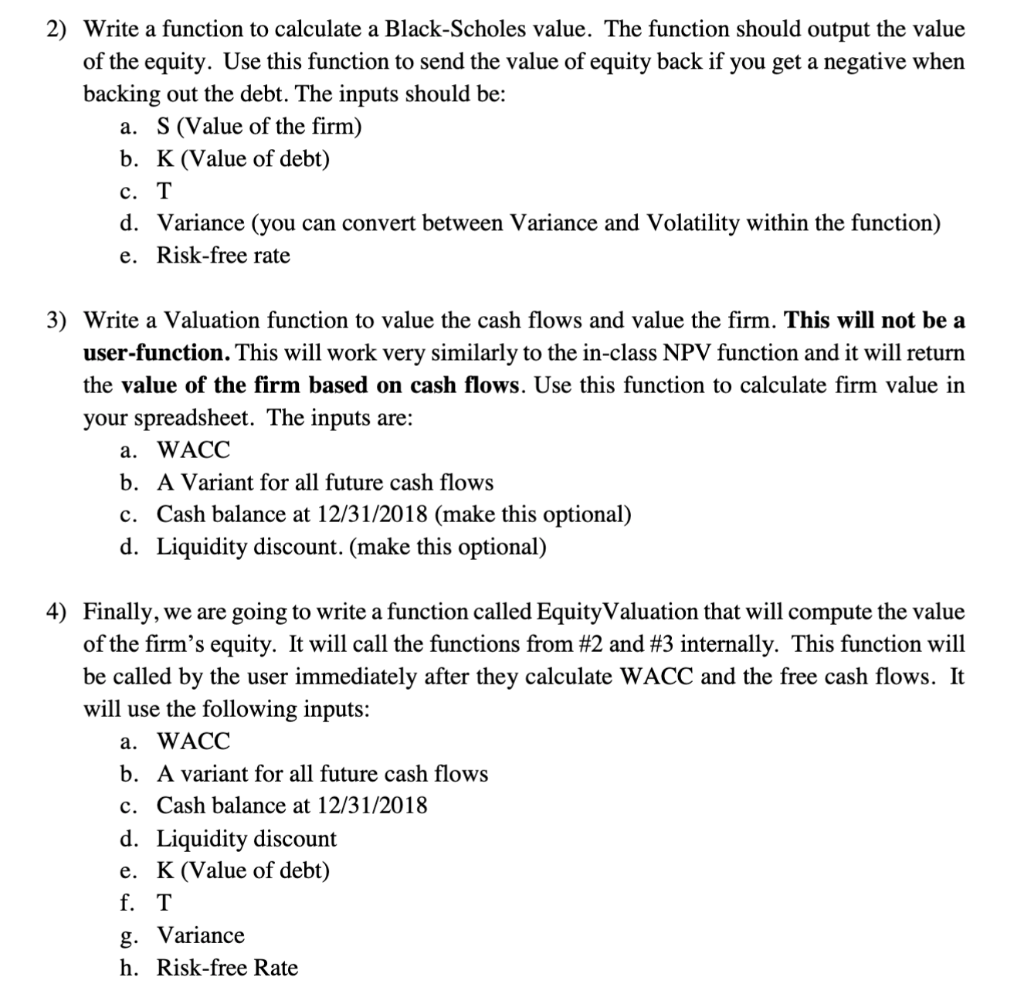

2) Write a function to calculate a Black-Scholes value. The function should output the value of the equity. Use this function to send the value of equity back if you get a negative when backing out the debt. The inputs should be: a. S (Value of the firm) b. K (Value of debt) d. Variance (you can convert between Variance and Volatility within the function) e. Risk-free rate 3) Write a Valuation function to value the cash flows and value the firm. This will not be a user-function. This will work very similarly to the in-class NPV function and it will return the value of the firm based on cash flows. Use this function to calculate firm value in your spreadsheet. The inputs are: a. WACC b. A Variant for all future cash flows c. Cash balance at 12/31/2018 (make this optional) d. Liquidity discount. (make this optional) 4) Finally, we are going to write a function called EquityValuation that will compute the value of the firm's equity. It will call the functions from #2 and #3 internally. This function will be called by the user immediately after they calculate WACC and the free cash flows. It will use the following inputs: a. WACC b. A variant for all future cash flows c. Cash balance at 12/31/2018 d. Liquiditv discount e. K (Value of debt) f. T g. Variance h. Risk-free Rate 2) Write a function to calculate a Black-Scholes value. The function should output the value of the equity. Use this function to send the value of equity back if you get a negative when backing out the debt. The inputs should be: a. S (Value of the firm) b. K (Value of debt) d. Variance (you can convert between Variance and Volatility within the function) e. Risk-free rate 3) Write a Valuation function to value the cash flows and value the firm. This will not be a user-function. This will work very similarly to the in-class NPV function and it will return the value of the firm based on cash flows. Use this function to calculate firm value in your spreadsheet. The inputs are: a. WACC b. A Variant for all future cash flows c. Cash balance at 12/31/2018 (make this optional) d. Liquidity discount. (make this optional) 4) Finally, we are going to write a function called EquityValuation that will compute the value of the firm's equity. It will call the functions from #2 and #3 internally. This function will be called by the user immediately after they calculate WACC and the free cash flows. It will use the following inputs: a. WACC b. A variant for all future cash flows c. Cash balance at 12/31/2018 d. Liquiditv discount e. K (Value of debt) f. T g. Variance h. Risk-free Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts