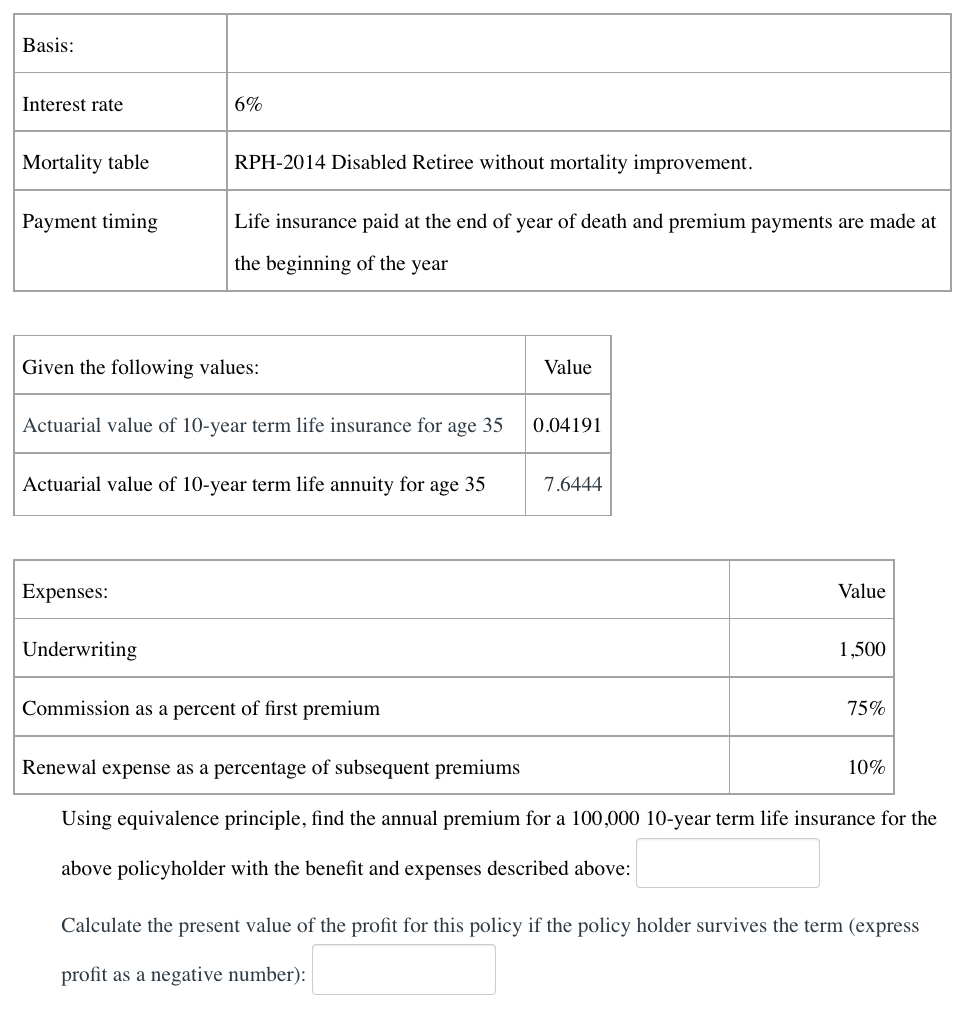

Question: Basis: Interest rate 6% Mortality table RPH-2014 Disabled Retiree without mortality improvement. Payment timing Life insurance paid at the end of year of death and

Basis: Interest rate 6% Mortality table RPH-2014 Disabled Retiree without mortality improvement. Payment timing Life insurance paid at the end of year of death and premium payments are made at the beginning of the year Given the following values: Value Actuarial value of 10-year term life insurance for age 35 0.04191 Actuarial value of 10-year term life annuity for age 35 7.6444 Expenses: Value Underwriting 1,500 Commission as a percent of first premium 75% Renewal expense as a percentage of subsequent premiums 10% Using equivalence principle, find the annual premium for a 100,000 10-year term life insurance for the above policyholder with the benefit and expenses described above: Calculate the present value of the profit for this policy if the policy holder survives the term (express profit as a negative number): Basis: Interest rate 6% Mortality table RPH-2014 Disabled Retiree without mortality improvement. Payment timing Life insurance paid at the end of year of death and premium payments are made at the beginning of the year Given the following values: Value Actuarial value of 10-year term life insurance for age 35 0.04191 Actuarial value of 10-year term life annuity for age 35 7.6444 Expenses: Value Underwriting 1,500 Commission as a percent of first premium 75% Renewal expense as a percentage of subsequent premiums 10% Using equivalence principle, find the annual premium for a 100,000 10-year term life insurance for the above policyholder with the benefit and expenses described above: Calculate the present value of the profit for this policy if the policy holder survives the term (express profit as a negative number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts