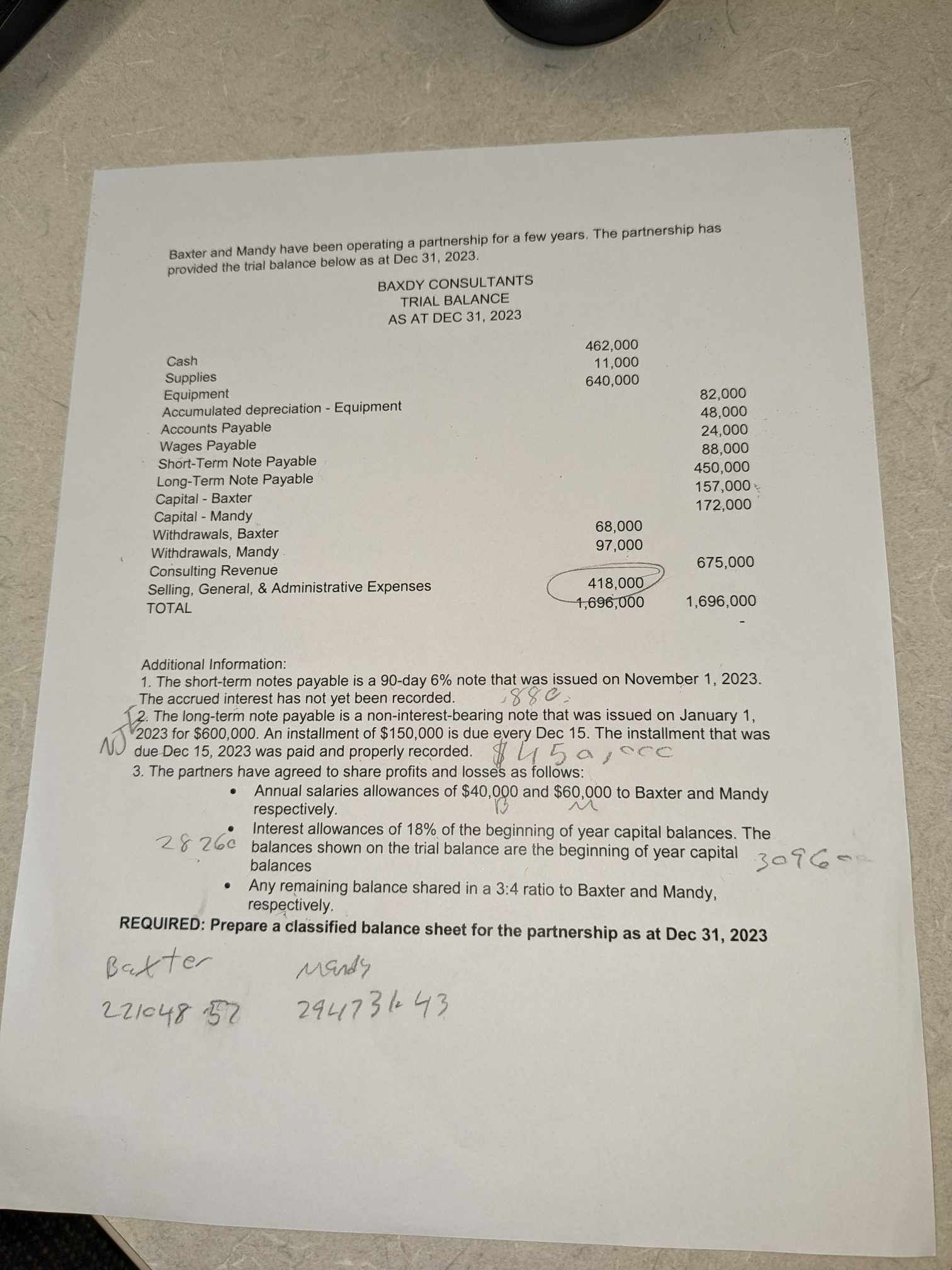

Question: Baxter and Mandy have been operating a partnership for a few years. The partnership has provided the trial balance below as at Dec 3 1

Baxter and Mandy have been operating a partnership for a few years. The partnership has

provided the trial balance below as at Dec

BAXDY CONSULTANTS

TRIAL BALANCE

AS AT DEC

Additional Information:

The shortterm notes payable is a day note that was issued on November

The accrued interest has not yet been recorded.

The longterm note payable is a noninterestbearing note that was issued on January

for $ An installment of $ is due every Dec The installment that was

due Dec was paid and properly recorded.

The partners have agreed to share profits and losses as follows:

Annual salaries allowances of $ and $ to Baxter and Mandy

respectively.

Interest allowances of of the beginning of year capital balances. The

balances shown on the trial balance are the beginning of year capital

balances

Any remaining balance shared in a : ratio to Baxter and Mandy,

respectively.

REQUIRED: Prepare a classified balance sheet for the partnership as at Dec

mand'y

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock