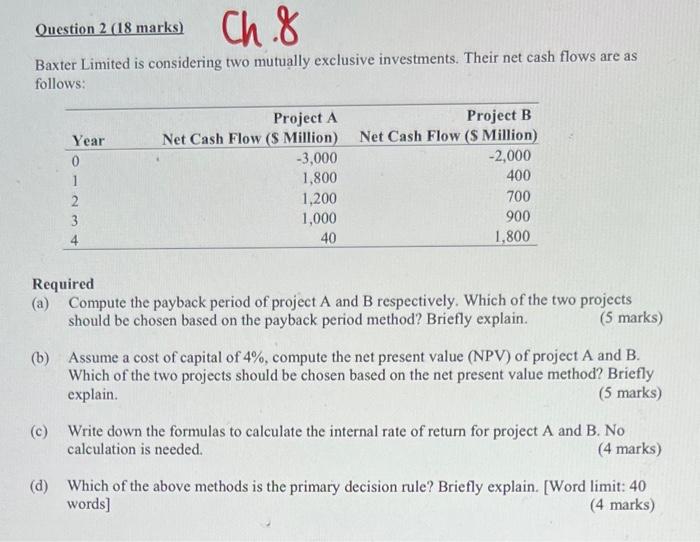

Question: Baxter Limited is considering two mutually exclusive investments. Their net cash flows are as follows: Required (a) Compute the payback period of project A and

Baxter Limited is considering two mutually exclusive investments. Their net cash flows are as follows: Required (a) Compute the payback period of project A and B respectively. Which of the two projects should be chosen based on the payback period method? Briefly explain. (5 marks) (b) Assume a cost of capital of 4%, compute the net present value (NPV) of project A and B. Which of the two projects should be chosen based on the net present value method? Briefly explain. (5 marks) (c) Write down the formulas to calculate the internal rate of return for project A and B. No calculation is needed. (4 marks) (d) Which of the above methods is the primary decision rule? Briefly explain. [Word limit: 40 words] (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts