Question: Bb Homework Assignment Chapte x Question 5 - Homework Assign *Search Results | Course Hero x Course Home X CC SCSU WebEx - Meeting Detail

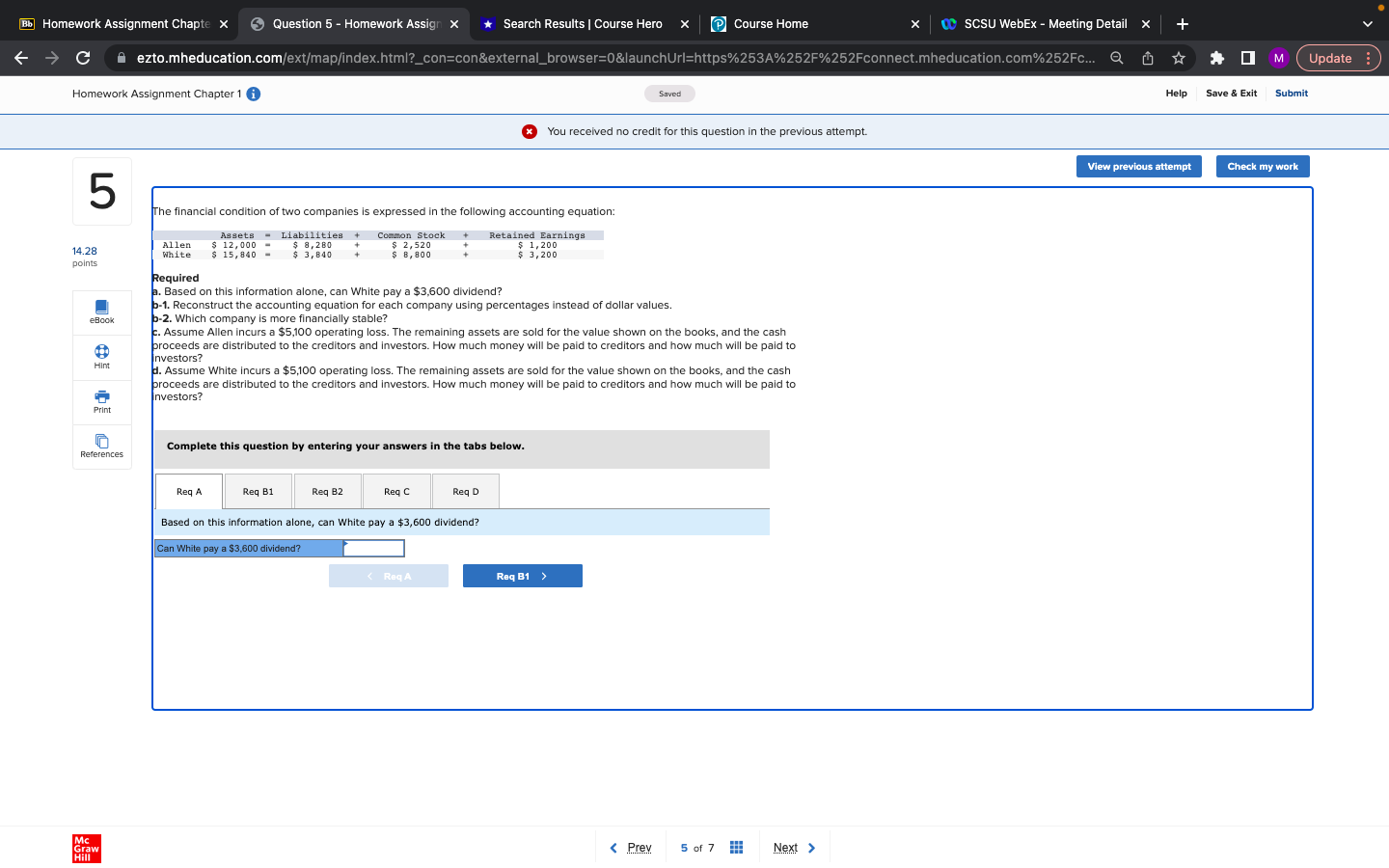

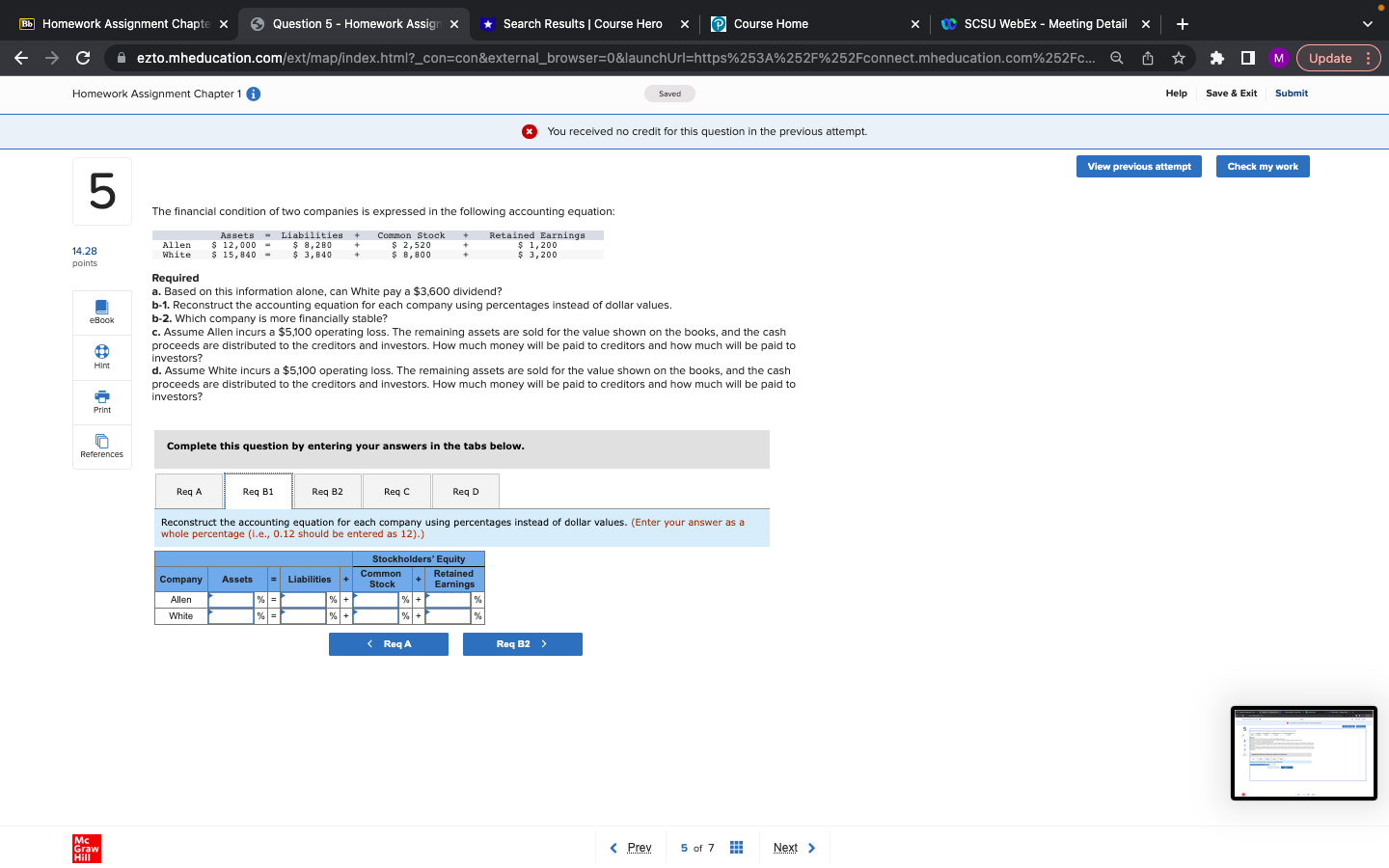

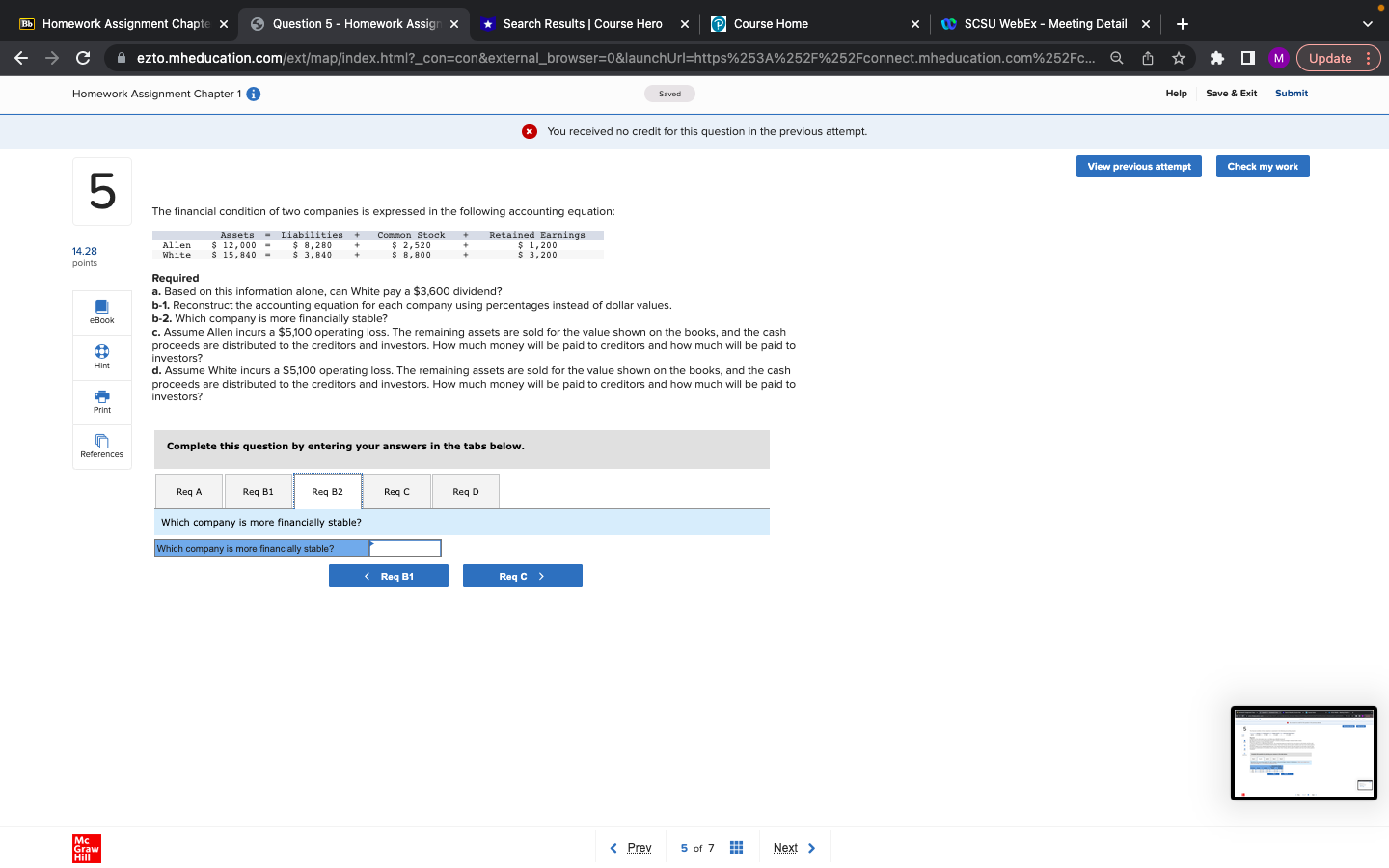

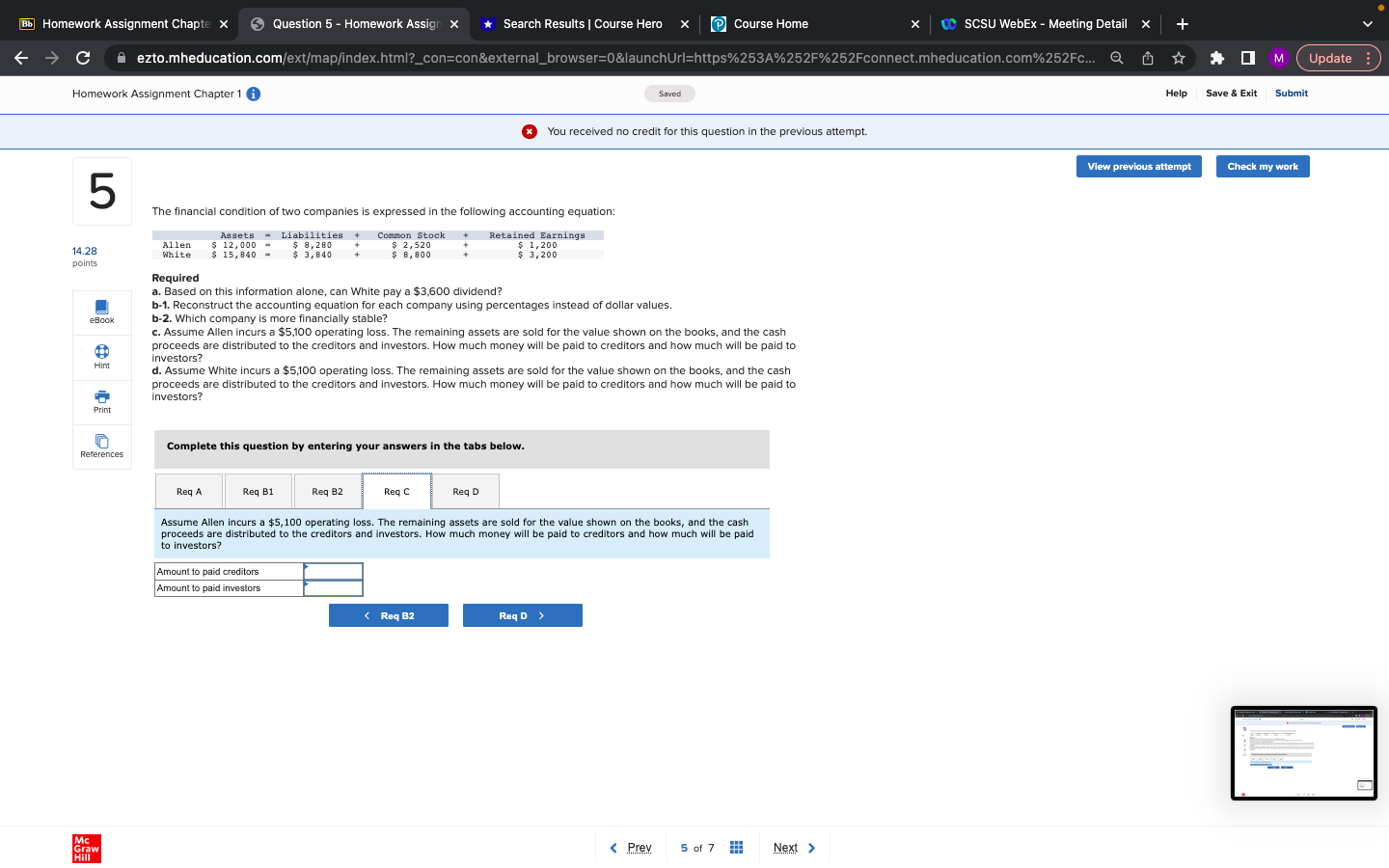

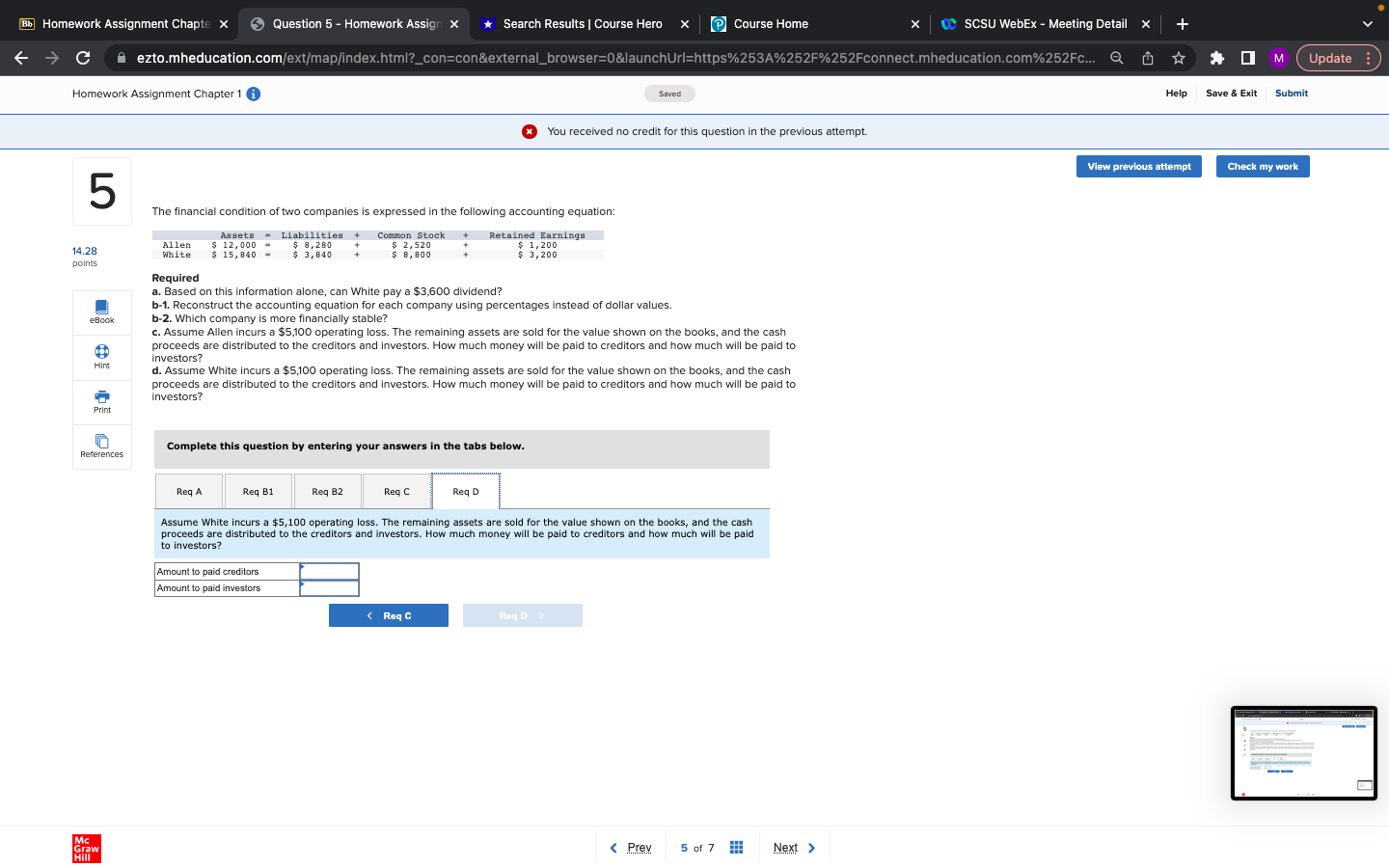

Bb Homework Assignment Chapte x Question 5 - Homework Assign *Search Results | Course Hero x Course Home X CC SCSU WebEx - Meeting Detail X C A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fconnect.mheducation.com%252Fc... Q OM Update : Homework Assignment Chapter 1 Saved Help Save & Exit Submit * You received no credit for this question in the previous attempt. View previous attempt Check my work 5 the financial condition of two companies is expressed in the following accounting equation: Assets - Liabilities Common Stock Retained Earnings 14.28 Allen $ 12, 000- $ 8,280 $ 2,520 $ 1, 200 White $ 15, 840 $ 3, 840 $ 8, 800 $ 3,200 points Required a. Based on this information alone, can White pay a $3,600 dividend? b-1. Reconstruct the accounting equation for each company using percentages instead of dollar values. eBook b-2. Which company is more financially stable? . Assume Allen incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to Hint nvestors? d. Assume White incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to Investors? Print Complete this question by entering your answers in the tabs below. References Req Req B1 Req B2 Reg C Reg D Based on this information alone, can White pay a $3,600 dividend? Can White pay a $3,600 dividend? Req A Req B1 > Bb Homework Assignment Chapte x Question 5 - Homework Assign *Search Results | Course Hero x Course Home X CC SCSU WebEx - Meeting Detail X C A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fconnect.mheducation.com%252Fc... Q Update : Homework Assignment Chapter 1 Saved Help Save & Exit Submit * You received no credit for this question in the previous attempt. View previous attempt Check my work 5 The financial condition of two companies is expressed in the following accounting equation: Assets Liabilities Common Stock Retained Earnings 14.28 Allen $ 12, 000 - $ 8, 280 $ 2,520 $ 1, 200 White $ 15, 840 $ 3, 840 $ 8, 800 $ 3,200 points Required a. Based on this information alone, can White pay a $3,600 dividend? b-1. Reconstruct the accounting equation for each company using percentages instead of dollar values. eBook b-2. Which company is more financially stable? c. Assume Allen incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to Hint investors? d. Assume White incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to investors? Print Complete this question by entering your answers in the tabs below. References Req A Req B1 Req B2 Reg C Reg D Reconstruct the accounting equation for each company using percentages instead of dollar values. (Enter your answer as a whole percentage (i.e., 0.12 should be entered as 12).) Stockholders' Equity Company Assets = Liabilities Common Retained Stock Earnings Allen % = % + % + % White % + 9% + 9% Bb Homework Assignment Chapte x Question 5 - Homework Assign *Search Results | Course Hero x Course Home X CC SCSU WebEx - Meeting Detail X C A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fconnect.mheducation.com%252Fc... Q Update : Homework Assignment Chapter 1 Saved Help Save & Exit Submit * You received no credit for this question in the previous attempt. View previous attempt Check my work 5 The financial condition of two companies is expressed in the following accounting equation: Assets Liabilities Common Stock Retained Earnings 14.28 Allen $ 12, 000 - $ 8, 280 $ 2,520 $ 1, 200 White $ 15, 840 $ 3, 840 $ 8, 800 $ 3,200 points Required a. Based on this information alone, can White pay a $3,600 dividend? b-1. Reconstruct the accounting equation for each company using percentages instead of dollar values. eBook b-2. Which company is more financially stable? c. Assume Allen incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to Hint investors? d. Assume White incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to investors? Print Complete this question by entering your answers in the tabs below. References Req Req B1 Req B2 Reg C Reg D Which company is more financially stable? Which company is more financially stable? Bb Homework Assignment Chapte x Question 5 - Homework Assign *Search Results | Course Hero x Course Home X CC SCSU WebEx - Meeting Detail X C A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fconnect.mheducation.com%252Fc... Q Update : Homework Assignment Chapter 1 Saved Help Save & Exit Submit * You received no credit for this question in the previous attempt. View previous attempt Check my work 5 The financial condition of two companies is expressed in the following accounting equation: Assets Liabilities Common Stock Retained Earnings 14.28 Allen $ 12, 000 - $ 8, 280 $ 2,520 $ 1, 200 White $ 15, 840 $ 3, 840 $ 8, 800 $ 3,200 points Required a. Based on this information alone, can White pay a $3,600 dividend? b-1. Reconstruct the accounting equation for each company using percentages instead of dollar values. eBook b-2. Which company is more financially stable? c. Assume Allen incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to Hint investors? d. Assume White incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to investors? Print Complete this question by entering your answers in the tabs below. References Req A Req B1 Req B2 Reg C Req D Assume Allen incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to investors? Amount to paid creditors Amount to paid investors Bb Homework Assignment Chapte x Question 5 - Homework Assign *Search Results | Course Hero x Course Home X CC SCSU WebEx - Meeting Detail X C A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fconnect.mheducation.com%252Fc... Q Update : Homework Assignment Chapter 1 Saved Help Save & Exit Submit * You received no credit for this question in the previous attempt. View previous attempt Check my work 5 The financial condition of two companies is expressed in the following accounting equation: Assets Liabilities Common Stock Retained Earnings 14.28 Allen $ 12, 000 - $ 8, 280 $ 2,520 $ 1, 200 White $ 15, 840 $ 3, 840 $ 8, 800 $ 3,200 points Required a. Based on this information alone, can White pay a $3,600 dividend? b-1. Reconstruct the accounting equation for each company using percentages instead of dollar values. eBook b-2. Which company is more financially stable? c. Assume Allen incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to Hint investors? d. Assume White incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to investors? Print Complete this question by entering your answers in the tabs below. References Req A Req B1 Req B2 Req C Reg C Assume White incurs a $5,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to investors? Amount to paid creditors Amount to paid investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts