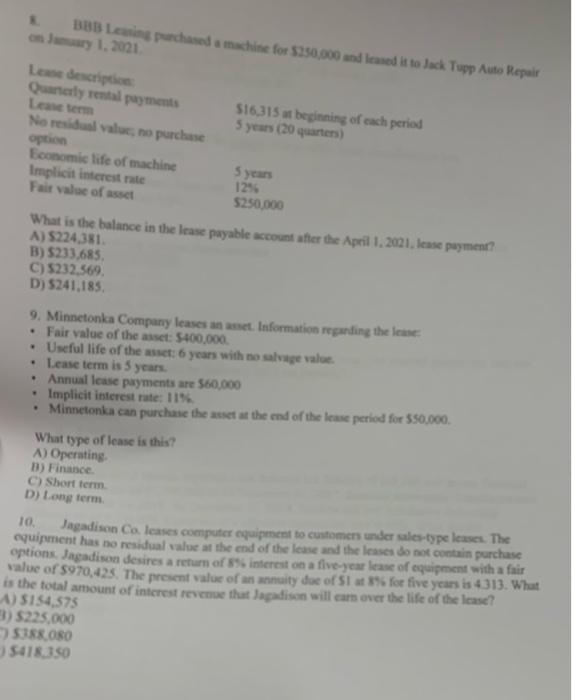

Question: B&B Lain purchased a machine for $250,000 and leaned it to Jack Tupp Auto Repair La descripti Quantly rental payments Leandem No residual value, no

B&B Lain purchased a machine for $250,000 and leaned it to Jack Tupp Auto Repair La descripti Quantly rental payments Leandem No residual value, no purchase option Economic life of machine Implicit interest rate Fair value of asset 516,315 at beginning of each period 5 years (20 quarters 5 years 12% $250,000 What is the balance in the lease payable account after the April 1.2021. lease payment? A) 5224381 B) 5233,685, C) 5232.569. D) 5241,185 9. Minnetonka Company leases and Information regarding the le Fair value of the asset: $400,000 Useful life of the set: 6 years with no salge value Lease term is 5 years. Annual lease payments are $60,000 Implicit interest rate: 11% Minnetonka can purchase the set at the end of the lease period for 550.000 What type of lease is this? A) Operating B) Finance C) Short term D) Long term 10, Jagadison Coleases computer equipment to customers under sales-type lases. The equipment has no residual value at the end of the lease and the lease do not contain purchase options. Jagadison desires a return of interest on a five-year lease of equipment with a fair value of $970,425. The present value of an annuity due of Stat 3% for five years is 4313. What is the total amount of interest revenue that Jagadison will cam over the life of the lease? A) $154,575 3) $225.000 SISK OSO 541810

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts