Question: Bb Take Test: Assessment 1 - Quiz - X + V X torrens.blackboard.com/webapps/assessment/take/launch.jsp?course_assessment_id=_576276_1&course_id=_135644_1&content_id=_11113839_1&step=null Q E X M Gmail YouTube . Maps Bb Blackboard Learn )|Mail

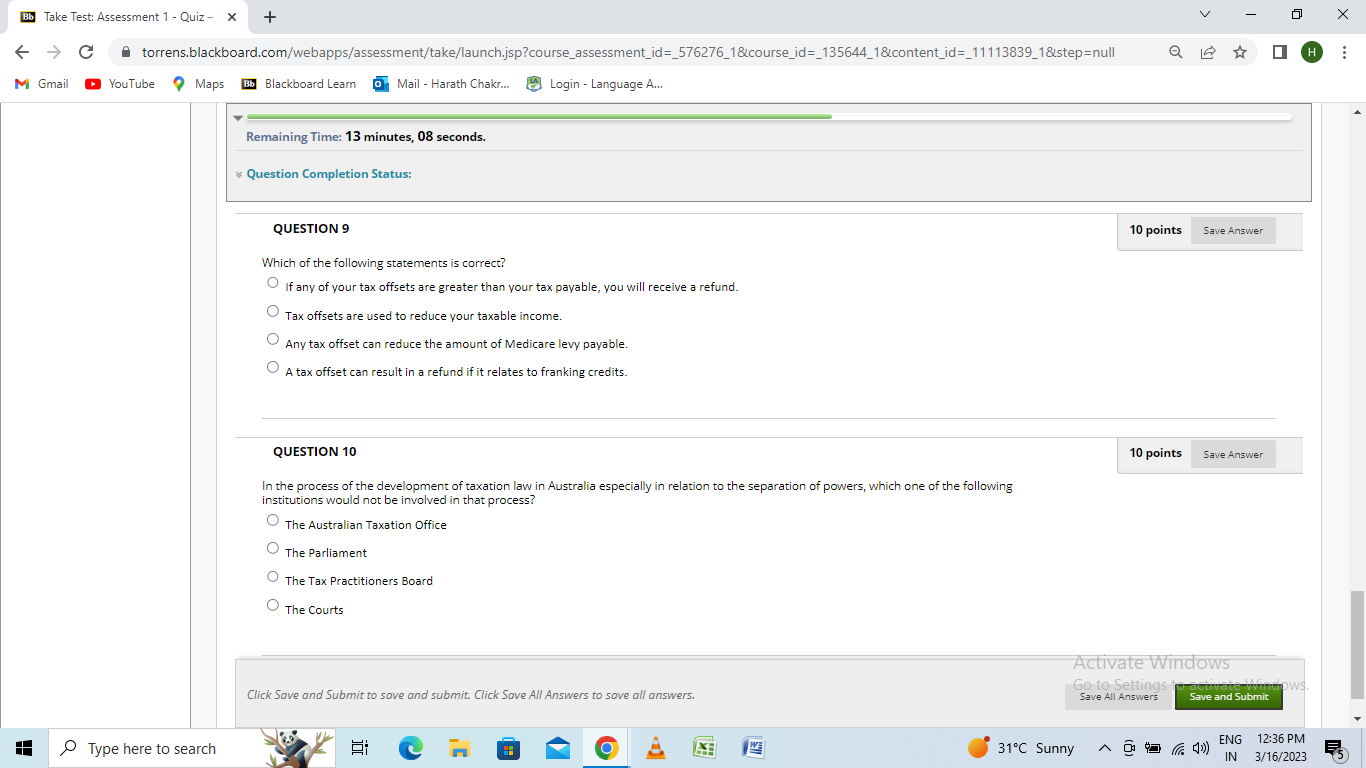

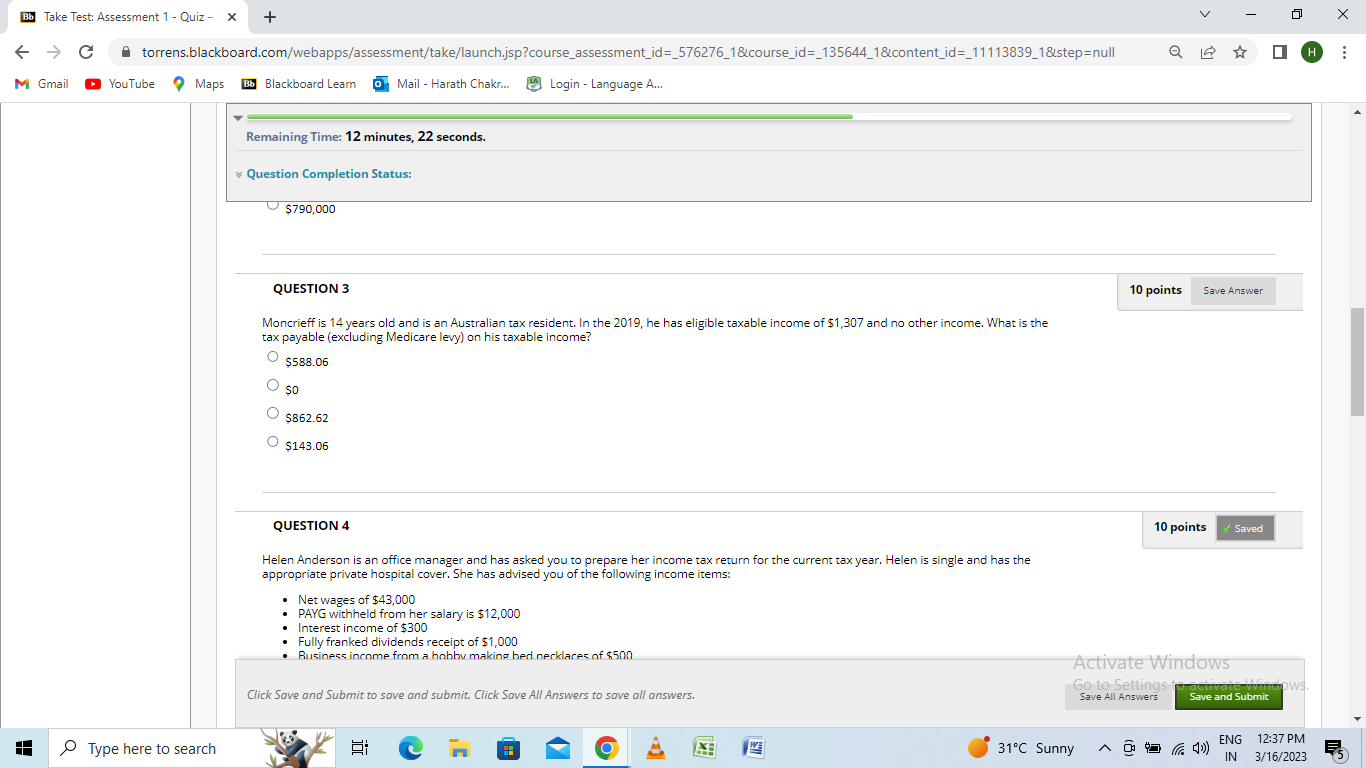

Bb Take Test: Assessment 1 - Quiz - X + V X torrens.blackboard.com/webapps/assessment/take/launch.jsp?course_assessment_id=_576276_1&course_id=_135644_1&content_id=_11113839_1&step=null Q E X M Gmail YouTube . Maps Bb Blackboard Learn )|Mail - Harath Chakr... Login - Language A... Remaining Time: 13 minutes, 08 seconds. Question Completion Status: QUESTION 9 10 points Save Answer Which of the following statements is correct? If any of your tax offsets are greater than your tax payable, you will receive a refund. Tax offsets are used to reduce your taxable income. Any tax offset can reduce the amount of Medicare levy payable. O A tax offset can result in a refund if it relates to franking credits. QUESTION 10 10 points Save Answer In the process of the development of taxation law in Australia especially in relation to the separation of powers, which one of the following institutions would not be involved in that process? The Australian Taxation Office The Parliament The Tax Practitioners Board The Courts Activate Windows Go to Settings OWS Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit Type here to search Eli O 31.C Sunny A DI (@ (1) ENG 12:36 PM IN 3/16/2023 ESBb Take Test: Assessment 1 - Quiz - X + V X torrens.blackboard.com/webapps/assessment/take/launch.jsp?course_assessment_id=_576276_1&course_id=_135644_1&content_id=_11113839_1&step=null Q E X M Gmail YouTube . Maps Bb Blackboard Learn )|Mail - Harath Chakr... Login - Language A... Remaining Time: 12 minutes, 22 seconds. Question Completion Status: $790,000 QUESTION 3 10 points Save Answer Moncrieff is 14 years old and is an Australian tax resident. In the 2019, he has eligible taxable income of $1,307 and no other income. What is the tax payable (excluding Medicare levy) on his taxable income? O $588.06 so 5862.62 O $143.06 QUESTION 4 10 points Saved Helen Anderson is an office manager and has asked you to prepare her income tax return for the current tax year. Helen is single and has the appropriate private hospital cover. She has advised you of the following income items: Net wages of $43,000 PAYG withheld from her salary is $12,000 Interest income of $300 Fully franked dividends receipt of $1,000 Business income from a hobby making bed necklaces of $500 Activate Windows Go to Settings DWS Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit Type here to search O 31'C Sunny D1 43 ( 0) ENG 12:37 PM IN 3/16/2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts