Question: BbCc AaBbCc AaBbCcDd AaBbCcDd AaBbcci AaB AaBbCcDd. eading 1 1 Heading 2 1 Normal Strong Subtitle Title Subtle Emp... Cha Sty Styles Part 1 The

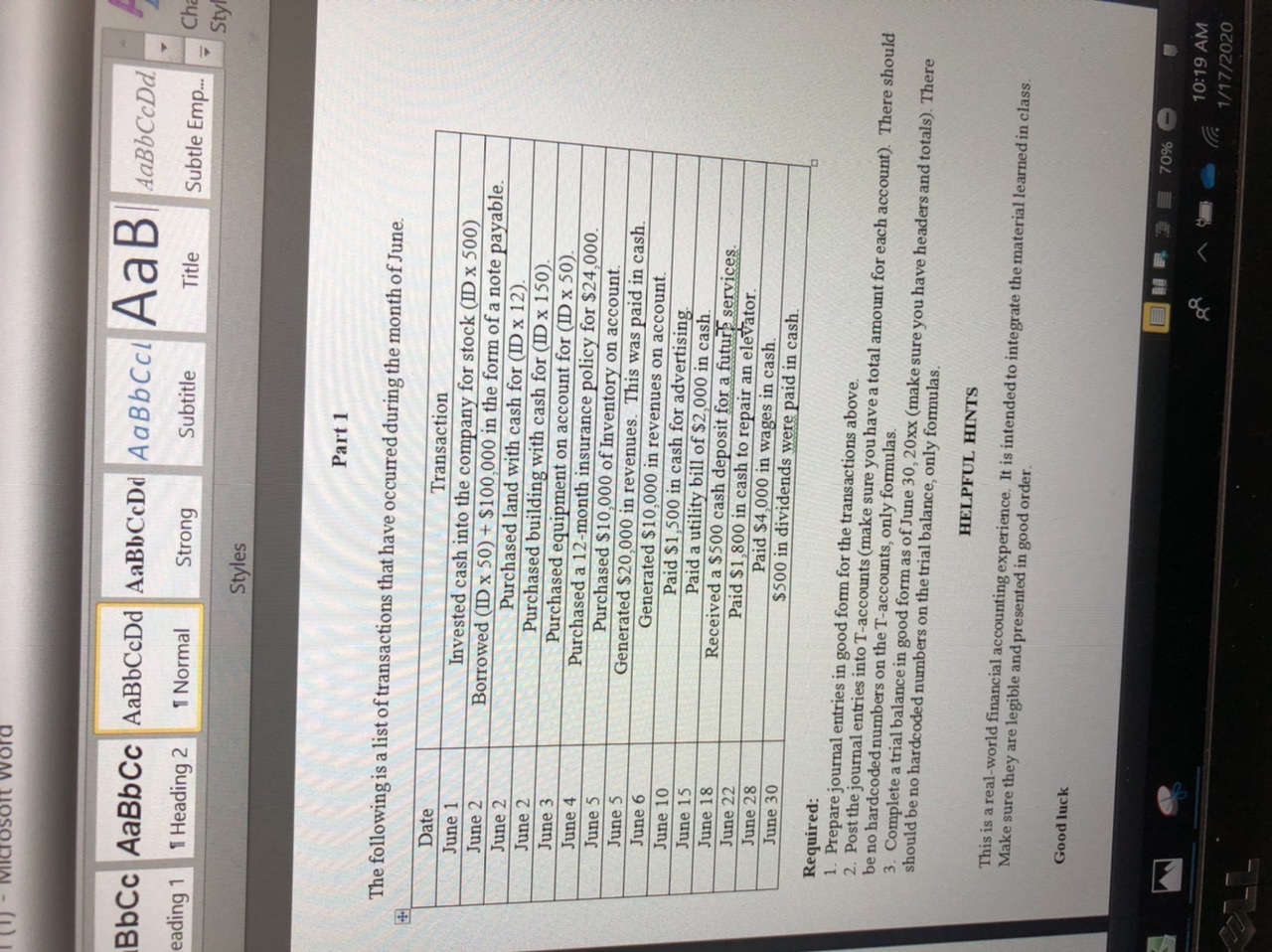

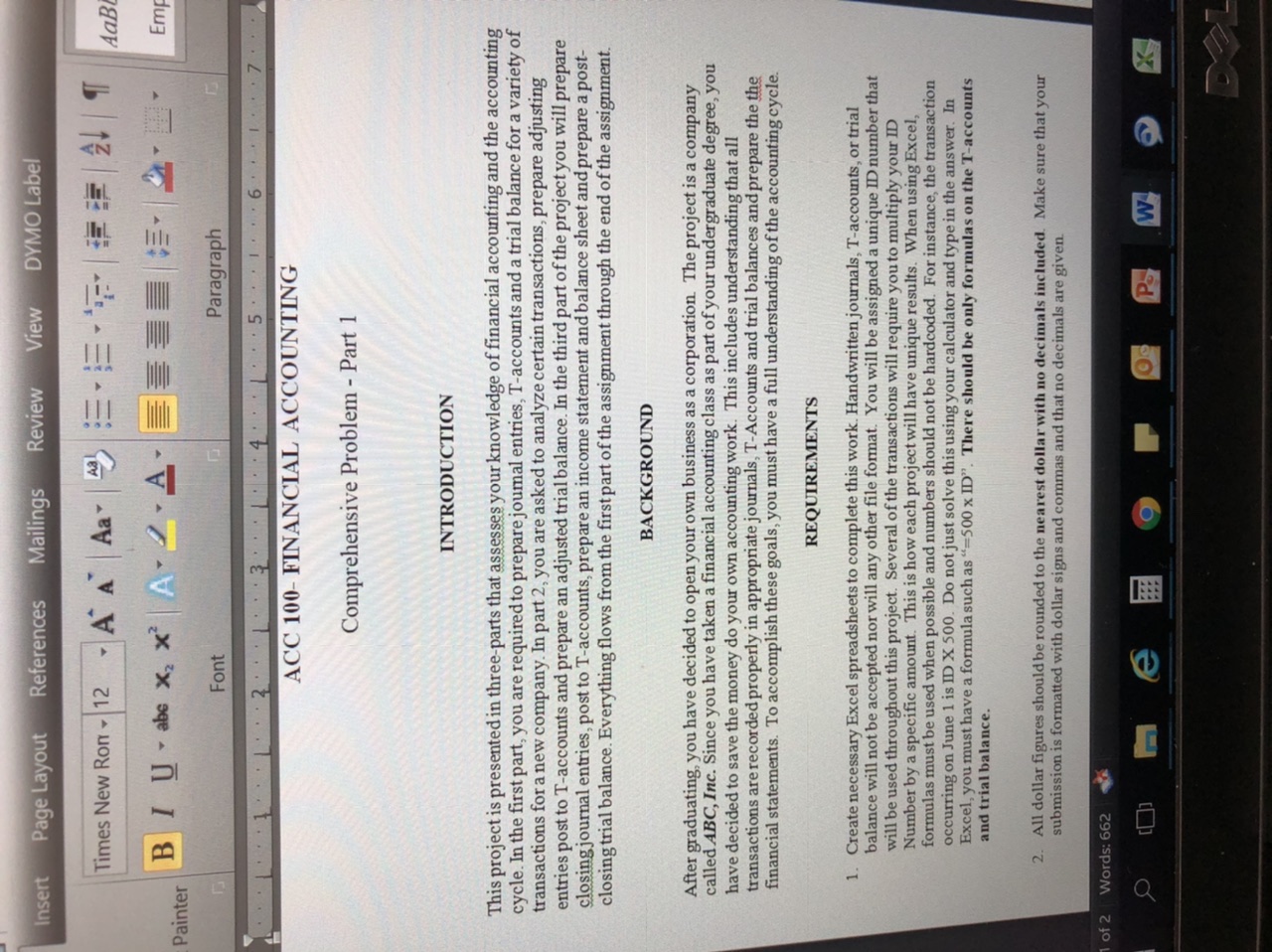

BbCc AaBbCc AaBbCcDd AaBbCcDd AaBbcci AaB AaBbCcDd. eading 1 1 Heading 2 1 Normal Strong Subtitle Title Subtle Emp... Cha Sty Styles Part 1 The following is a list of transactions that have occurred during the month of June. Date Transaction June 1 Invested cash into the company for stock (ID x 500) June 2 Borrowed (ID x 50) + $100,000 in the form of a note payable June 2 Purchased land with cash for (ID x 12). June 2 Purchased building with cash for (ID x 150). June 3 Purchased equipment on account for (ID x 50). June 4 Purchased a 12-month insurance policy for $24,000. June 5 Purchased $10,000 of Inventory on account. June 5 Generated $20,000 in revenues. This was paid in cash June 6 Generated $10,000 in revenues on account June 10 Paid $1,500 in cash for advertising June 15 Paid a utility bill of $2,000 in cash. June 18 Received a $500 cash deposit for a future services. June 22 Paid $1,800 in cash to repair an elevator. June 28 Paid $4,000 in wages in cash. June 30 $500 in dividends were paid in cash Required: 1. Prepare journal entries in good form for the transactions above. 2. Post the journal entries into T-accounts (make sure you have a total amount for each account). There should be no hardcoded numbers on the T-accounts, only formulas. 3. Complete a trial balance in good form as of June 30, 20xx (make sure you have headers and totals). There should be no hardcoded numbers on the trial balance, only formulas. HELPFUL HINTS This is a real-world financial accounting experience. It is intended to integrate the material learned in class. Make sure they are legible and presented in good order. Good luck 170% 10:19 AM 1/17/2020Insert Page Layout References Mailings Review View DYMO Label Times New Ron - 12 - A A |Aa-|43= AaB Painter 3 1 U - abc x2 X? |A . 2 . A. Emp Font Paragraph L . . 1 . . . L . . . 2 . . . L . . . 3 . . . 1 . . . 4 . . . 1 . . . 5 . . . 1 . . . 6. . . 1 . .7 . . . ACC 100-FINANCIAL ACCOUNTING Comprehensive Problem - Part 1 INTRODUCTION This project is presented in three-parts that assesses your knowledge of financial accounting and the accounting cycle. In the first part, you are required to prepare journal entries, T-accounts and a trial balance for a variety of transactions for a new company. In part 2, you are asked to analyze certain transactions, prepare adjusting entries post to T-accounts and prepare an adjusted trial balance. In the third part of the project you will prepare closing journal entries, post to T-accounts, prepare an income statement and balance sheet and prepare a post- closing trial balance. Everything flows from the first part of the assignment through the end of the assignment. BACKGROUND After graduating, you have decided to open your own business as a corporation. The project is a company called ABC, Inc. Since you have taken a financial accounting class as part of your undergraduate degree, you have decided to save the money do your own accounting work. This includes understanding that all transactions are recorded properly in appropriate journals, T-Accounts and trial balances and prepare the the financial statements. To accomplish these goals, you must have a full understanding of the accounting cycle. REQUIREMENTS 1. Create necessary Excel spreadsheets to complete this work. Handwritten journals, T-accounts, or trial balance will not be accepted nor will any other file format. You will be assigned a unique ID number that will be used throughout this project. Several of the transactions will require you to multiply your ID Number by a specific amount. This is how each project will have unique results. When using Excel, formulas must be used when possible and numbers should not be hardcoded. For instance, the transaction occurring on June 1 is ID X 500. Do not just solve this using your calculator and type in the answer. In Excel, you must have a formula such as "=500 x ID". There should be only formulas on the T-accounts and trial balance. 2. All dollar figures should be rounded to the nearest dollar with no decimals included. Make sure that your submission is formatted with dollar signs and commas and that no decimals are given. of 2 Words: 662 O