Question: bbhosted.cuny.edu 2019 e Question Completion Status QUESTION 6 Income Statement You have been given the following information for Sherry's Sandwich Corp. Net sales $300,000 Gross

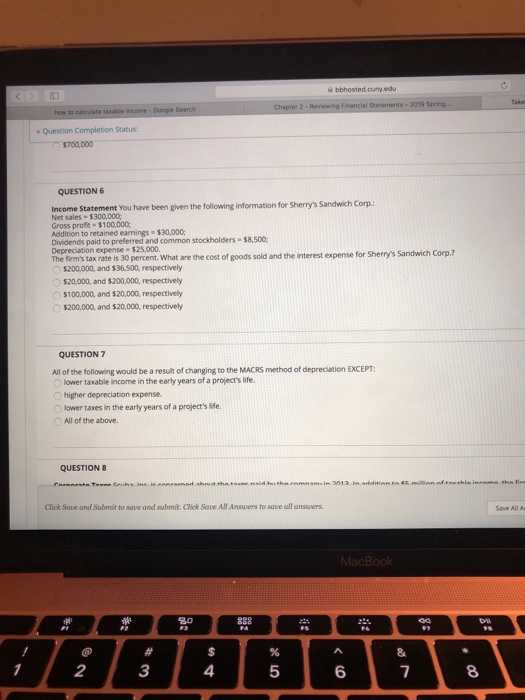

bbhosted.cuny.edu 2019 e Question Completion Status QUESTION 6 Income Statement You have been given the following information for Sherry's Sandwich Corp. Net sales $300,000 Gross prof-$100,000 Addition to retained earnings $30,000 Dividends paid to preferred and common stockholders s8,500 Depreciation expense $25,000. The firm's tax rate is 30 percent. What are the cost of goods sold and the interest expense for Sherry's Sandwich Corp.? $200,000, and $36,500, respectively $20,000, and $200,000, respectively $100,000, and $20,000, respectively $200,000, and $20,000, respectively QUESTION 7 All of the following would be a result of changing to the MACRS method of depreciation EXCEPT: lower taxable income in the early years of a project's life higher depreciation expense. lower taxes in the early years of a project's ife. OAll of the above. QUESTION 8 Click Save and Submit to save and submit, Click Save All Ansvers to save all answers Save All As 2 3 4 5 6 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts