Question: BD CMIbr 11 % Paste B 5 Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font 23 A1 v X

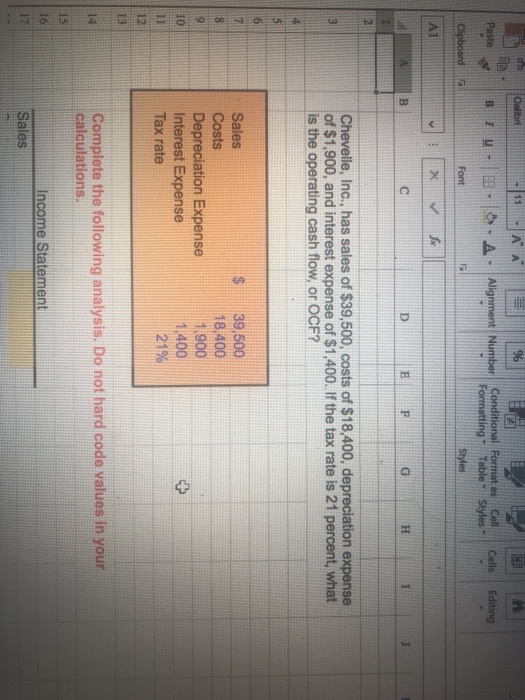

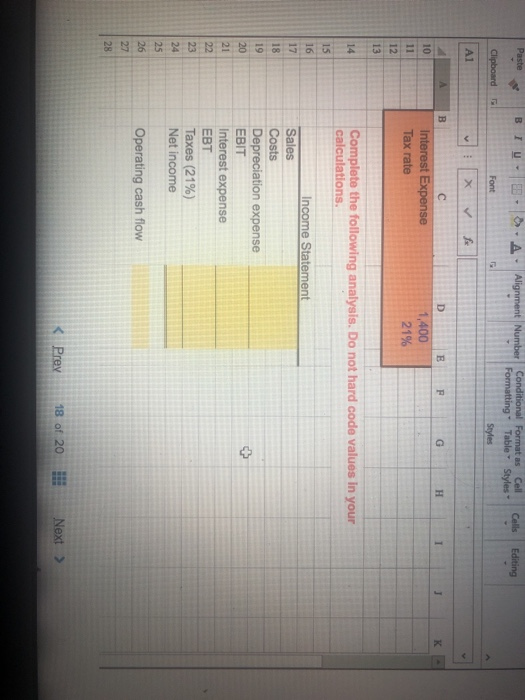

BD CMIbr 11 % Paste B 5 Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font 23 A1 v X A B D E F G H T 2 Chevelle, Inc., has sales of $39,500, costs of $18,400, depreciation expense of $1,900, and interest expense of $1,400. If the tax rate is 21 percent, what is the operating cash flow, or OCF? 6 7 $ 18 9 Sales Costs Depreciation Expense Interest Expense Tax rate 39,500 18,400 1,900 1,400 21% 10 11 12 13 14 Complete the following analysis. Do not hard code values in your calculations. 15 16 Income Statement 17 Sales Paste BIU- E- Calls Editing Alignment Number Conditional Format as Cell Formatting Table Styles - Styles Clipboard Font Al f A B F G H K Interest Expense Tax rate 10 11 12 13 D E 1,400 21% 14 Complete the following analysis. Do not hard code values in your calculations. 15 16 17 18 19 20 Income Statement Sales Costs Depreciation expense EBIT Interest expense EBT Taxes (21%) Net income 21 23 24 25 26 27 28 Operating cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts