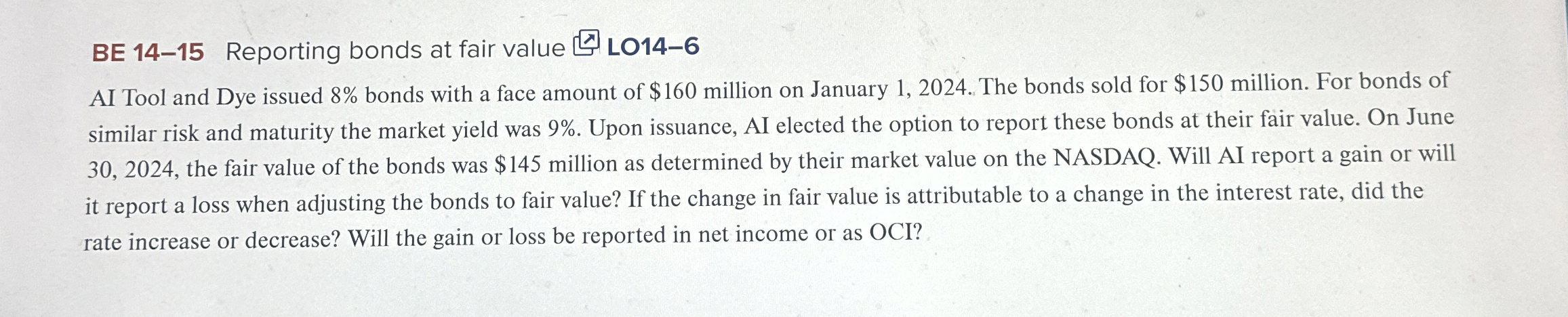

Question: BE 1 4 - 1 5 Reporting bonds at fair value L O 1 4 - 6 2 AI Tool and Dye issued 8 %

BE Reporting bonds at fair value

AI Tool and Dye issued bonds with a face amount of $ million on January The bonds sold for $ million. For bonds of similar risk and maturity the market yield was Upon issuance, AI elected the option to report these bonds at their fair value. On June the fair value of the bonds was $ million as determined by their market value on the NASDAQ. Will AI report a gain or will it report a loss when adjusting the bonds to fair value? If the change in fair value is attributable to a change in the interest rate, did the rate increase or decrease? Will the gain or loss be reported in net income or as OCI?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock