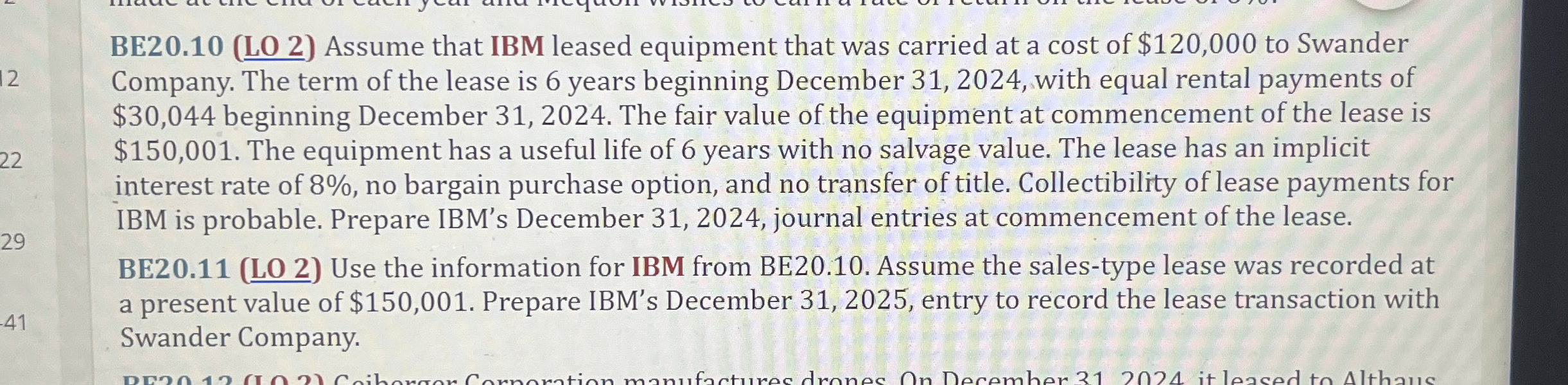

Question: BE 2 0 . 1 0 ( LO 2 ) Assume that IBM leased equipment that was carried at a cost of $ 1 2

BELO Assume that IBM leased equipment that was carried at a cost of $ to Swander Company. The term of the lease is years beginning December with equal rental payments of $ beginning December The fair value of the equipment at commencement of the lease is $ The equipment has a useful life of years with no salvage value. The lease has an implicit interest rate of no bargain purchase option, and no transfer of title. Collectibility of lease payments for IBM is probable. Prepare IBM's December journal entries at commencement of the lease.

BE Use the information for IBM from BE Assume the salestype lease was recorded at a present value of $ Prepare IBM's December entry to record the lease transaction with Swander Company.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock