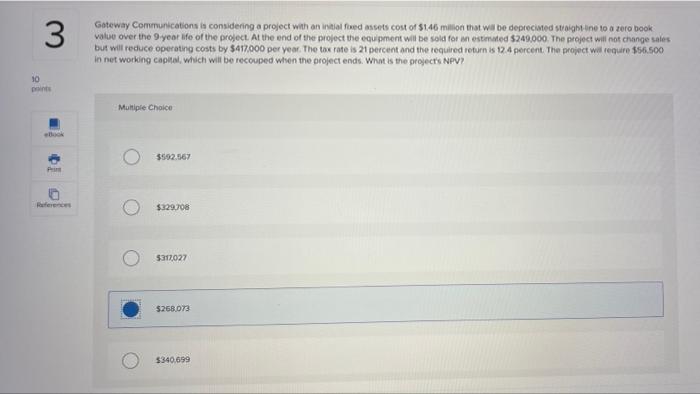

Question: Be accurate please 3 Gateway Communication is considering a project with an initial freed assets cost of $1.46 million that will be deprecimod straighting to

3 Gateway Communication is considering a project with an initial freed assets cost of $1.46 million that will be deprecimod straighting to a zero book value over the year ife of the project. At the end of the project the equipment will be sold for an estimated $249,000. The project will not change sales but will reduce operating costs by $417.000 per year. The tax rate is 21 percent and the required return is 12.4 percent. The project will require 156.500 In net working capital, which will be recouped when the project ends. What is the projects NPV? 10 Multiple Choice $592.567 Pem 0 o $329.708 $317027 $268.073 $340,099

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts