Question: be Calibri 11 A A % Paste BI U Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A C16

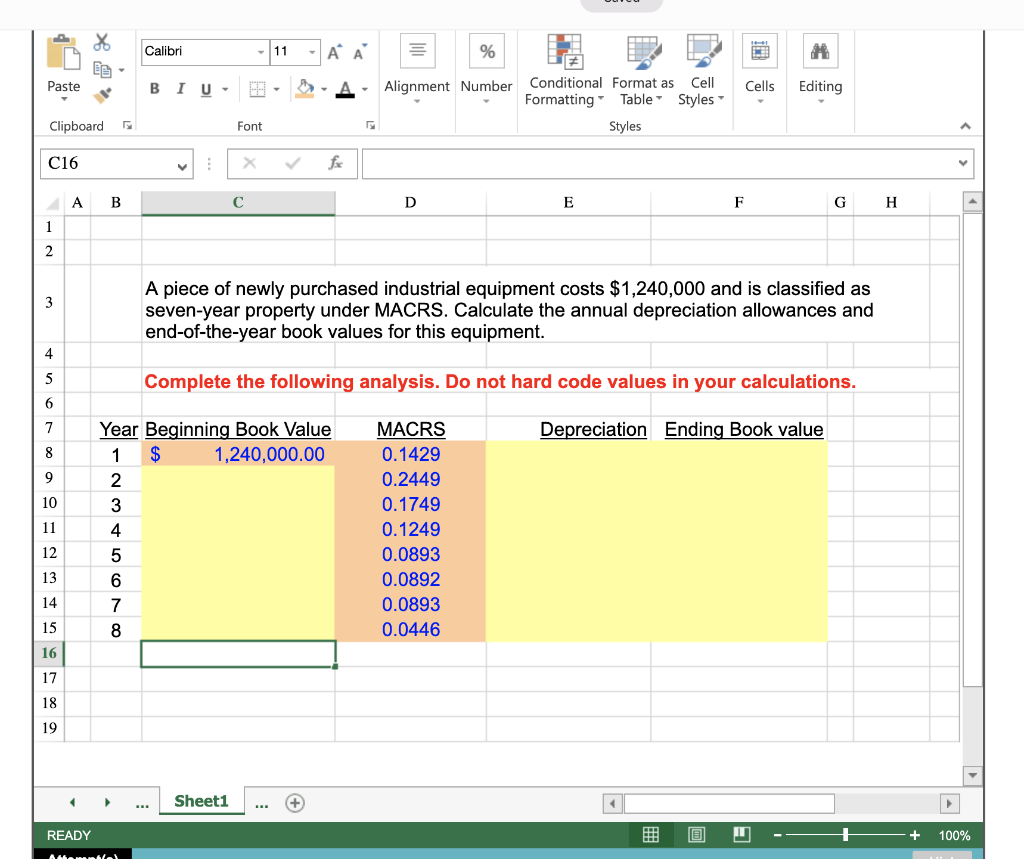

be Calibri 11 A A % Paste BI U Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A C16 : X fx A B D E F G H 1 2 3 A piece of newly purchased industrial equipment costs $1,240,000 and is classified as seven-year property under MACRS. Calculate the annual depreciation allowances and end-of-the-year book values for this equipment. 4 5 Complete the following analysis. Do not hard code values in your calculations. 6 7 Depreciation Ending Book value 8 Year Beginning Book Value 1 $ 1,240,000.00 2 3 10 11 4 MACRS 0.1429 0.2449 0.1749 0.1249 0.0893 0.0892 0.0893 0.0446 12 0001WN- 13 6 7 14 15 16 17 18 19 Sheet1 READY + 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts