Question: be fast plzz Evaluate this stock and option: S = $200 Time = 6 months Risk free 3% annual Strike = 220 Implied volatility =

be fast plzz

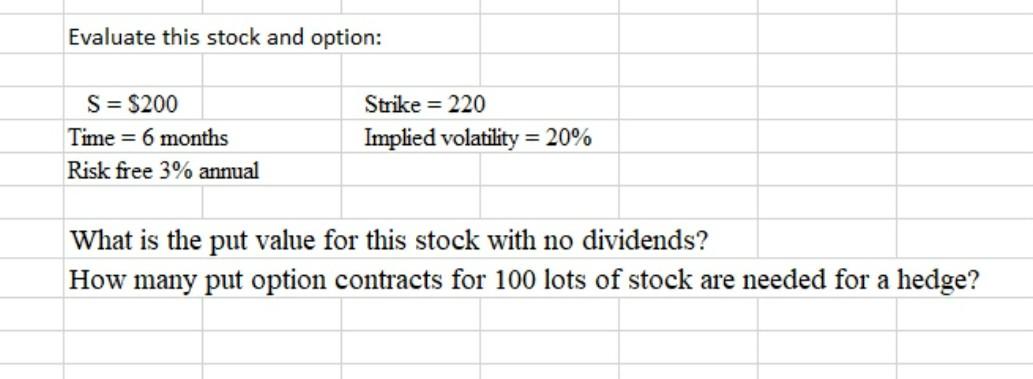

Evaluate this stock and option: S = $200 Time = 6 months Risk free 3% annual Strike = 220 Implied volatility = 20% What is the put value for this stock with no dividends? How many put option contracts for 100 lots of stock are needed for a hedge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts