Question: BE REQUIRED: Provide adjustment notes (journal entries) (description not required) Prepare an adjusted trial balance sheet as at 31 December 2021. Prepare income statement, owner's

BE REQUIRED:

- Provide adjustment notes (journal entries) (description not required)

- Prepare an adjusted trial balance sheet as at 31 December 2021.

- Prepare income statement, owner's equity statement and balance sheet for the year ended 31 December 2021.

URGENTTTT !!!!!!!! PLEASE ANSWER ASAP !!!!!!!!!

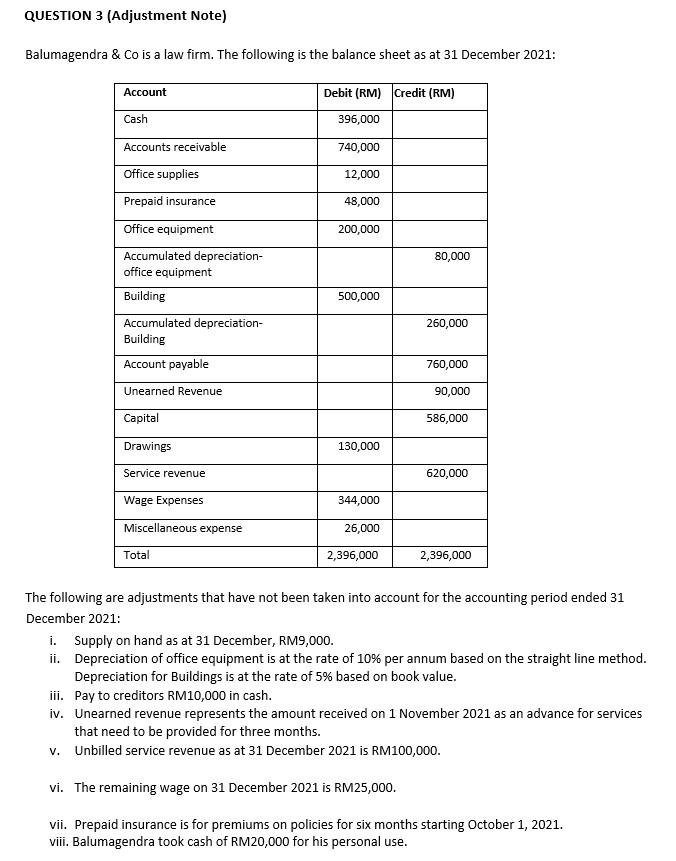

QUESTION 3 (Adjustment Note) Balumagendra & Co is a law firm. The following is the balance sheet as at 31 December 2021: Account Debit (RM) Credit (RM) Cash 396,000 Accounts receivable 740,000 Office supplies 12,000 Prepaid insurance 48,000 Office equipment 200,000 Accumulated depreciation- 80,000 office equipment Building 500,000 260,000 Accumulated depreciation- Building Account payable 760,000 Unearned Revenue 90,000 Capital 586,000 Drawings 130,000 Service revenue 620,000 Wage Expenses 344,000 Miscellaneous expense 26,000 Total 2,396,000 2,396,000 The following are adjustments that have not been taken into account for the accounting period ended 31 December 2021: i. Supply on hand as at 31 December, RM9,000. ii. Depreciation of office equipment is at the rate of 10% per annum based on the straight line method. Depreciation for Buildings is at the rate of 5% based on book value. iii. Pay to creditors RM10,000 in cash. iv. Unearned revenue represents the amount received on 1 November 2021 as an advance for services that need to be provided for three months. v. Unbilled service revenue as at 31 December 2021 is RM100,000. vi. The remaining wage on 31 December 2021 is RM25,000. vii. Prepaid insurance is for premiums on policies for six months starting October 1, 2021. viii. Balumagendra took cash of RM20,000 for his personal use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts