Question: Be sure to create and fill in the TVM solver tables for questions involving Annuities, compound, and Mortgage(Advanced tvm solver) and provide a concluding statement.

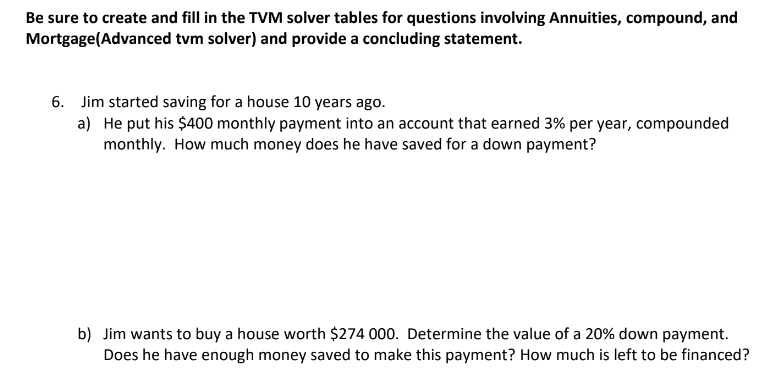

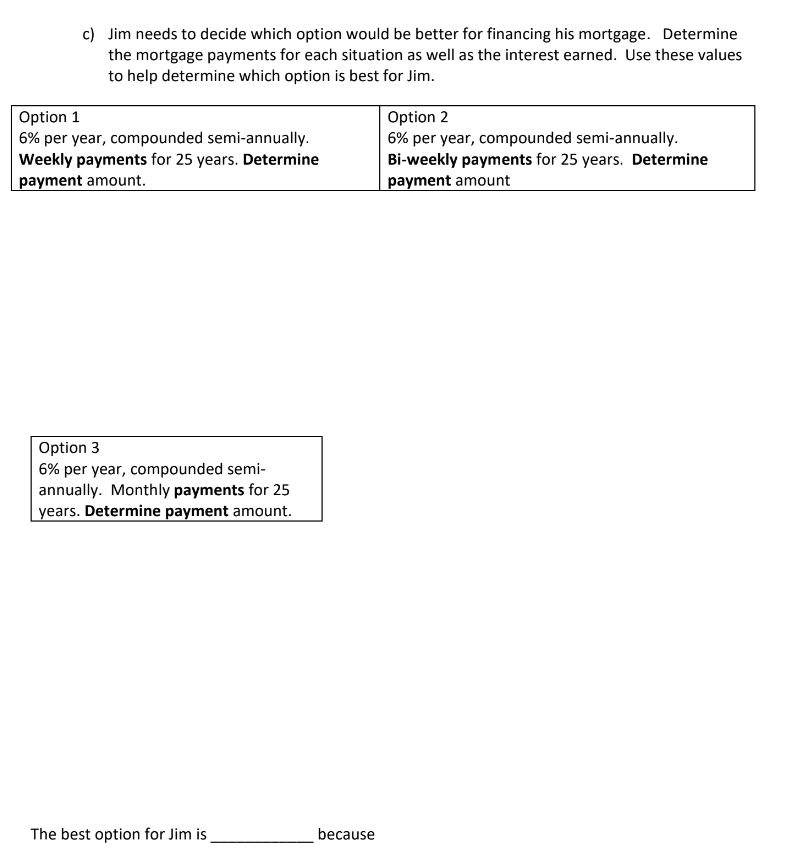

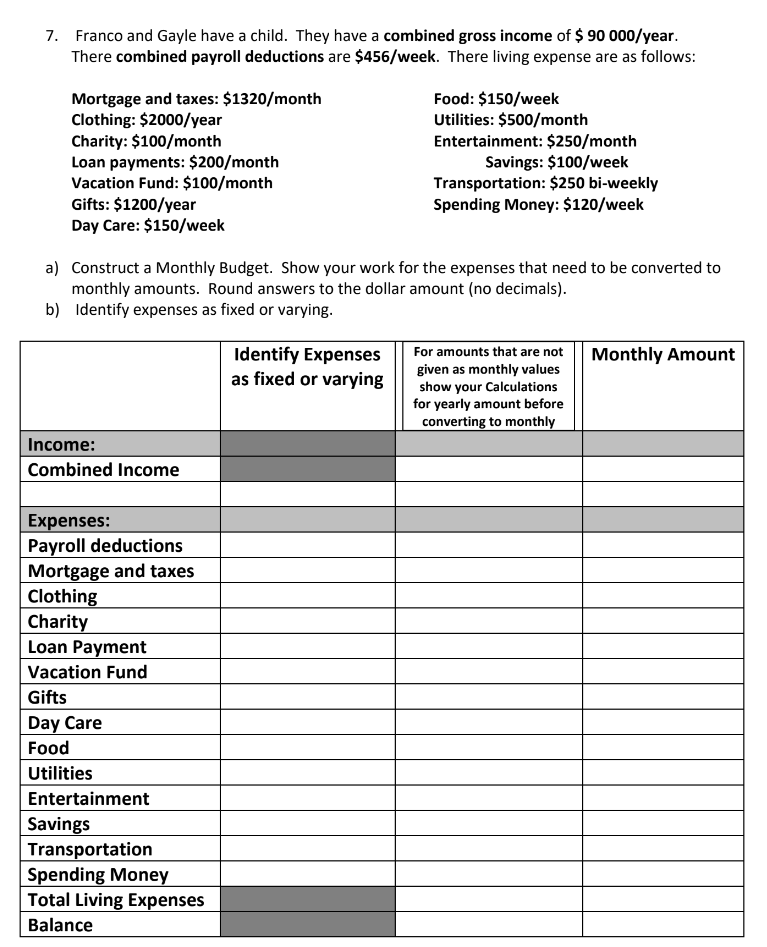

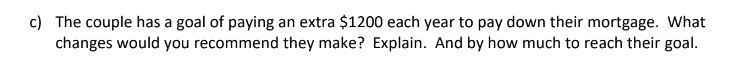

Be sure to create and fill in the TVM solver tables for questions involving Annuities, compound, and Mortgage(Advanced tvm solver) and provide a concluding statement. 6. Jim started saving for a house 10 years ago. a) He put his $400 monthly payment into an account that earned 3% per year, compounded monthly. How much money does he have saved for a down payment? b) Jim wants to buy a house worth $274 000. Determine the value of a 20% down payment. Does he have enough money saved to make this payment? How much is left to be financed?c} .Iim needs to decide which option would be better for nancing his mortgage. Determine the mortgage payments for each situation as well as the interest earned. Use these values to help determine which option is best for Jim. Option 1 Option 2 6% per year, compounded semi-annually. $56 per year, compounded semi-annually. Weekly payments for 25 years. Determine Bi-weekly payments for 25 years. Determine payment amount. payment amount omms 5% per year, compounded semi- annually. Monthly payments for 25 years. Determine payment amount. The best option for Jim is because 7. Franco and Gayle have a child. They have a combined gross income of $ 90 000/year. There combined payroll deductions are $456/week. There living expense are as follows: Mortgage and taxes: $1320/month Food: $150/week Clothing: $2000/year Utilities: $500/month Charity: $100/month Entertainment: $250/month Loan payments: $200/month Savings: $100/week Vacation Fund: $100/month Transportation: $250 bi-weekly Gifts: $1200/year Spending Money: $120/week Day Care: $150/week a) Construct a Monthly Budget. Show your work for the expenses that need to be converted to monthly amounts. Round answers to the dollar amount (no decimals). b) Identify expenses as fixed or varying. Identify Expenses For amounts that are not Monthly Amount as fixed or varying given as monthly values show your Calculations for yearly amount before converting to monthly Income: Combined Income Expenses: Payroll deductions Mortgage and taxes Clothing Charity Loan Payment Vacation Fund Gifts Day Care Food Utilities Entertainment Savings Transportation Spending Money Total Living Expenses Balancec] The couple has a goal of paying an extra $1200 each year to pay down their mortgage. What changes would you recommend they make? Explain. And by how much to reach their goal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts