Question: Be sure to identify each item's character. At the end of each problem, you will have - ordinary income or loss, - capital gain or

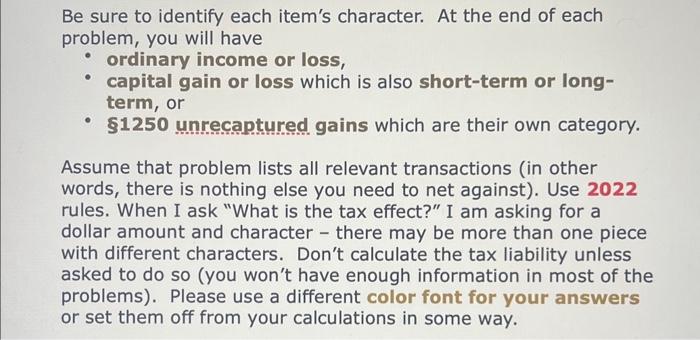

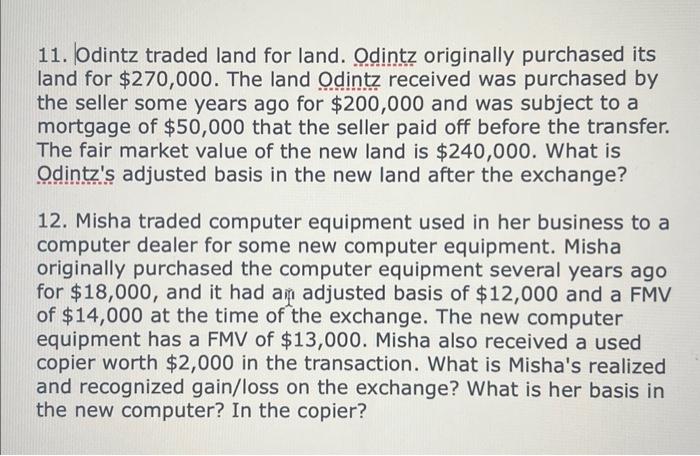

Be sure to identify each item's character. At the end of each problem, you will have - ordinary income or loss, - capital gain or loss which is also short-term or longterm, or - $1250 unrecaptured gains which are their own category. Assume that problem lists all relevant transactions (in other words, there is nothing else you need to net against). Use 2022 rules. When I ask "What is the tax effect?" I am asking for a dollar amount and character - there may be more than one piece with different characters. Don't calculate the tax liability unless asked to do so (you won't have enough information in most of the problems). Please use a different color font for your answers or set them off from your calculations in some way. 11. Odintz traded land for land. Odintz originally purchased its land for $270,000. The land Odintz received was purchased by the seller some years ago for $200,000 and was subject to a mortgage of $50,000 that the seller paid off before the transfer. The fair market value of the new land is $240,000. What is Odintt's adjusted basis in the new land after the exchange? 12. Misha traded computer equipment used in her business to a computer dealer for some new computer equipment. Misha originally purchased the computer equipment several years ago for $18,000, and it had ain adjusted basis of $12,000 and a FMV of $14,000 at the time of the exchange. The new computer equipment has a FMV of $13,000. Misha also received a used copier worth $2,000 in the transaction. What is Misha's realized and recognized gain/loss on the exchange? What is her basis in the new computer? In the copier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts