Question: Be sure to use 2018 amounts please!! Required information The following information applies to the questions displayed below] This year Lloyd, a single taxpayer, estimates

Be sure to use 2018 amounts please!!

Be sure to use 2018 amounts please!!

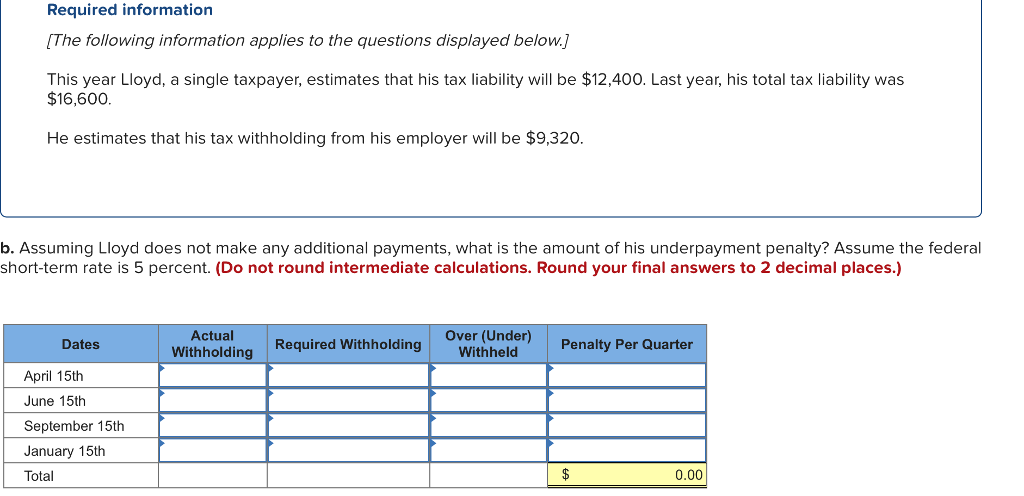

Required information The following information applies to the questions displayed below] This year Lloyd, a single taxpayer, estimates that his tax liability will be $12,400. Last year, his total tax liability was $16,600 He estimates that his tax withholding from his employer will be $9,320. b. Assuming Lloyd does not make any additional payments, what is the amount of his underpayment penalty? Assume the federal short-term rate is 5 percent. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Actual Withholding Required Withholding Over (Under) Dates WithheldPenalty Per Quarter April 15th June 15th September 15th January 15th Total 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts