Question: Be sure to write clear steps for your derivations. 3. (20 points) An all-equity firm is considering the following projects: Project w X Y Z

Be sure to write clear steps for your derivations.

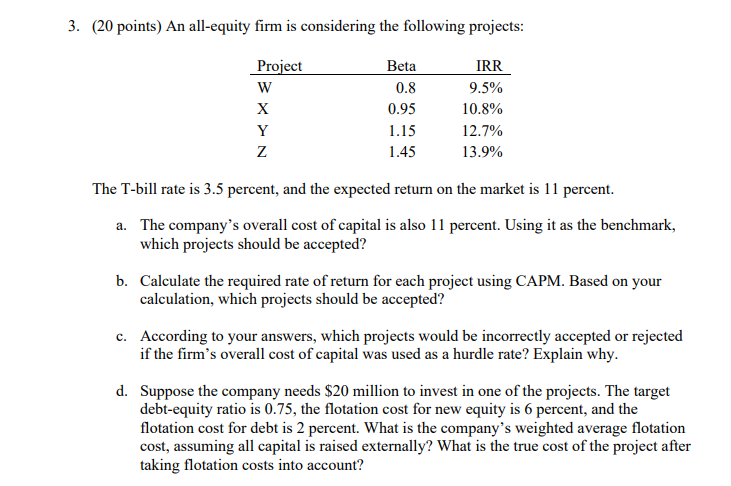

3. (20 points) An all-equity firm is considering the following projects: Project w X Y Z Beta 0.8 0.95 1.15 1.45 IRR 9.5% 10.8% 12.7% 13.9% The T-bill rate is 3.5 percent, and the expected return on the market is 11 percent. a. The company's overall cost of capital is also 11 percent. Using it as the benchmark, which projects should be accepted? b. Calculate the required rate of return for each project using CAPM. Based on your calculation, which projects should be accepted? c. According to your answers, which projects would be incorrectly accepted or rejected if the firm's overall cost of capital was used as a hurdle rate? Explain why. d. Suppose the company needs $20 million to invest in one of the projects. The target debt-equity ratio is 0.75, the flotation cost for new equity is 6 percent, and the flotation cost for debt is 2 percent. What is the company's weighted average flotation cost, assuming all capital is raised externally? What is the true cost of the project after taking flotation costs into account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts