Question: BE (This information will be used for problems 27 - 33) Silvio's Sausage Factory has come up with a new line of spicy sausages. Silvio

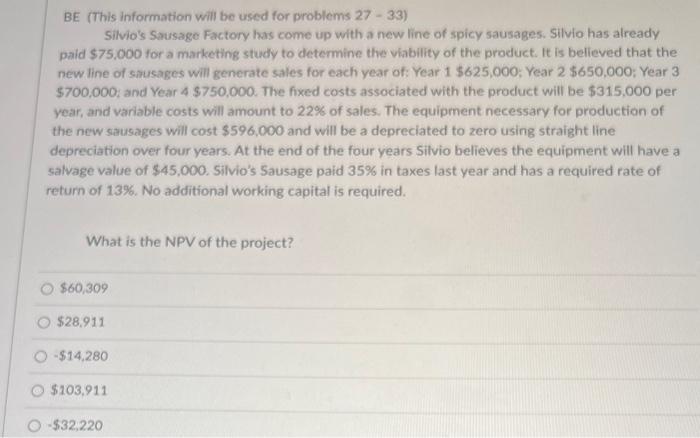

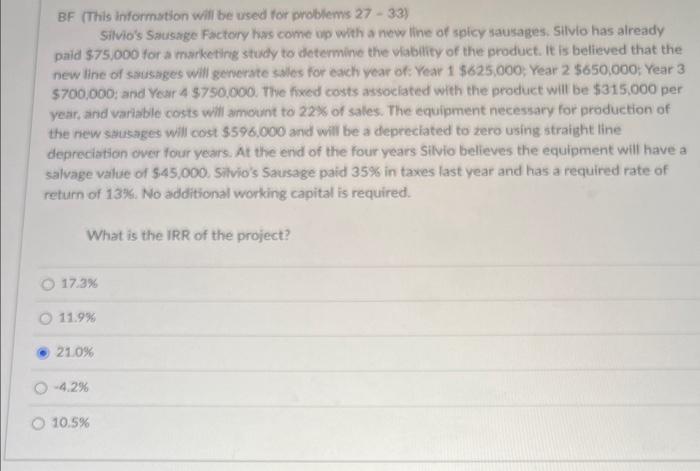

BE (This information will be used for problems 27 - 33) Silvio's Sausage Factory has come up with a new line of spicy sausages. Silvio has already paid $75.000 for a marketing study to determine the vability of the product. It is believed that the new line of srusages will generate sales for each year of: Year 1$625,000; Year 2$650,000; Year 3 $700,000; and Year 4$750,000. The fixed costs associated with the product will be $315,000 per year, and variable costs will amount to 22% of sales. The equipment necessary for production of the new sausages will cost $596,000 and will be a depreciated to zero using straight line depreciation over four years. At the end of the four years Silvio believes the equipment will have a salvage value of $45,000. Silvio's Sausage paid 35% in taxes last year and has a required rate of return of 13%. No additional working capital is required. What is the NPV of the project? $60,309$28,911$14,280$103,911$32,220 BF (This informstion will be used for problems 2733 ) Silvio's Sausage Factory has come op whth a new line of spicy sausages. Silvio has already paid \$75,000 for a marketing study to determine the vability of the product. It is believed that the new line of sausages will generate sales for each year of: Year 1$625,000; Year 2$650,000; Year 3 $700,000; and Year 4$750,000. The fixed costs associated with the product will be $315,000 per year, and variable costs will amount to 22% of sales. The equipment necessary for production of the new sausages will cost $596,000 and will be a depreciated to zero using straight line depreciation over four years. At the end of the four years Silvio believes the equipment will have a salvage value of 5.45,000, Silvio's Sausage paid 35% in taxes last year and has a required rate of return of 13%. No additional working capital is required. What is the IRR of the project? 17.3% 11.9% 21.0% 4.2% 10.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts