Question: BE8-10 Presented below are data on three promissory notes. Determine the missing amounts. (b) What is the cash realizable value of the accounts receivable (1)

BE8-10

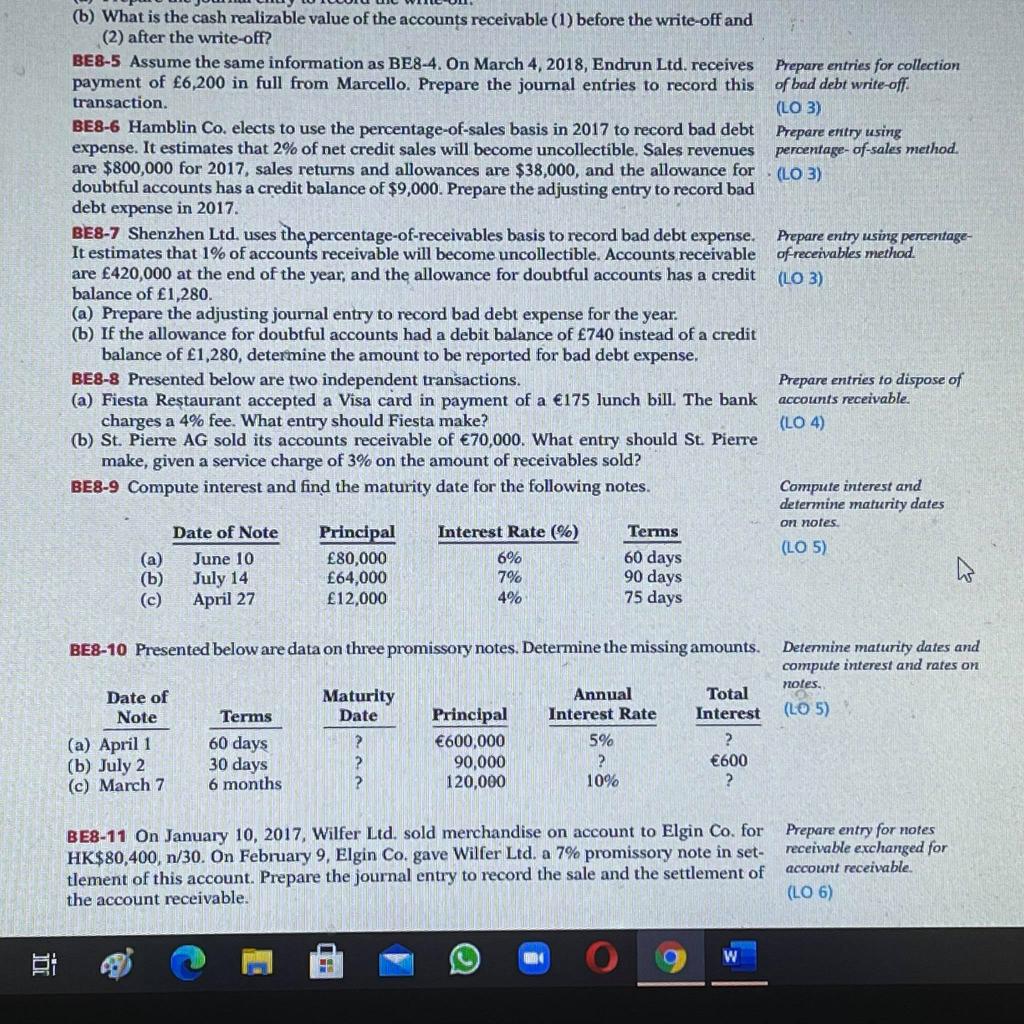

Presented below are data on three promissory notes. Determine the missing amounts.

(b) What is the cash realizable value of the accounts receivable (1) before the write-off and (2) after the write-off? BE8-5 Assume the same information as BE8-4. On March 4, 2018, Endrun Ltd. receives Prepare entries for collection payment of 6,200 in full from Marcello. Prepare the journal entries to record this of bad debt write-off transaction (LO 3) BE8-6 Hamblin Co. elects to use the percentage-of-sales basis in 2017 to record bad debt Prepare entry using expense. It estimates that 2% of net credit sales will become uncollectible. Sales revenues percentage-of-sales method. are $800,000 for 2017, sales returns and allowances are $38,000, and the allowance for (LO 3) doubtful accounts has a credit balance of $9,000. Prepare the adjusting entry to record bad debt expense in 2017. BE8-7 Shenzhen Ltd. uses the percentage-of-receivables basis to record bad debt expense. Prepare entry using percentage- It estimates that 1% of accounts receivable will become uncollectible. Accounts receivable ofreceivables method. are 420,000 at the end of the year, and the allowance for doubtful accounts has a credit (LO 3) balance of 1,280. (a) Prepare the adjusting journal entry to record bad debt expense for the year. (b) If the allowance for doubtful accounts had a debit balance of 740 instead of a credit balance of 1,280, determine the amount to be reported for bad debt expense. BE8-8 Presented below are two independent transactions. Prepare entries to dispose of (a) Fiesta Restaurant accepted a Visa card in payment of a 175 lunch bill. The bank accounts receivable. charges a 4% fee. What entry should Fiesta make? (LO 4) (b) St. Pierre AG sold its accounts receivable of 70,000. What entry should St. Pierre make, given a service charge of 3% on the amount of receivables sold? BE8-9 Compute interest and find the maturity date for the following notes. Compute interest and determine maturity dates on notes Date of Note Principal Interest Rate (%) Terms (a) (LO 5) June 10 80,000 6% 60 days (b) July 14 64,000 7% 90 days (C) April 27 12,000 4% 75 days BE8-10 Presented below are data on three promissory notes. Determine the missing amounts. Detennine maturity dates and compute interest and rates on notes. (LO 5) Maturity Date Total Interest Date of Note (a) April 1 (b) July 2 (c) March 7 Terms 60 days 30 days 6 months ? ? ? Principal 600,000 90,000 120,000 Annual Interest Rate 5% ? 10% ? 600 ? BE8-11 On January 10, 2017, Wilfer Ltd. sold merchandise on account to Elgin Co. for HK$80,400, n/30. On February 9, Elgin Co. gave Wilfer Ltd. a 7% promissory note in set- tlement of this account. Prepare the journal entry to record the sale and the settlement of the account receivable. Prepare entry for notes receivable exchanged for account receivable (LO 6) W DI LE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts