Question: Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2021 (the end of Beale's fiscal year), the following pension-related data were available:

Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2021 (the end of Beale's fiscal year), the following pension-related data were available:

| Projected Benefit Obligation | ($ in millions) | ||||

| Balance, January 1, 2021 | $ | 460 | |||

| Service cost | 48 | ||||

| Interest cost, discount rate, 5% | 23 | ||||

| Gain due to changes in actuarial assumptions in 2021 | (14 | ) | |||

| Pension benefits paid | (23 | ) | |||

| Balance, December 31, 2021 | $ | 494 | |||

| Plan Assets | ($ in millions) | ||||

| Balance, January 1, 2021 | $ | 520 | |||

| Actual return on plan assets | 33 | ||||

| (Expected return on plan assets, $38) | |||||

| Cash contributions | 74 | ||||

| Pension benefits paid | (23 | ) | |||

| Balance, December 31, 2021 | $ | 604 | |||

| January 1, 2021, balances: | ($ in millions) | ||

| Pension asset | $ | 60 | |

| Prior service costAOCI (amortization $7 per year) | 49 | ||

| Net gainAOCI (any amortization over 10 years) | 92 | ||

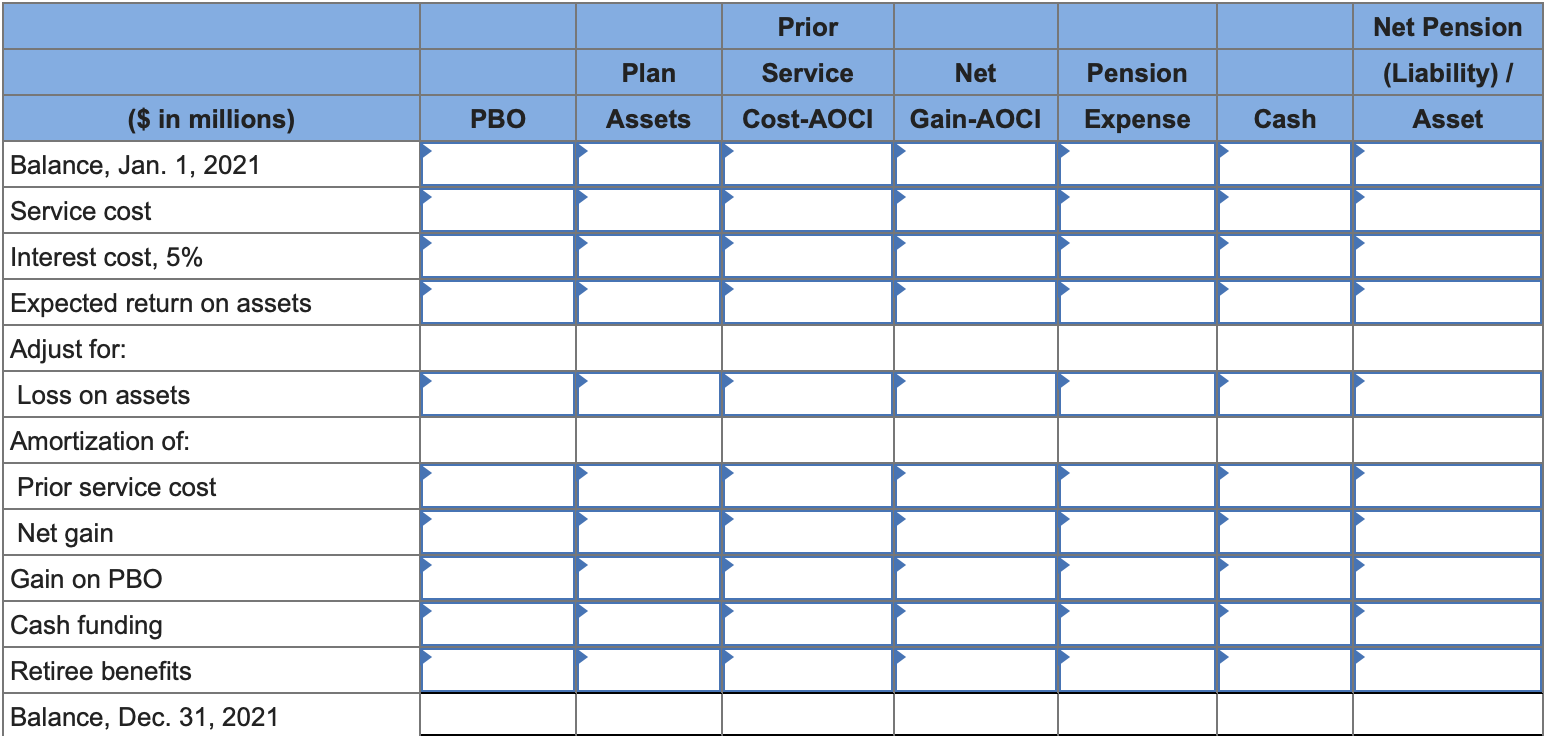

Required: Prepare a pension spreadsheet to show the relationship among the PBO, plan assets, prior service cost, the net gain, pension expense, and the net pension asset. (Enter credit amounts with a minus sign and debit amounts with a positive sign. Enter your answers in millions.)

Prior Plan Service Net Pension Net Pension (Liability) / Asset PBO Assets Cost-AOCI Gain-AOCI Expense Cash ($ in millions) Balance, Jan. 1, 2021 Service cost Interest cost, 5% Expected return on assets Adjust for: Loss on assets Amortization of: Prior service cost Net gain Gain on PBO Cash funding Retiree benefits Balance, Dec. 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts