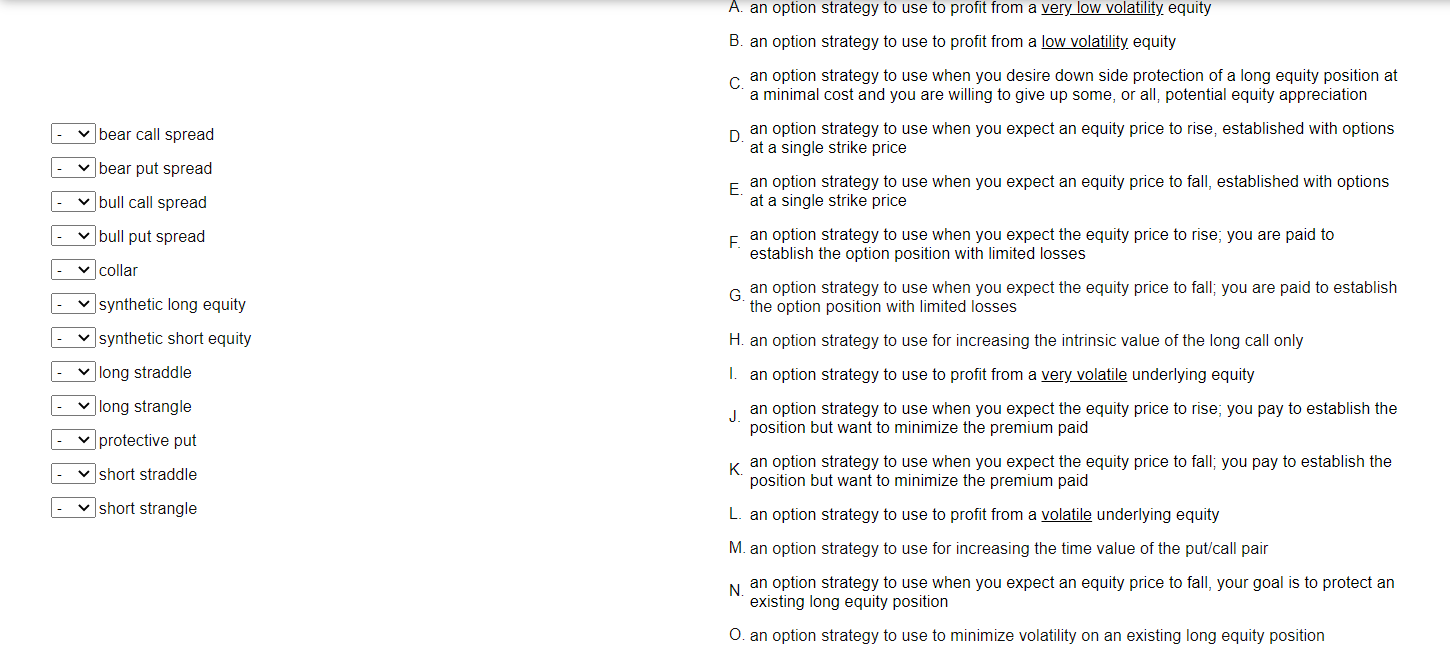

Question: bear call spread v bear put spread bull call spread bull put spread v collar v synthetic long equity synthetic short equity A. an option

bear call spread v bear put spread bull call spread bull put spread v collar v synthetic long equity synthetic short equity A. an option strategy to use to profit from a very low volatility, equity B. an option strategy to use to profit from a low volatility, equity C. an option strategy to use when you desire down side protection of a long equity position at a minimal cost and you are willing to give up some, or all, potential equity appreciation D. an option strategy to use when you expect an equity price to rise, established with options at a single strike price E. an option strategy to use when you expect an equity price to fall, established with options at a single strike price an option strategy to use when you expect the equity price to rise, you are paid to establish the option position with limited losses G an option strategy to use when you expect the equity price to fall; you are paid to establish the option position with limited losses H. an option strategy to use for increasing the intrinsic value of the long call only 1. an option strategy to use to profit from a very volatile underlying equity an option strategy to use when you expect the equity price to rise, you pay to establish the position but want to minimize the premium paid K. an option strategy to use when you expect the equity price to fall; you pay to establish the position but want to minimize the premium paid L. an option strategy to use to profit from a volatile underlying equity M. an option strategy to use for increasing the time value of the put/call pair N. an option strategy to use when you expect an equity price to fall, your goal is to protect an existing long equity position 0. an option strategy to use to minimize volatility on an existing long equity position long straddle long strangle J. protective put short straddle V short strangle bear call spread v bear put spread bull call spread bull put spread v collar v synthetic long equity synthetic short equity A. an option strategy to use to profit from a very low volatility, equity B. an option strategy to use to profit from a low volatility, equity C. an option strategy to use when you desire down side protection of a long equity position at a minimal cost and you are willing to give up some, or all, potential equity appreciation D. an option strategy to use when you expect an equity price to rise, established with options at a single strike price E. an option strategy to use when you expect an equity price to fall, established with options at a single strike price an option strategy to use when you expect the equity price to rise, you are paid to establish the option position with limited losses G an option strategy to use when you expect the equity price to fall; you are paid to establish the option position with limited losses H. an option strategy to use for increasing the intrinsic value of the long call only 1. an option strategy to use to profit from a very volatile underlying equity an option strategy to use when you expect the equity price to rise, you pay to establish the position but want to minimize the premium paid K. an option strategy to use when you expect the equity price to fall; you pay to establish the position but want to minimize the premium paid L. an option strategy to use to profit from a volatile underlying equity M. an option strategy to use for increasing the time value of the put/call pair N. an option strategy to use when you expect an equity price to fall, your goal is to protect an existing long equity position 0. an option strategy to use to minimize volatility on an existing long equity position long straddle long strangle J. protective put short straddle V short strangle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts