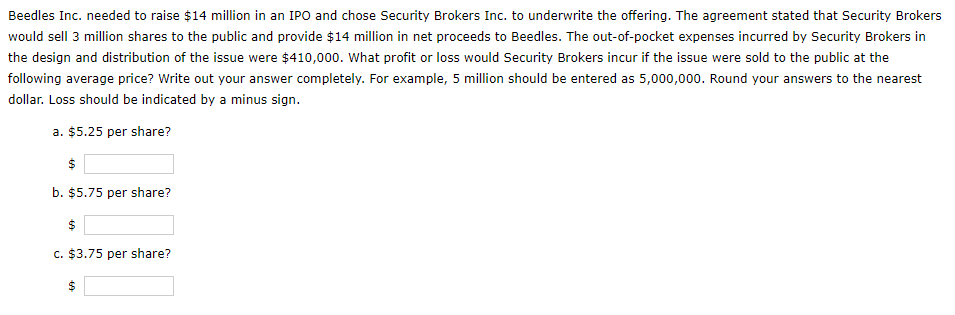

Question: Beedles Inc. needed to raise ( $ 14 ) million in an IPO and chose Security Brokers Inc. to underwrite the offering. The agreement stated

Beedles Inc. needed to raise \\( \\$ 14 \\) million in an IPO and chose Security Brokers Inc. to underwrite the offering. The agreement stated that Security Brokers would sell 3 million shares to the public and provide \\( \\$ 14 \\) million in net proceeds to Beedles. The out-of-pocket expenses incurred by Security Brokers in the design and distribution of the issue were \\( \\$ 410,000 \\). What profit or loss would Security Brokers incur if the issue were sold to the public at the following average price? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answers to the nearest dollar. Loss should be indicated by a minus sign. a. \\( \\$ 5.25 \\) per share? \\( \\$ \\) b. \\( \\$ 5.75 \\) per share? \\( \\$ \\) c. \\( \\$ 3.75 \\) per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts