Question: Beene Distributing is considering a project that will return $150,000 annually at the end of each year for the next six years. If Beene demands

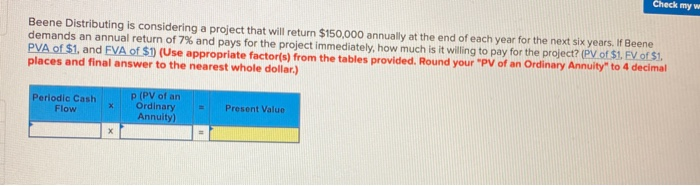

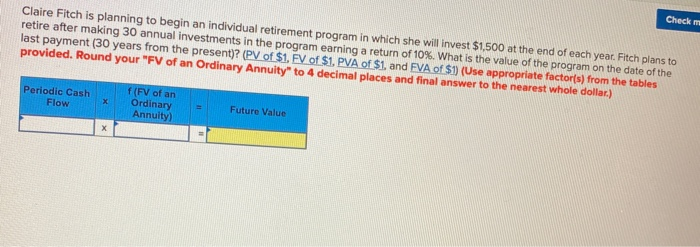

Beene Distributing is considering a project that will return $150,000 annually at the end of each year for the next six years. If Beene demands an annual return of 7% and pays for the project immediately, how much is it willing to pay for the project? (PV of $1. EV of $1. PVA of $1, and EVA of $1 (Use appropriate factor(s) from the tables provided. Round your "PV of an Ordinary Annuity" to 4 decimal places and final answer to the nearest whole dollar.) Periodic Cash Flow pPy of an Ordinary Annuity) Present Value Claire Fitch is planning to begin an individual retirement program in which she will invest $1,500 at the end of each year. Fitch plans to retire after making 30 annual investments in the program earning a return of 10%. What is the value of the program on the date of the last payment (30 years from the present)? (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "FV of an Ordinary Annuity" to 4 decimal places and final answer to the nearest whole dollar.) Periodic Cash Flow x f(FV of an Ordinary Annuity) Future Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts