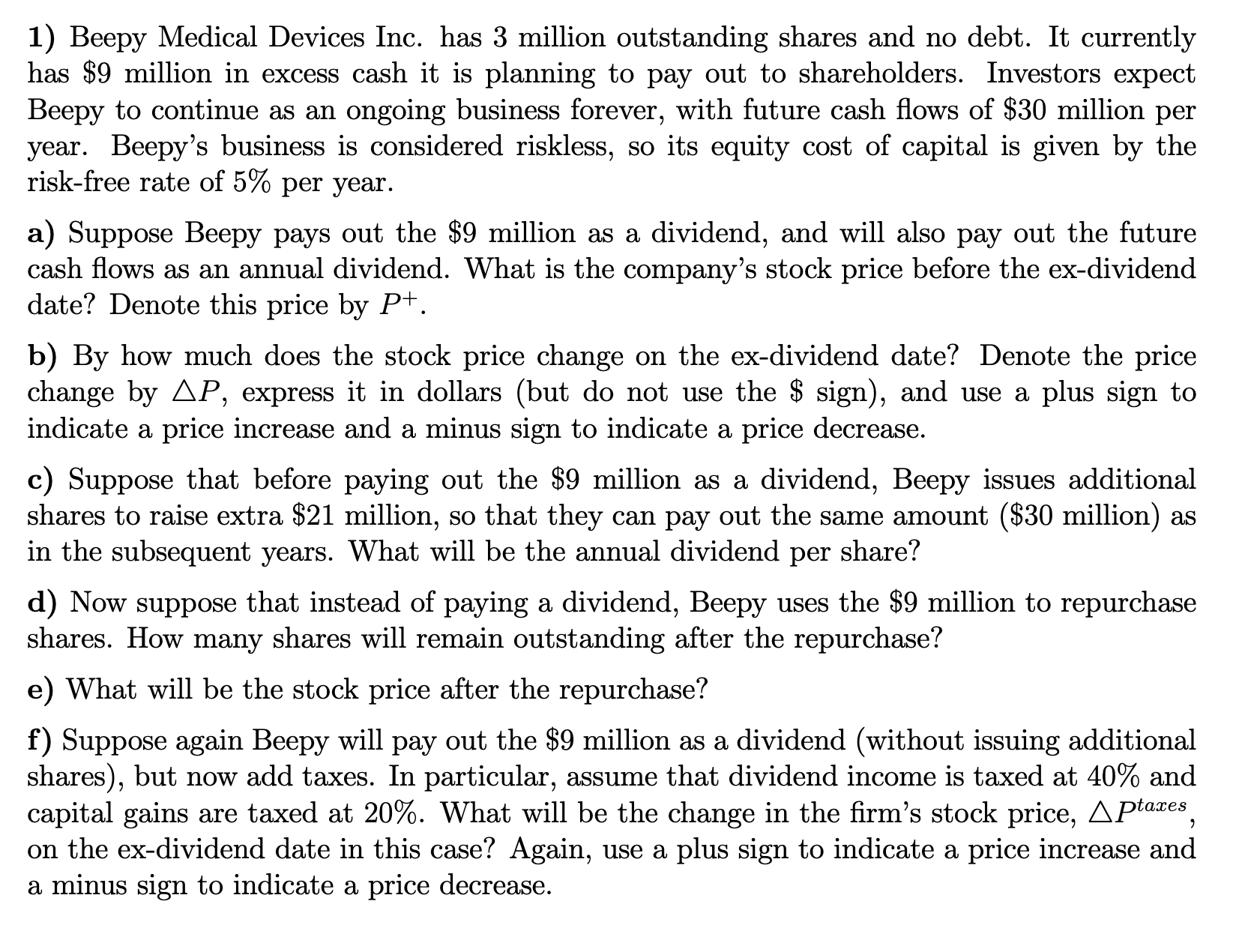

Question: Beepy Medical Devices Inc. has 3 million outstanding shares and no debt. It currently has $ 9 million in excess cash it is planning to

Beepy Medical Devices Inc. has million outstanding shares and no debt. It currently has $ million in excess cash it is planning to pay out to shareholders. Investors expect Beepy to continue as an ongoing business forever, with future cash flows of $ million per year. Beepy's business is considered riskless, so its equity cost of capital is given by the riskfree rate of per year. a Suppose Beepy pays out the $ million as a dividend, and will also pay out the future cash flows as an annual dividend. What is the company's stock price before the exdividend date? Denote this price by P b By how much does the stock price change on the exdividend date? Denote the price change by P express it in dollars but do not use the $ sign and use a plus sign to indicate a price increase and a minus sign to indicate a price decrease. c Suppose that before paying out the $ million as a dividend, Beepy issues additional shares to raise extra $ million, so that they can pay out the same amount $ million as in the subsequent years. What will be the annual dividend per share? d Now suppose that instead of paying a dividend, Beepy uses the $ million to repurchase shares. How many shares will remain outstanding after the repurchase? e What will be the stock price after the repurchase? f Suppose again Beepy will pay out the $ million as a dividend without issuing additional shares but now add taxes. In particular, assume that dividend income is taxed at and capital gains are taxed at What will be the change in the firm's stock price, Ptaxes on the exdividend date in this case? Again, use a plus sign to indicate a price increase and a minus sign to indicate a price decrease. please answer all parts, thank you!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock