Question: Question 1 BEF Pte Ltd develops and sells both standard and customised software. On 1 January 20X1, the company entered into a contract with

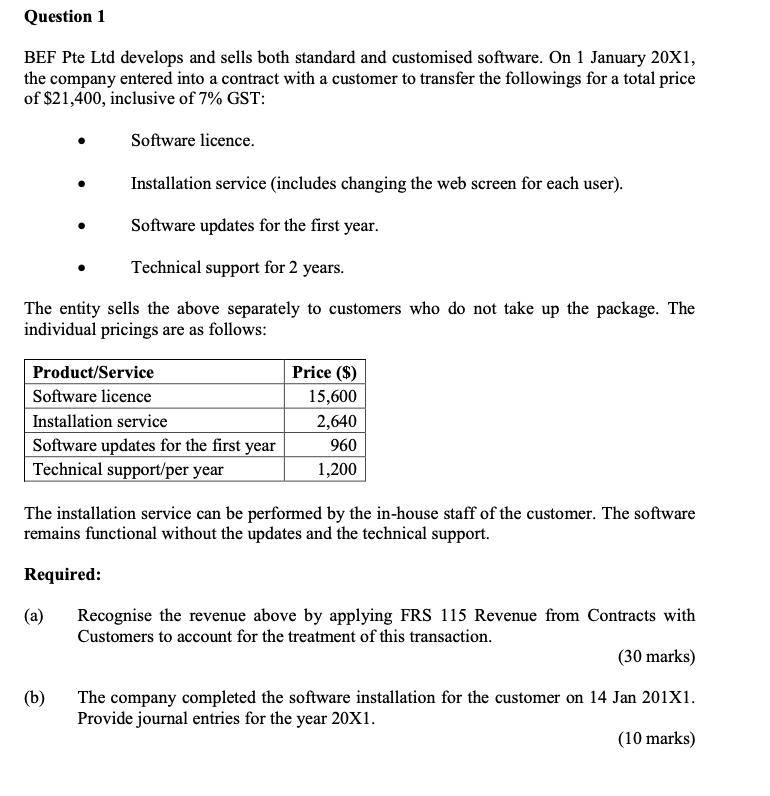

Question 1 BEF Pte Ltd develops and sells both standard and customised software. On 1 January 20X1, the company entered into a contract with a customer to transfer the followings for a total price of $21,400, inclusive of 7% GST: Installation service (includes changing the web screen for each user). Software updates for the first year. Technical support for 2 years. The entity sells the above separately to customers who do not take up the package. The individual pricings are as follows: Software licence. Product/Service Software licence Installation service Software updates for the first year Technical support/per year (a) The installation service can be performed by the in-house staff of the customer. The software remains functional without the updates and the technical support. Required: (b) Price ($) 15,600 2,640 960 1,200 Recognise the revenue above by applying FRS 115 Revenue from Contracts with Customers to account for the treatment of this transaction. (30 marks) The company completed the software installation for the customer on 14 Jan 201X1. Provide journal entries for the year 20X1. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

a Income is recognized as follows 1 For the software licence the entire amou... View full answer

Get step-by-step solutions from verified subject matter experts