Question: Before solving the question, PLEASE MAKE SURE YOU HAVE a STRONG UNDERSTANDING OF the MATERIAL RELATED TO THIS PROBLEM AND DO NOT POST a SOLUTION

Before solving the question, PLEASE MAKE SURE YOU HAVE a STRONG UNDERSTANDING OF the MATERIAL RELATED TO THIS PROBLEM AND DO NOT POST a SOLUTION UNLESS YOU ARE FULLY SURE ABOUT THE ANSWER. Show completely your solution and make it clearly readable. Please solve all the questions because all of them are related, and I cannot post each one individually as well as my package for this month is over ):

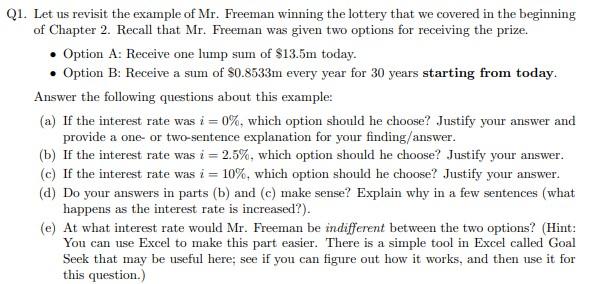

Q1. Let us revisit the example of Mr. Freeman winning the lottery that we covered in the beginning of Chapter 2. Recall that Mr. Freeman was given two options for receiving the prize. Option A: Receive one lump sum of $13.5m today. Option B: Receive a sum of $0.8533m every year for 30 years starting from today. Answer the following questions about this example: (a) If the interest rate was i = 0%, which option should he choose? Justify your answer and provide a one or two-sentence explanation for your finding/answer. (b) If the interest rate was i = 2.5%, which option should he choose? Justify your answer. (c) If the interest rate was i = 10%, which option should he choose? Justify your answer. (d) Do your answers in parts (b) and (c) make sense? Explain why in a few sentences (what happens as the interest rate is increased?). (e) At what interest rate would Mr. Freeman be indifferent between the two options? (Hint: You can use Excel to make this part easier. There is a simple tool in Excel called Goal Seek that may be useful here: see if you can figure out how it works, and then use it for this question.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts