Question: [ begin { array } { r } 3 7 , 5 0 0 $ quad begin {

beginarrayr

$ quad beginarrayr

endarray

endarray

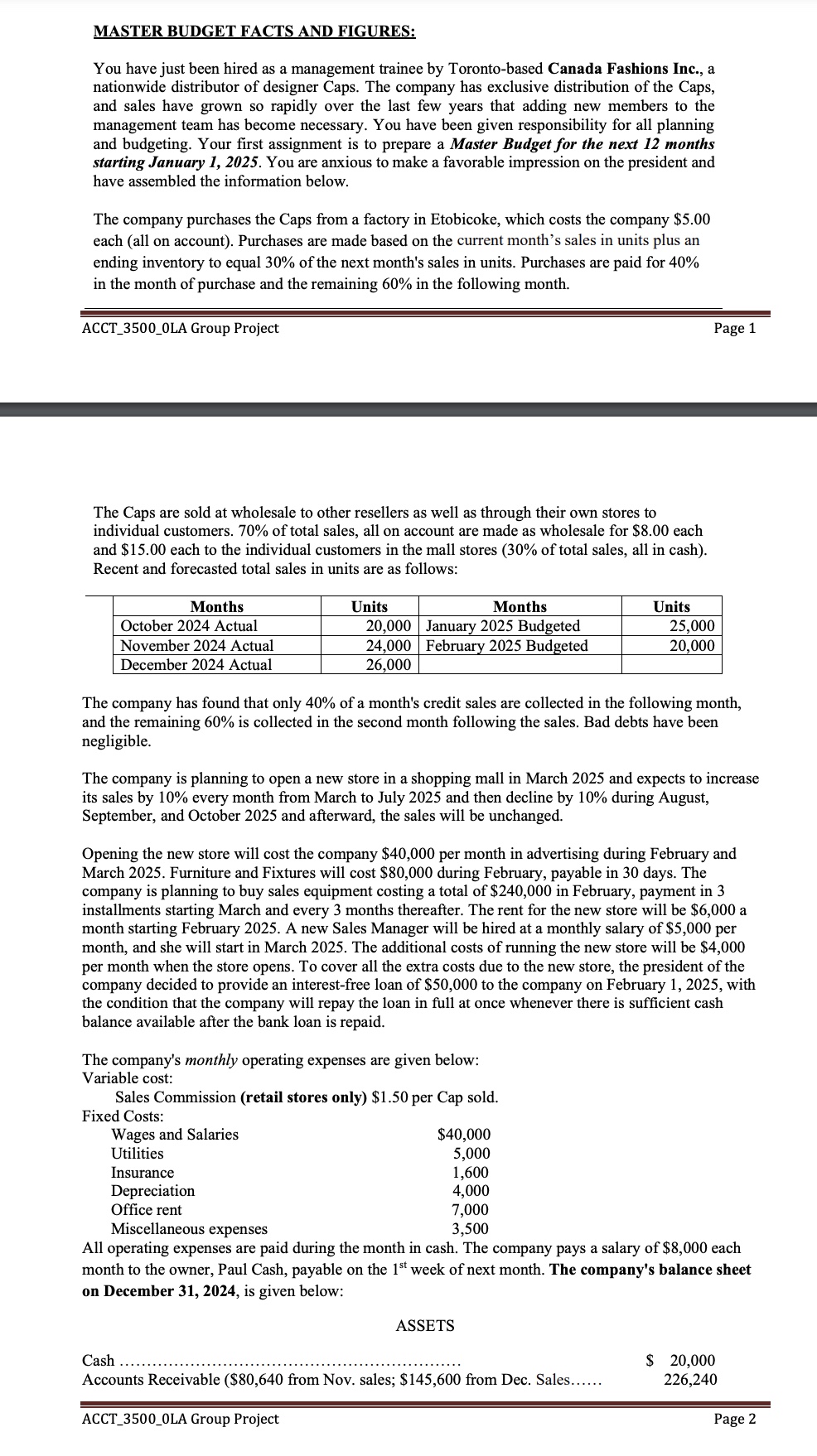

LIABILITIES AND SHAREHOLDER'S EQUITY

Accounts Payable

Salaries Payable

Capital Stock

Retained Earnings

Total Liabilities and Shareholders' Equity

The company maintains a policy to have a minimum ending cash balance of $ at the end of each month. It has a Line of Credit agreement with the Popular Bank of Toronto that allows the company to borrow in increments of $ at the beginning of each month, up to a total line of credit of $ The interest rate on these loans is per month, and for simplicity, we will assume that interest is not compounded. Whenever possible, the company would repay the bank as much of the loan as possible in increments of $ while still retaining at least $ in cash balance. Interest on the loan is paid only at the time of repayment of the loan and only on the repayment amount. The loan from the President will be paid whenever there is a sufficient cash balance after the repayment of the bank loan.

Required: Prepare a master budget for the months from January to December Include the following in detail:

A Cover page indicating your group number, member names with ID and participation in details.

A Sales Budget, by month and in total.

A Schedule of expected cash collections from sales, by month and in total.

Marks

marks

A Merchandise Purchases budget in units and dollars. Show the budget by month and in total.

Marks

A Schedule of Expected Cash Disbursements for merchandise purchases, by month and in total.

Marks

A Cash Budget. Show the budget by month and in Total.

A Budgeted Income Statement for the year ending December

Marks

A Budgeted Balance Sheet as of December

Marks

Because sales have increased after the opening of the new store, do you think that the company

Marks made a wise decision by opening the store? The owner could have invested the $ interestfree Loan elsewhere earning an interest annually. Explain if the loan was needed considering the cash situation. Your answer must be supported by numberscalculations

Marks

Note: Please make sure that you round off all the sales in units and other amounts. Because of this roundoff, your Budgeted Balance Sheet may have a difference of around mathbf$ to $ between Total Assets and Total Liabilities. You may ignore this difference or add it to any account to balance.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock