Question: begin { tabular } { | c | c | c | c | c | c | } hline multirow [

begintabularcccccc

hline multirowbbegintabularl

Year

endtabular & multicolumnrBeginning of the Year & multirowbGain Loss

hline & multicolumnrmultirowbPBO & multicolumnlmultirowtFair Value of Pension Plan &

hline & & & & & for the

hline & & & & begintabularl

Assets

endtabular & begintabularl

Year

endtabular

hline X & $ & & $ & & $

hline X & & & & &

hline X & & & & &

hline X & & & & &

hline X & & & & &

hline X & & & & &

hline

endtabular

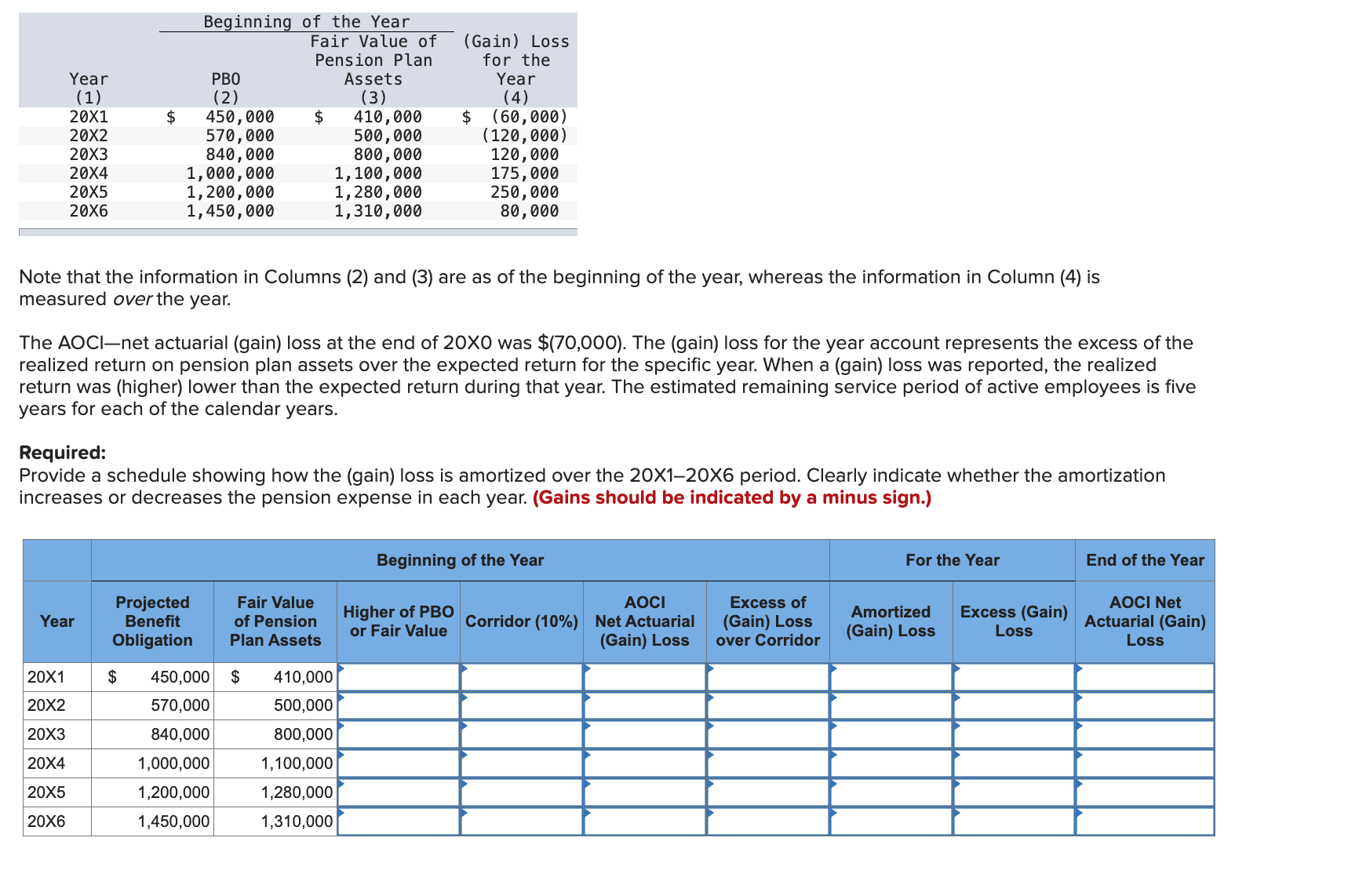

Note that the information in Columns and are as of the beginning of the year, whereas the information in Column is measured over the year.

The AOCInet actuarial gain loss at the end of X was $ The gain loss for the year account represents the excess of the realized return on pension plan assets over the expected return for the specific year. When a gain loss was reported, the realized return was higher lower than the expected return during that year. The estimated remaining service period of active employees is five years for each of the calendar years.

Required:

Provide a schedule showing how the gain loss is amortized over the XX period. Clearly indicate whether the amortization increases or decreases the pension expense in each year. Gains should be indicated by a minus sign.

begintabularcccccccccc

hline & multicolumncBeginning of the Year & multicolumnrFor the Year & End of the Year

hline Year & Projected Benefit Obligation & Fair Value of Pension Plan Assets & Higher of PBO or Fair Value & Corridor & begintabularl

AOCI

Net Actuarial Gain Loss

endtabular & Excess of Gain Loss over Corridor & Amortized Gain Loss & begintabularl

Excess Gain

Loss

endtabular & AOCI Net Actuarial Gain Loss

hline X & $ & $ & & & & & & &

hline X & & & & & & & & &

hline X & & & & & & & & &

hline X & & & & & & & & &

hline X & & & & & & & & &

hline X & & & & & & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock